Question: KFC's CEO is selecting between two mutually exclusive projects. The firm needs to make a $3,500 payment to bondholders at the end of the

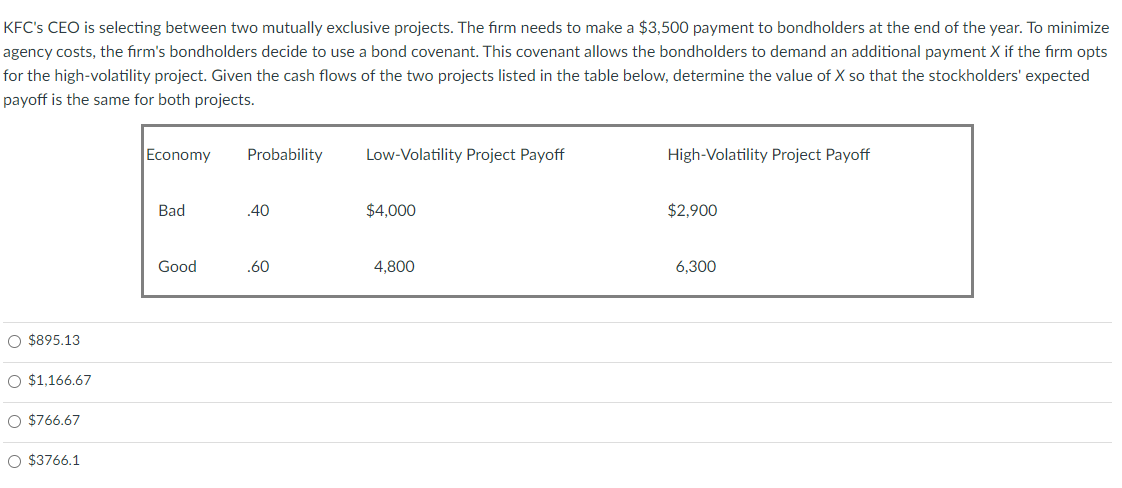

KFC's CEO is selecting between two mutually exclusive projects. The firm needs to make a $3,500 payment to bondholders at the end of the year. To minimize agency costs, the firm's bondholders decide to use a bond covenant. This covenant allows the bondholders to demand an additional payment X if the firm opts for the high-volatility project. Given the cash flows of the two projects listed in the table below, determine the value of X so that the stockholders' expected payoff is the same for both projects. $895.13 $1,166.67 $766.67 $3766.1 Economy Probability Low-Volatility Project Payoff Bad .40 $4,000 Good .60 4,800 High-Volatility Project Payoff $2,900 6,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts