Question: kindly help me do question 3 quickly, I'll give you thumbs up for it, thankyou in advance :) reporting to the Chief Investment Officer (CIO).

kindly help me do question 3 quickly, I'll give you thumbs up for it, thankyou in advance :)

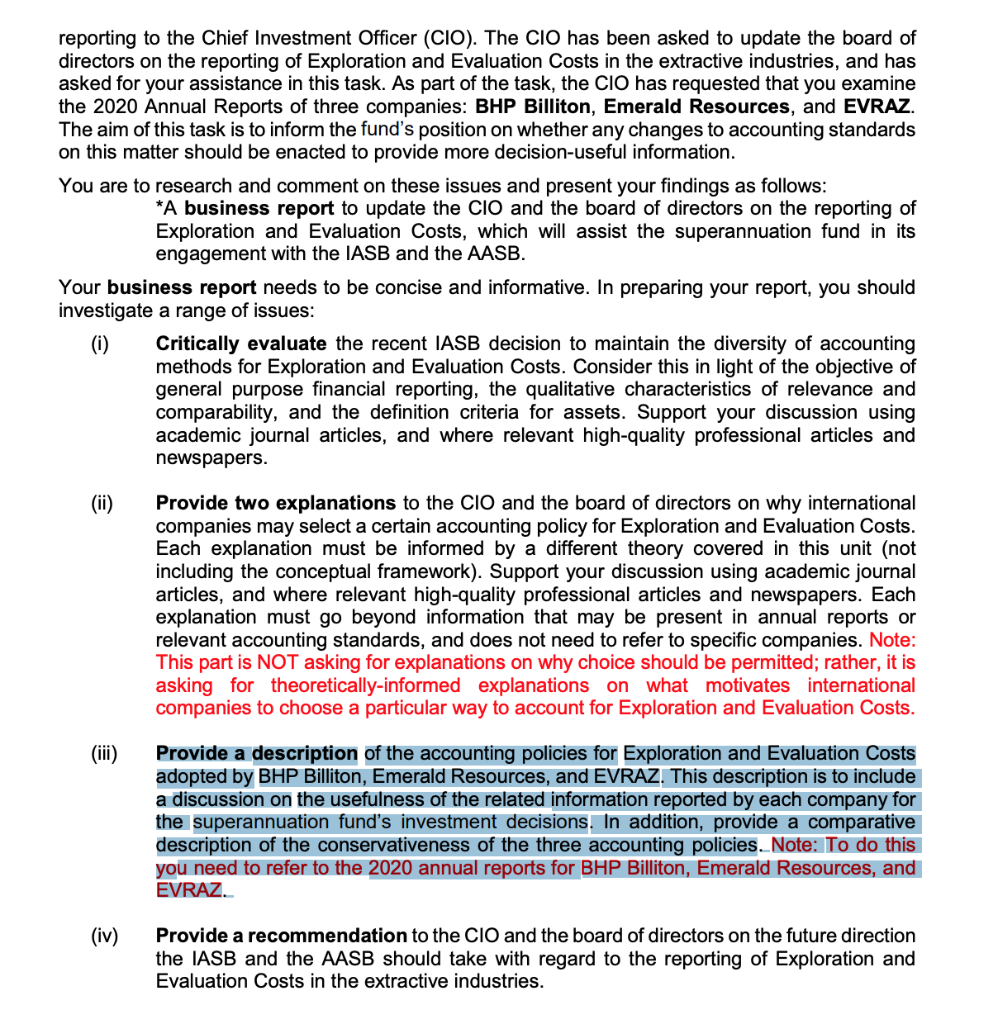

reporting to the Chief Investment Officer (CIO). The CIO has been asked to update the board of directors on the reporting of Exploration and Evaluation Costs in the extractive industries, and has asked for your assistance in this task. As part of the task, the CIO has requested that you examine the 2020 Annual Reports of three companies: BHP Billiton, Emerald Resources, and EVRAZ. The aim of this task is to inform the fund's position on whether any changes to accounting standards on this matter should be enacted to provide more decision-useful information. You are to research and comment on these issues and present your findings as follows: *A business report to update the CIO and the board of directors on the reporting of Exploration and Evaluation Costs, which will assist the superannuation fund in its engagement with the IASB and the AASB. Your business report needs to be concise and informative. In preparing your report, you should investigate a range of issues: (i) Critically evaluate the recent IASB decision to maintain the diversity of accounting methods for Exploration and Evaluation Costs. Consider this in light of the objective of general purpose financial reporting, the qualitative characteristics of relevance and comparability, and the definition criteria for assets. Support your discussion using academic journal articles, and where relevant high-quality professional articles and newspapers. (ii) Provide two explanations to the CIO and the board of directors on why international companies may select a certain accounting policy for Exploration and Evaluation Costs. Each explanation must be informed by a different theory covered in this unit (not including the conceptual framework). Support your discussion using academic journal articles, and where relevant high-quality professional articles and newspapers. Each explanation must go beyond information that may be present in annual reports or relevant accounting standards, and does not need to refer to specific companies. Note: This part is NOT asking for explanations on why choice should be permitted; rather, it is asking for theoretically-informed explanations on what motivates international companies to choose a particular way to account for Exploration and Evaluation Costs. (iii) Provide a description of the accounting policies for Exploration and Evaluation Costs adopted by BHP Billiton, Emerald Resources, and EVRAZ. This description is to include a discussion on the usefulness of the related information reported by each company for the superannuation fund's investment decisions. In addition, provide a comparative description of the conservativeness of the three accounting policies. Note: To do this you need to refer to the 2020 annual reports for BHP Billiton, Emerald Resources, and EVRAZ. (iv) Provide a recommendation to the CIO and the board of directors on the future direction the IASB and the AASB should take with regard to the reporting of Exploration and Evaluation Costs in the extractive industries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts