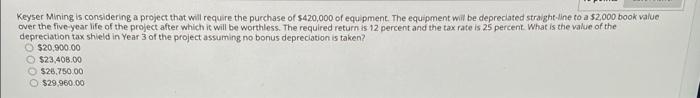

Question: Keyser Mining is considering a project that will require the purchase of $420,000 of equipment. The equipment will be deprecated straight-line to a $2,000 book

Keyser Mining is considering a project that will require the purchase of $420,000 of equipment. The equipment will be deprecated straight-line to a $2,000 book value over the five year life of the project after which it will be worthless. The required return is 12 percent and the tax rate is 25 percent. What is the value of the depreciation tax shield in Year 3 of the project assuming no bonus depreciation is taken? $20.900.00 $23,408.00 $26.750.00 $29.960.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts