Question: kindly check this!!!!! Fill in the blanks: Encode amounts in whole numbers; do not put peso sign; do not use comma. Norton and Morris are

kindly check this!!!!!

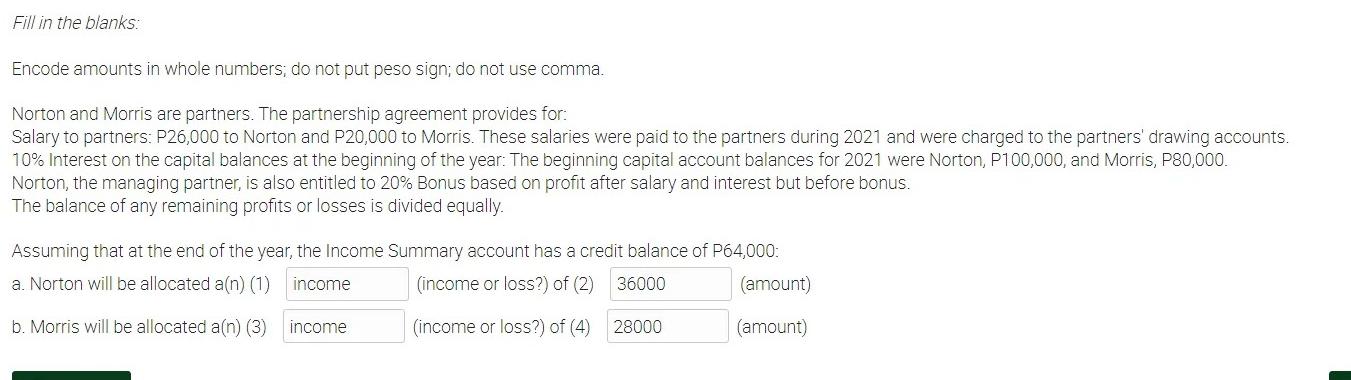

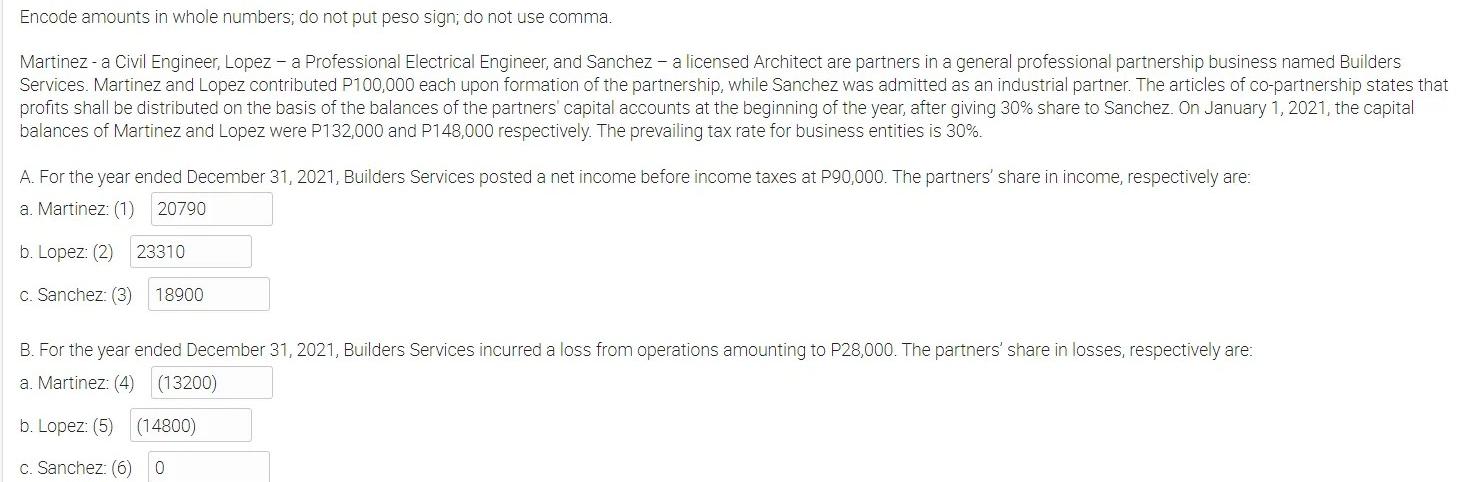

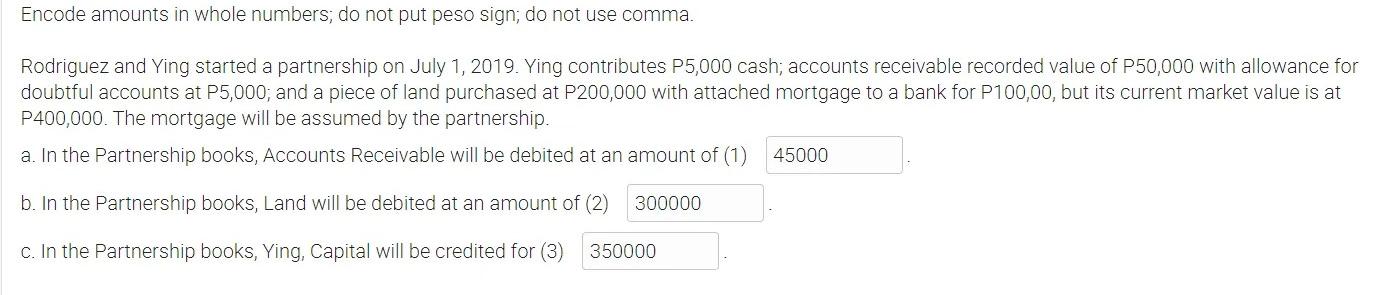

Fill in the blanks: Encode amounts in whole numbers; do not put peso sign; do not use comma. Norton and Morris are partners. The partnership agreement provides for: Salary to partners: P26,000 to Norton and P20,000 to Morris. These salaries were paid to the partners during 2021 and were charged to the partners' drawing accounts. 10% Interest on the capital balances at the beginning of the year: The beginning capital account balances for 2021 were Norton, P100,000, and Morris, P80,000. Norton, the managing partner, is also entitled to 20% Bonus based on profit after salary and interest but before bonus. The balance of any remaining profits or losses is divided equally. Assuming that at the end of the year, the Income Summary account has a credit balance of P64,000: a. Norton will be allocated a(n) (1) income (income or loss?) of (2) 36000 (amount) b. Morris will be allocated an) (3) income (income or loss?) of (4) 28000 (amount) Encode amounts in whole numbers; do not put peso sign; do not use comma. Martinez - a Civil Engineer, Lopez - a Professional Electrical Engineer, and Sanchez - a licensed Architect are partners in a general professional partnership business named Builders Services. Martinez and Lopez contributed P100,000 each upon formation of the partnership, while Sanchez was admitted as an industrial partner. The articles of co-partnership states that profits shall be distributed on the basis of the balances of the partners' capital accounts at the beginning of the year, after giving 30% share to Sanchez. on January 1, 2021, the capital balances of Martinez and Lopez were P132,000 and P148,000 respectively. The prevailing tax rate for business entities is 30%. A. For the year ended December 31, 2021, Builders Services posted a net income before income taxes at P90,000. The partners' share in income, respectively are: a. Martinez: (1 20790 b. Lopez: (2) 23310 c. Sanchez: (3) 18900 B. For the year ended December 31, 2021, Builders Services incurred a loss from operations amounting to P28,000. The partners' share in losses, respectively are: a. Martinez: (4) (13200) b. Lopez: (5) (14800) c. Sanchez: (6) 0 Encode amounts in whole numbers; do not put peso sign; do not use comma. Rodriguez and Ying started a partnership on July 1, 2019. Ying contributes P5,000 cash; accounts receivable recorded value of P50,000 with allowance for doubtful accounts at P5,000; and a piece of land purchased at P200,000 with attached mortgage to a bank for P100,00, but its current market value is at P400,000. The mortgage will be assumed by the partnership. a. In the Partnership books, Accounts Receivable will be debited at an amount of (1) 45000 b. In the Partnership books, Land will be debited at an amount of (2) 300000 c. In the Partnership books, Ying, Capital will be credited for (3) 350000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts