Question: Kindly provide answer in 30 mins ... thanks Question No: 03 2This is mb21972 his is a subjective question, hence you have to write your

Kindly provide answer in 30 mins ... thanks

Kindly provide answer in 30 mins ... thanks

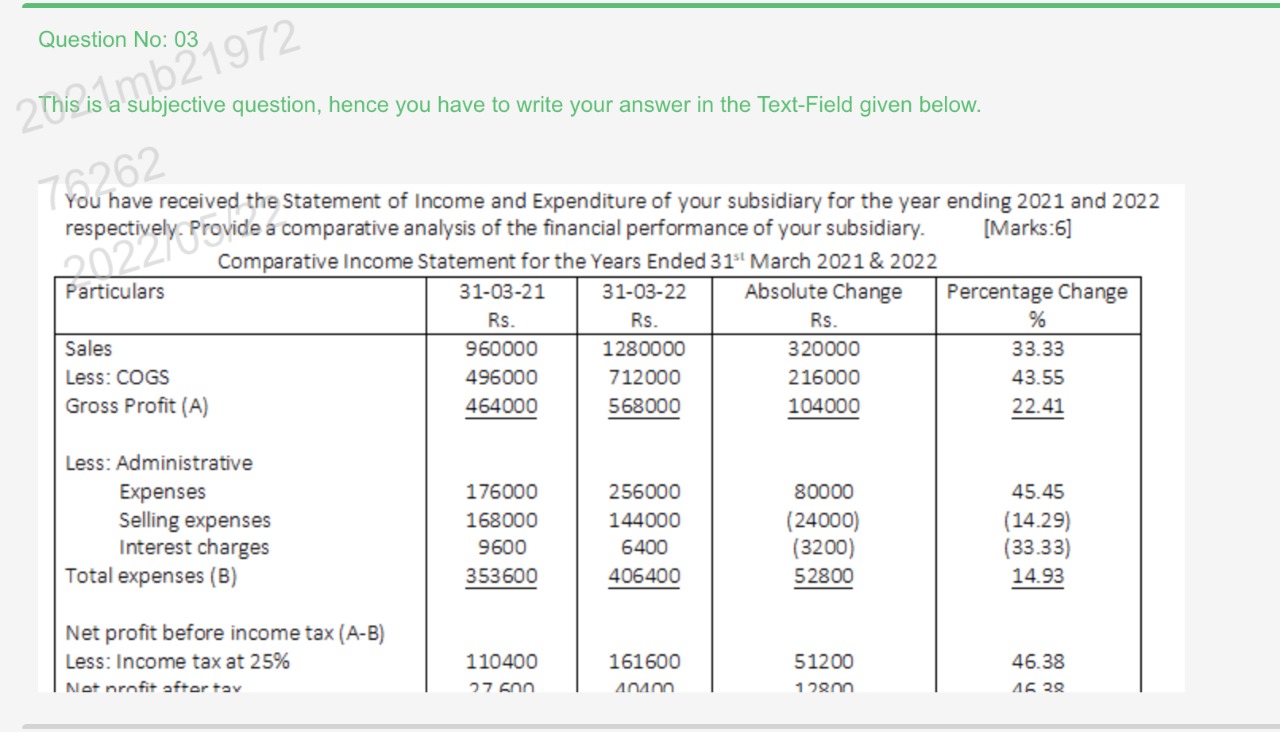

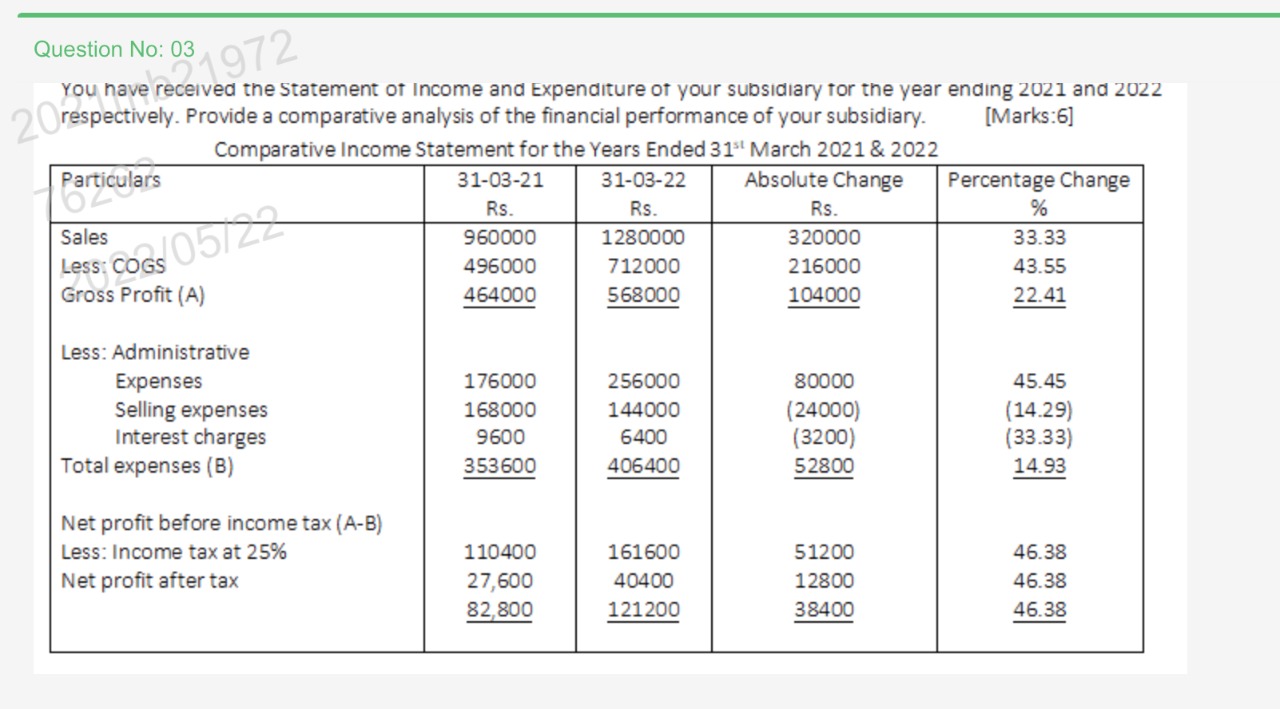

Question No: 03 2This is mb21972 his is a subjective question, hence you have to write your answer in the Text-Field given below. 76262 You have received the Statement of Income and Expenditure of your subsidiary for the year ending 2021 and 2022 respectively. Pr [Marks:6] a comparative analysis of the financial performance of your subsidiary. Comparative Income Statement for the Years Ended 31st March 2021 & 2022 Absolute Change Particulars 31-03-21 31-03-22 Rs. Percentage Change % Rs. Sales Rs. 960000 1280000 320000 33.33 Less: COGS 496000 712000 216000 43.55 Gross Profit (A) 464000 568000 104000 22.41 Less: Administrative Expenses 176000 256000 80000 45.45 Selling expenses 168000 144000 (24000) (14.29) Interest charges 9600 6400 (3200) (33.33) Total expenses (B) 353600 406400 52800 14.93 Net profit before income tax (A-B) Less: Income tax at 25% 110400 161600 51200 46.38 Net profit after tav 27 600 40400 12800 46 38 Question No: 03 You have e rec1972 received the Statement of Income and Expenditure of your subsidiary for the year ending 2021 and 2022 20 respectively. Provide a comparative analysis of the financial performance of your subsidiary. [Marks:6] Comparative Income Statement for the Years Ended 31st March 2021 & 2022 Particulars 31-03-21 31-03-22 Particu Absolute Change Percentage Change Rs. Rs. Rs. % Sales 960000 1280000 320000 33.33 Less: 496000 712000 216000 43.55 Gross Profit (A) 464000 568000 104000 22.41 Less: Administrative Expenses 176000 256000 80000 45.45 Selling expenses 168000 144000 (24000) (14.29) Interest charges 9600 6400 (3200) (33.33) Total expenses (B) 353600 406400 52800 14.93 Net profit before income tax (A-B) Less: Income tax at 25% 110400 161600 51200 46.38 Net profit after tax 27,600 40400 12800 46.38 82,800 121200 38400 46.38 COGS 05/22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts