Question: Kindly answer the questions within 30 mins. It is urgent. Will upvote 4. a. Construct a portfolio of European put options with the payoff at

Kindly answer the questions within 30 mins. It is urgent. Will upvote

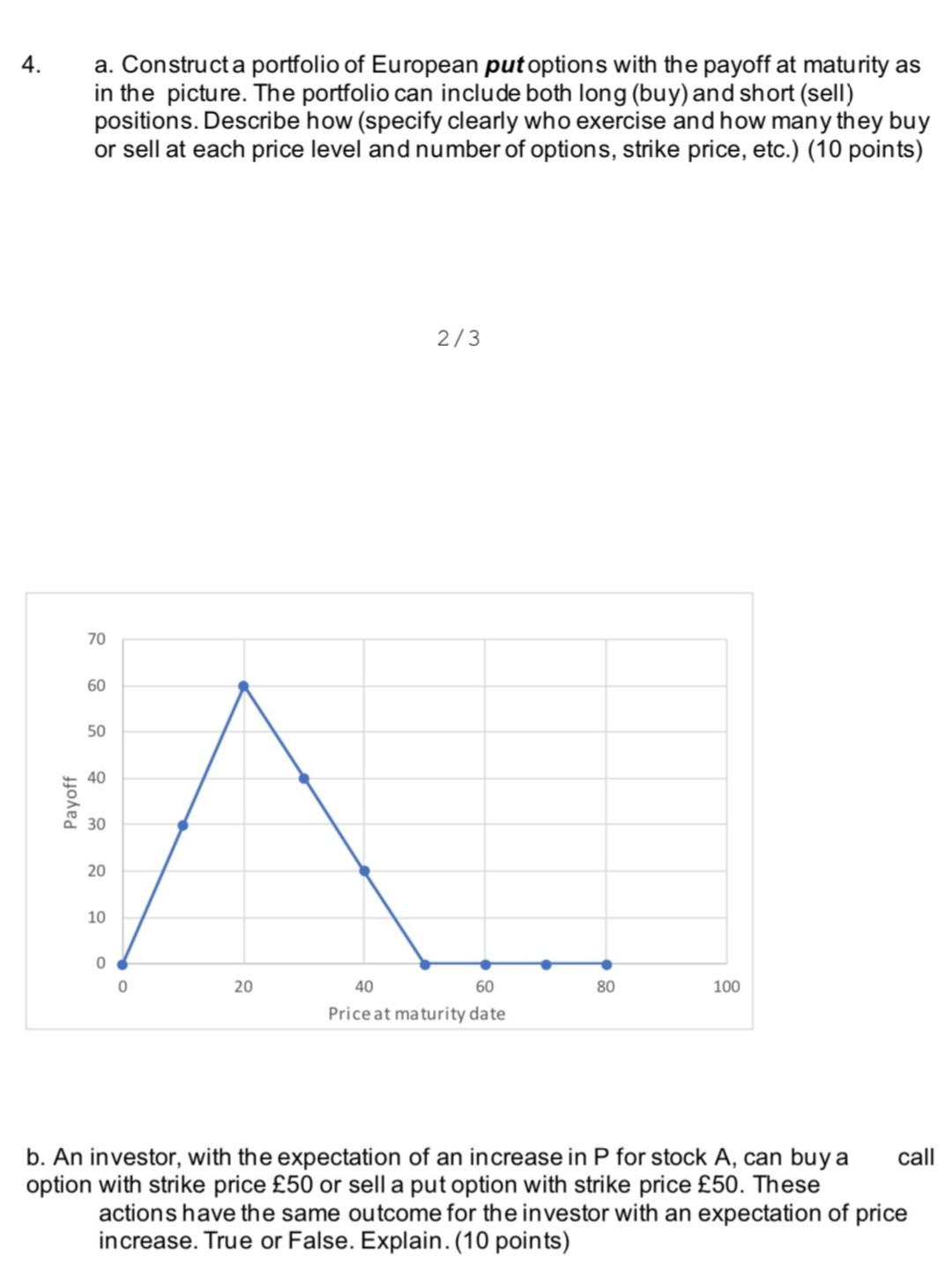

4. a. Construct a portfolio of European put options with the payoff at maturity as in the picture. The portfolio can include both long (buy) and short (sell) positions. Describe how (specify clearly who exercise and how many they buy or sell at each price level and number of options, strike price, etc.) (10 points) 2/3 70 60 50 40 Payoff 30 A 20 10 0 0 20 80 100 40 60 Priceat maturity date b. An investor, with the expectation of an increase in P for stock A, can buy a call option with strike price 50 or sell a put option with strike price 50. These actions have the same outcome for the investor with an expectation of price increase. True or False. Explain.(10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts