Question: Khaled is looking into buying an annuity that will pay him $$ , 0 0 0 per year for the next 1 0 years, with

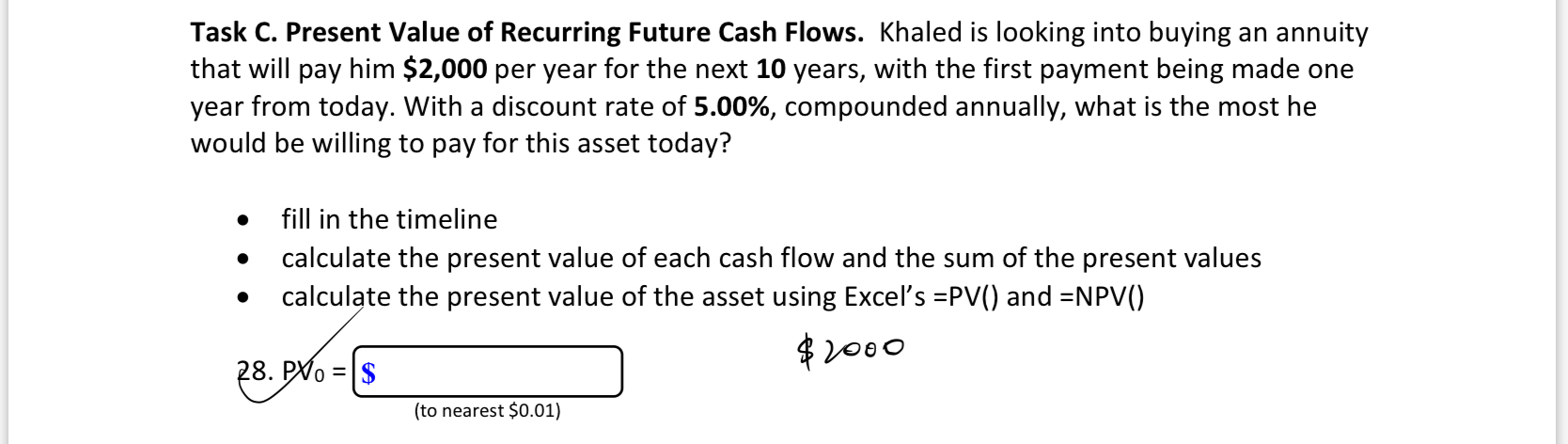

Khaled is looking into buying an annuity that will pay him $$ per year for the next years, with the first payment being made one year from today. With a discount rate of compounded annually, what is the most he would be willing to pay for this asset today?

calculate the present value of each cash flow and the sum of the present values

to nearest $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock