Question: KINDLY ANSWER ALL PARTS USING EXCEL AND EXPLAIN YOUR ANSWERS. THANKS! QUESTION 3: ABC company has 1,000 employees. The total annual base pay for all

KINDLY ANSWER ALL PARTS USING EXCEL AND EXPLAIN YOUR ANSWERS. THANKS!

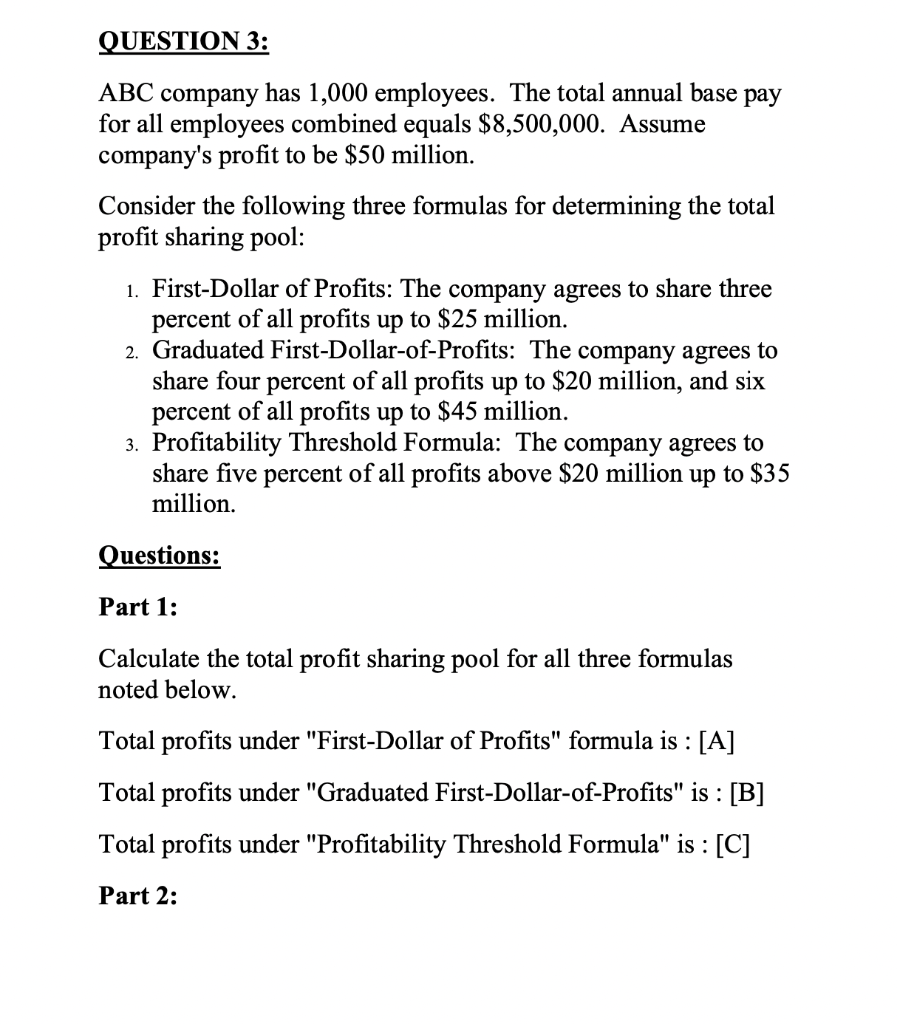

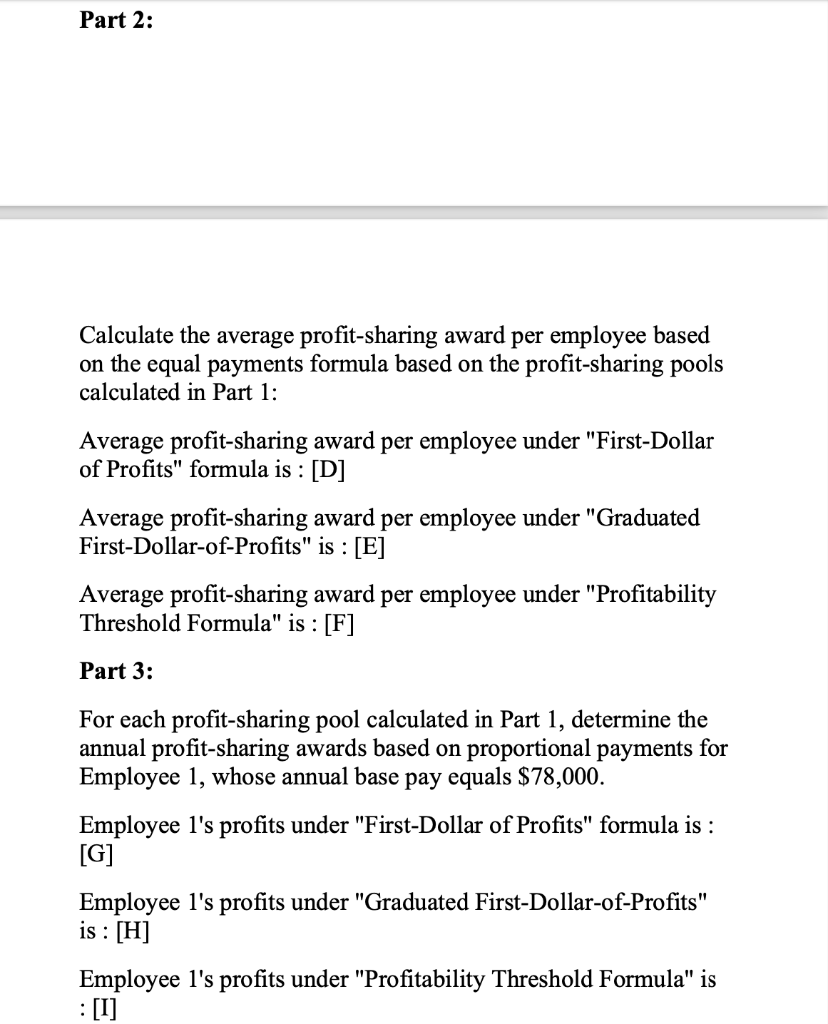

QUESTION 3: ABC company has 1,000 employees. The total annual base pay for all employees combined equals $8,500,000. Assume company's profit to be $50 million. Consider the following three formulas for determining the total profit sharing pool: 1. First-Dollar of Profits: The company agrees to share three percent of all profits up to $25 million. 2. Graduated First-Dollar-of-Profits: The company agrees to share four percent of all profits up to $20 million, and six percent of all profits up to $45 million. 3. Profitability Threshold Formula: The company agrees to share five percent of all profits above $20 million up to $35 million. Questions: Part 1: Calculate the total profit sharing pool for all three formulas noted below. Total profits under "First-Dollar of Profits" formula is : [A] Total profits under "Graduated First-Dollar-of-Profits" is : [B] Total profits under "Profitability Threshold Formula" is : [C] Part 2: Part 2: Calculate the average profit-sharing award per employee based on the equal payments formula based on the profit-sharing pools calculated in Part 1: Average profit-sharing award per employee under "First-Dollar of Profits" formula is : [D] Average profit-sharing award per employee under "Graduated First-Dollar-of-Profits" is : [E] Average profit-sharing award per employee under "Profitability Threshold Formula" is : [F] Part 3: For each profit-sharing pool calculated in Part 1, determine the annual profit-sharing awards based on proportional payments for Employee 1, whose annual base pay equals $78,000. Employee 1's profits under "First-Dollar of Profits" formula is : [G] Employee 1's profits under "Graduated First-Dollar-of-Profits" is : [H] Employee 1's profits under "Profitability Threshold Formula" is : [I]Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock