Question: KINDLY HELP ME WITH THE CASE STUDY. THANK YOU, IT IS BASED ON BUSINESS CYCLE , INVESTMENT MODULE V : BUSINESS CYCLES Case Study The

KINDLY HELP ME WITH THE CASE STUDY. THANK YOU, IT IS BASED ON BUSINESS CYCLE , INVESTMENT

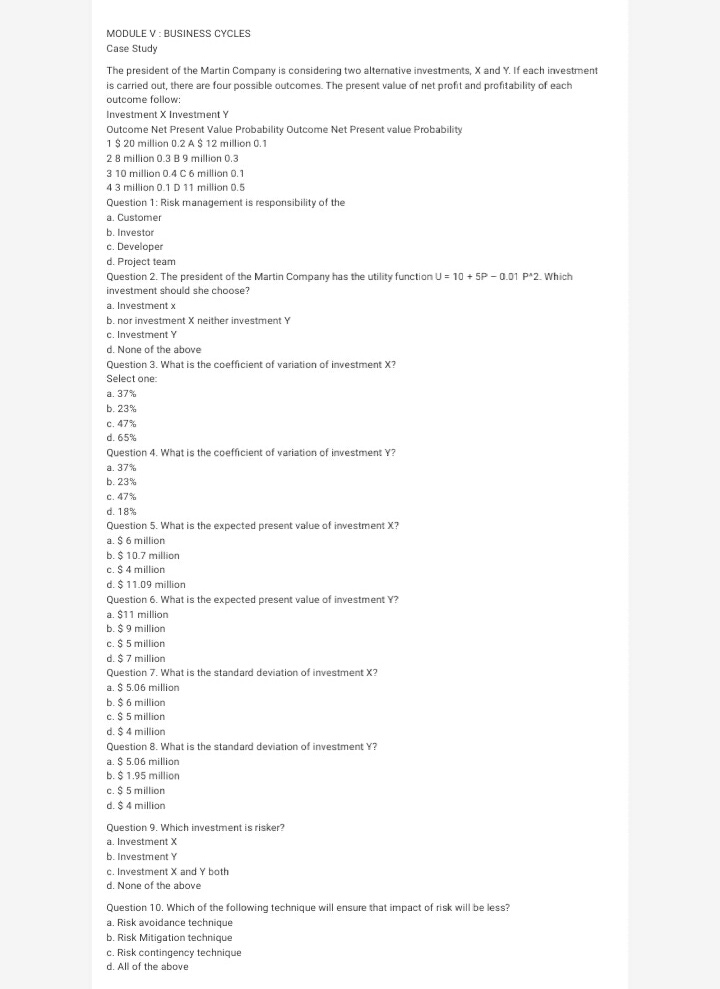

MODULE V : BUSINESS CYCLES Case Study The president of the Martin Company is considering two alternative investments, X and Y. If each investment is carried out, there are four possible outcomes. The present value of net profit and profitability of each outcome follow: Investment X Investment Y Outcome Net Present Value Probability Outcome Net Present value Probability 1 $ 20 million 0.2 A $ 12 million 0.1 2 8 million 0.3 B 9 million 0.3 3 10 million 0.4 C 6 million 0. 1 4 3 million 0.1 D 11 million 0.5 Question 1: Risk management is responsibility of the a. Customer b. Investor c. Developer d. Project team Question 2. The president of the Martin Company has the utility function U = 10 + 5P - 0.01 P*2. Which investment should she choose? a. Investment x b. nor investment X neither investment Y c. Investment Y d. None of the above Question 3. What is the coefficient of variation of investment X? Select one a. 37% b. 23% c. 47% d. 65% Question 4. What is the coefficient of variation of investment Y? a. 37% b. 23% c. 47% d. 18% Question 5. What is the expected present value of investment X? a. $ 6 million b. $ 10.7 million c. $ 4 million d. $ 11.09 million Question 6. What is the expected present value of investment Y? a. $11 million b. $ 9 million c. $ 5 million d. $ 7 million Question 7. What is the standard deviation of investment X? a. $ 5.06 million b. $ 6 million c. $ 5 million d. $ 4 million Question 8. What is the standard deviation of investment Y? a. $ 5.06 million b. $ 1.95 million c. $ 5 million d. $ 4 million Question 9. Which investment is risker? a. Investment X b. Investment Y c. Investment X and Y both d. None of the above Question 10. Which of the following technique will ensure that impact of risk will be less? a. Risk avoidance technique b. Risk Mitigation technique c. Risk contingency technique d. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts