Question: *kindly include the explanation for no. 6 Adjusting Entry *Adjusted Trial Balance *Income Statement *Balance Sheet THANK YOU The Sandhill Shop, owned by Andrew John,

*kindly include the explanation for no. 6 Adjusting Entry *Adjusted Trial Balance *Income Statement *Balance Sheet THANK YOU

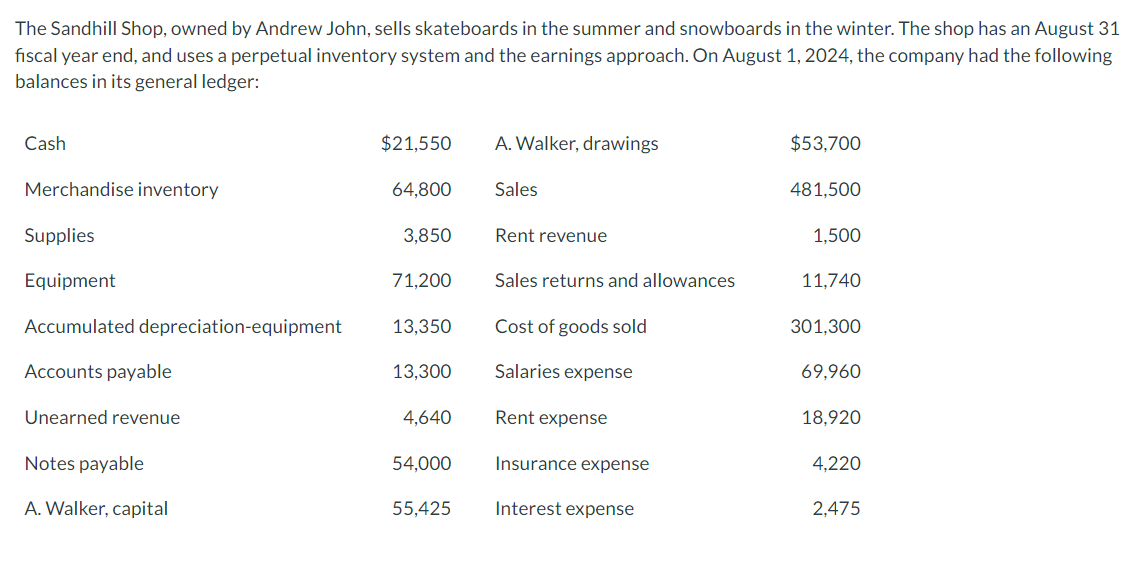

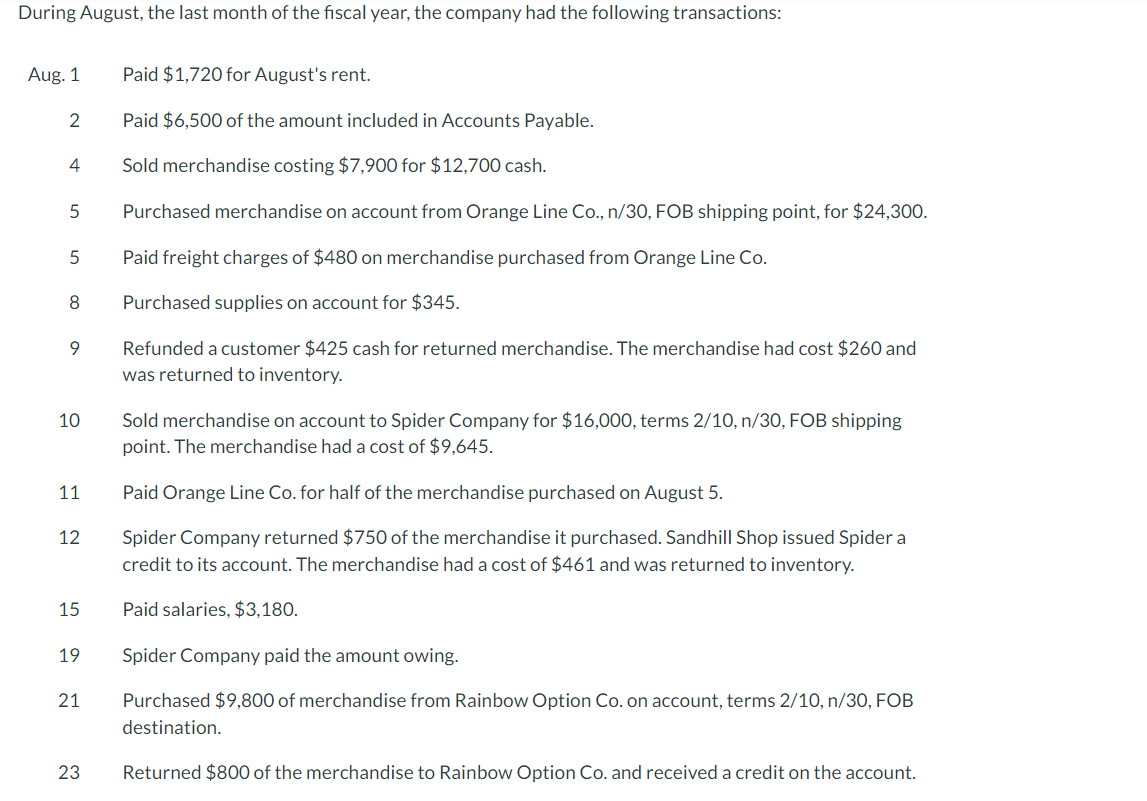

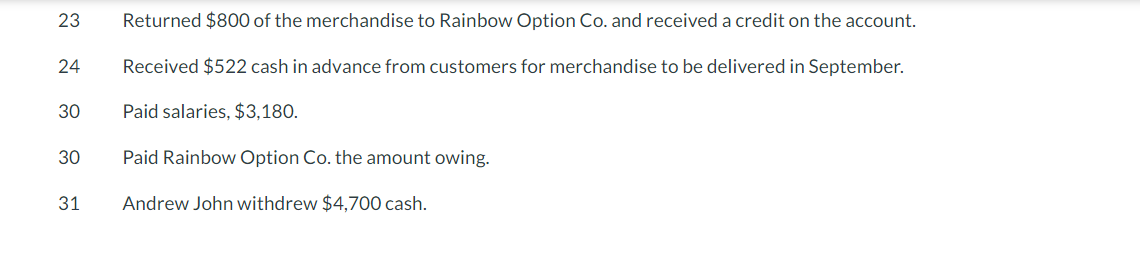

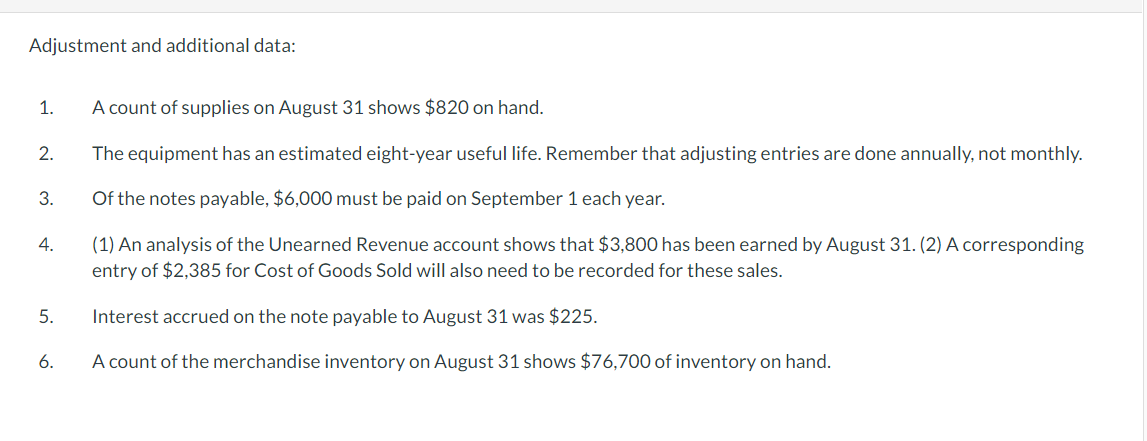

The Sandhill Shop, owned by Andrew John, sells skateboards in the summer and snowboards in the winter. The shop has an August 31 fiscal year end, and uses a perpetual inventory system and the earnings approach. On August 1, 2024, the company had the following balances in its general ledger: Durng August, the last month of the fiscal year, the company had the following transactions: Aug. 1 Paid $1,720 for August's rent. 2 Paid $6,500 of the amount included in Accounts Payable. 4 Sold merchandise costing $7,900 for $12,700 cash. 5 Purchased merchandise on account from Orange Line Co., n/30, FOB shipping point, for $24,300. 5 Paid freight charges of $480 on merchandise purchased from Orange Line Co. 8 Purchased supplies on account for $345. 9 Refunded a customer $425 cash for returned merchandise. The merchandise had cost $260 and was returned to inventory. 10 Sold merchandise on account to Spider Company for $16,000, terms 2/10,n/30, FOB shipping point. The merchandise had a cost of $9,645. 11 Paid Orange Line Co. for half of the merchandise purchased on August 5. 12 Spider Company returned $750 of the merchandise it purchased. Sandhill Shop issued Spider a credit to its account. The merchandise had a cost of $461 and was returned to inventory. 15 Paid salaries, $3,180. 19 Spider Company paid the amount owing. 21 Purchased $9,800 of merchandise from Rainbow Option Co. on account, terms 2/10,n/30, FOB destination. 23 Returned $800 of the merchandise to Rainbow Option C. and received a credit on the account. 23 Returned $800 of the merchandise to Rainbow Option Co. and received a credit on the account. 24 Received $522 cash in advance from customers for merchandise to be delivered in September. 30 Paid salaries, $3,180. 30 Paid Rainbow Option Co. the amount owing. 31 Andrew John withdrew $4,700 cash. Adjustment and additional data: 1. A count of supplies on August 31 shows $820 on hand. 2. The equipment has an estimated eight-year useful life. Remember that adjusting entries are done annually, not monthly. 3. Of the notes payable, $6,000 must be paid on September 1 each year. 4. (1) An analysis of the Unearned Revenue account shows that $3,800 has been earned by August 31. (2) A corresponding entry of $2,385 for Cost of Goods Sold will also need to be recorded for these sales. 5. Interest accrued on the note payable to August 31 was $225. 6. A count of the merchandise inventory on August 31 shows $76,700 of inventory on hand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts