Question: Kimberly started as an intern for Splish Enterprises last month, and this is the first time she is able to see how the joint

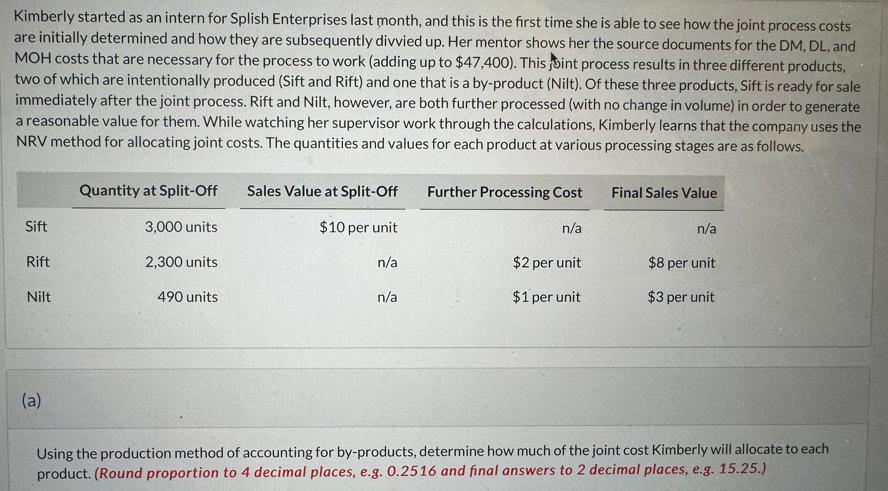

Kimberly started as an intern for Splish Enterprises last month, and this is the first time she is able to see how the joint process costs are initially determined and how they are subsequently divvied up. Her mentor shows her the source documents for the DM, DL, and MOH costs that are necessary for the process to work (adding up to $47,400). This joint process results in three different products, two of which are intentionally produced (Sift and Rift) and one that is a by-product (Nilt). Of these three products, Sift is ready for sale immediately after the joint process. Rift and Nilt, however, are both further processed (with no change in volume) in order to generate a reasonable value for them. While watching her supervisor work through the calculations, Kimberly learns that the company uses the NRV method for allocating joint costs. The quantities and values for each product at various processing stages are as follows. Quantity at Split-Off Sift 3,000 units Sales Value at Split-Off $10 per unit Further Processing Cost Final Sales Value n/a n/a Rift 2,300 units n/a $2 per unit $8 per unit Nilt 490 units n/a $1 per unit $3 per unit (a) Using the production method of accounting for by-products, determine how much of the joint cost Kimberly will allocate to each product. (Round proportion to 4 decimal places, e.g. 0.2516 and final answers to 2 decimal places, e.g. 15.25.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts