Question: kindly do it hand written with proper format [sr|notes|exempted|taxable] Please answer me in 20-30 mins Income Tax Ordinance, 2001: Q.5:Mr.Nooris a telecommunication engineer working with

kindly do it hand written with proper format

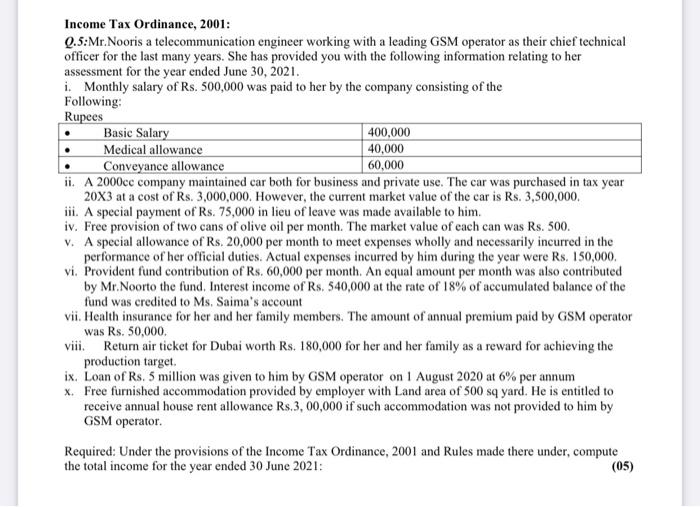

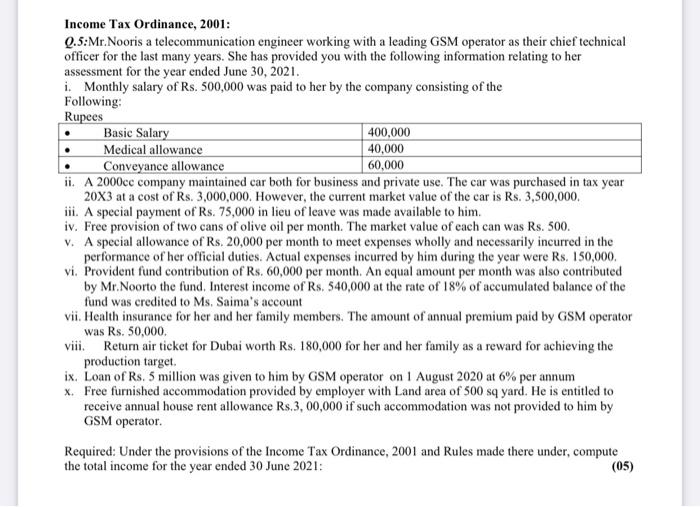

Income Tax Ordinance, 2001: Q.5:Mr.Nooris a telecommunication engineer working with a leading GSM operator as their chief technical officer for the last many years. She has provided you with the following information relating to her assessment for the year ended June 30, 2021. 1. Monthly salary of Rs. 500,000 was paid to her by the company consisting of the Following: Rupees Basic Salary 400,000 Medical allowance 40,000 Conveyance allowance 60,000 ii. A 2000cc company maintained car both for business and private use. The car was purchased in tax year 20x3 at a cost of Rs. 3,000,000. However, the current market value of the car is Rs. 3,500,000 iii. A special payment of Rs. 75,000 in lieu of leave was made available to him. iv. Free provision of two cans of olive oil per month. The market value of each can was Rs. 500. V. A special allowance of Rs. 20,000 per month to meet expenses wholly and necessarily incurred in the performance of her official duties. Actual expenses incurred by him during the year were Rs. 150,000, vi. Provident fund contribution of Rs. 60,000 per month. An equal amount per month was also contributed by Mr.Noorto the fund, Interest income of Rs. 540,000 at the rate of 18% of accumulated balance of the fund was credited to Ms. Saima's account vii. Health insurance for her and her family members. The amount of annual premium paid by GSM operator was Rs. 50,000 viii. Return air ticket for Dubai worth Rs. 180,000 for her and her family as a reward for achieving the production target ix. Loan of Rs. 5 million was given to him by GSM operator on 1 August 2020 at 6% per annum x. Free furnished accommodation provided by employer with Land area of 500 sq yard. He is entitled to receive annual house rent allowance Rs.3,00,000 if such accommodation was not provided to him by GSM operator Required: Under the provisions of the Income Tax Ordinance, 2001 and Rules made there under, compute the total income for the year ended 30 June 2021: (05)

[sr|notes|exempted|taxable]

Please answer me in 20-30 mins

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock