Question: Kindly help me with a,b,c,d,e,f,g Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax

Kindly help me with a,b,c,d,e,f,g

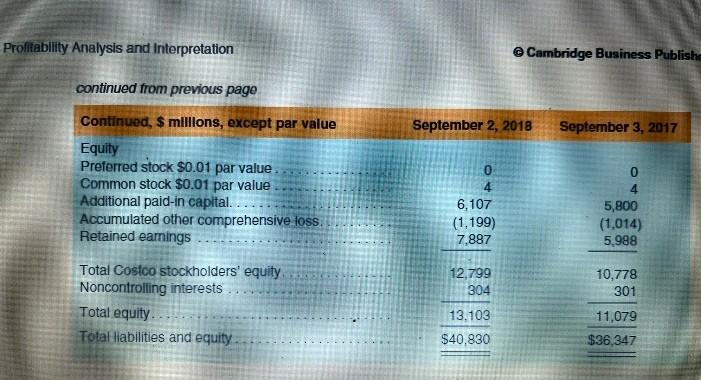

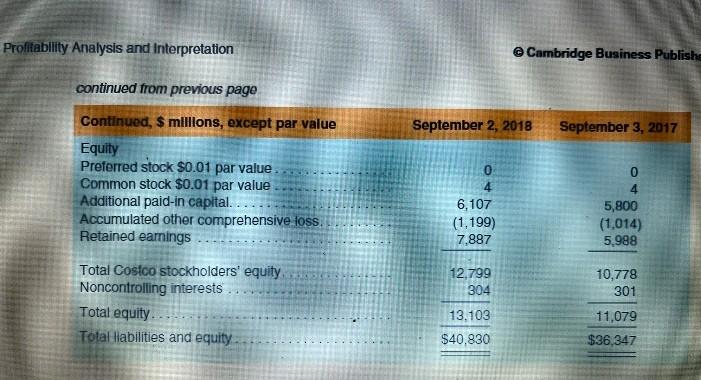

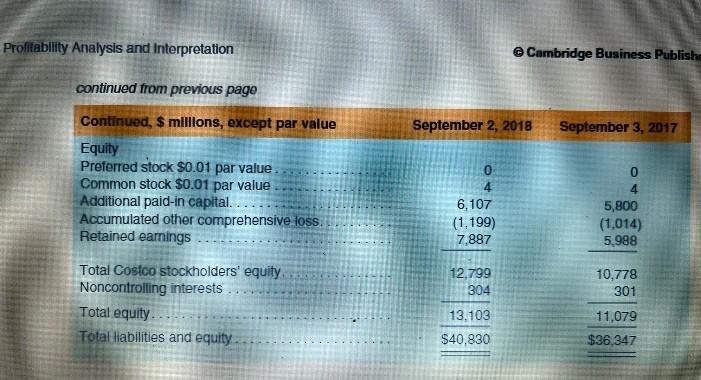

Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate Costco's RNOA into net operating profit margin (NOPM) and net operat- ing asset turnover (NOAT) for 2018: confirm that RNOA NOPM x NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. e. Compute return on equity (ROE) for 2018. f. Infer the nonoperating return component of ROE for 2018. g. Comment on the difference between ROE and RNOA. What does this relation suggest about Costco's use of equity capital? Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate Costco's RNOA into net operating profit margin (NOPM) and net operat- ing asset turnover (NOAT) for 2018: confirm that RNOA NOPM x NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. e. Compute return on equity (ROE) for 2018. f. Infer the nonoperating return component of ROE for 2018. g. Comment on the difference between ROE and RNOA. What does this relation suggest about Costco's use of equity capital? Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate Costco's RNOA into net operating profit margin (NOPM) and net operat- ing asset turnover (NOAT) for 2018: confirm that RNOA NOPM x NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. e. Compute return on equity (ROE) for 2018. f. Infer the nonoperating return component of ROE for 2018. g. Comment on the difference between ROE and RNOA. What does this relation suggest about Costco's use of equity capital? Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate Costco's RNOA into net operating profit margin (NOPM) and net operat- ing asset turnover (NOAT) for 2018: confirm that RNOA NOPM x NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. e. Compute return on equity (ROE) for 2018. f. Infer the nonoperating return component of ROE for 2018. g. Comment on the difference between ROE and RNOA. What does this relation suggest about Costco's use of equity capital? Profitability Analysis and Interpretation continued from previous page Continued, $ millions, except par value Equity Preferred stock $0.01 par value. Common stock $0.01 par value Additional paid-in capital... Accumulated other comprehensive loss. Retained earnings Total Costco stockholders' equity. Noncontrolling interests Total equity... Total liabilities and equity Cambridge Business Publishe September 3, 2017 4 5,800 (1,014) 5,988 10,778 301 11,079 $36,347 September 2, 2018 0 4 6,107 (1,199) 7,887 12,799 304 13.103 $40,830 Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate Costco's RNOA into net operating profit margin (NOPM) and net operat- ing asset turnover (NOAT) for 2018: confirm that RNOA NOPM x NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. e. Compute return on equity (ROE) for 2018. f. Infer the nonoperating return component of ROE for 2018. g. Comment on the difference between ROE and RNOA. What does this relation suggest about Costco's use of equity capital? Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate Costco's RNOA into net operating profit margin (NOPM) and net operat- ing asset turnover (NOAT) for 2018: confirm that RNOA NOPM x NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. e. Compute return on equity (ROE) for 2018. f. Infer the nonoperating return component of ROE for 2018. g. Comment on the difference between ROE and RNOA. What does this relation suggest about Costco's use of equity capital? Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate Costco's RNOA into net operating profit margin (NOPM) and net operat- ing asset turnover (NOAT) for 2018: confirm that RNOA NOPM x NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. e. Compute return on equity (ROE) for 2018. f. Infer the nonoperating return component of ROE for 2018. g. Comment on the difference between ROE and RNOA. What does this relation suggest about Costco's use of equity capital? Required a. Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is 22%. b. Compute net operating assets (NOA) for 2018 and 2017. c. Compute and disaggregate Costco's RNOA into net operating profit margin (NOPM) and net operat- ing asset turnover (NOAT) for 2018: confirm that RNOA NOPM x NOAT. d. Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. e. Compute return on equity (ROE) for 2018. f. Infer the nonoperating return component of ROE for 2018. g. Comment on the difference between ROE and RNOA. What does this relation suggest about Costco's use of equity capital? Profitability Analysis and Interpretation continued from previous page Continued, $ millions, except par value Equity Preferred stock $0.01 par value. Common stock $0.01 par value Additional paid-in capital... Accumulated other comprehensive loss. Retained earnings Total Costco stockholders' equity. Noncontrolling interests Total equity... Total liabilities and equity Cambridge Business Publishe September 3, 2017 4 5,800 (1,014) 5,988 10,778 301 11,079 $36,347 September 2, 2018 0 4 6,107 (1,199) 7,887 12,799 304 13.103 $40,830

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts