Question: When an asset that should be capitalized is instead expensed, what is the effect on the financial statements in the year the asset is acquired?

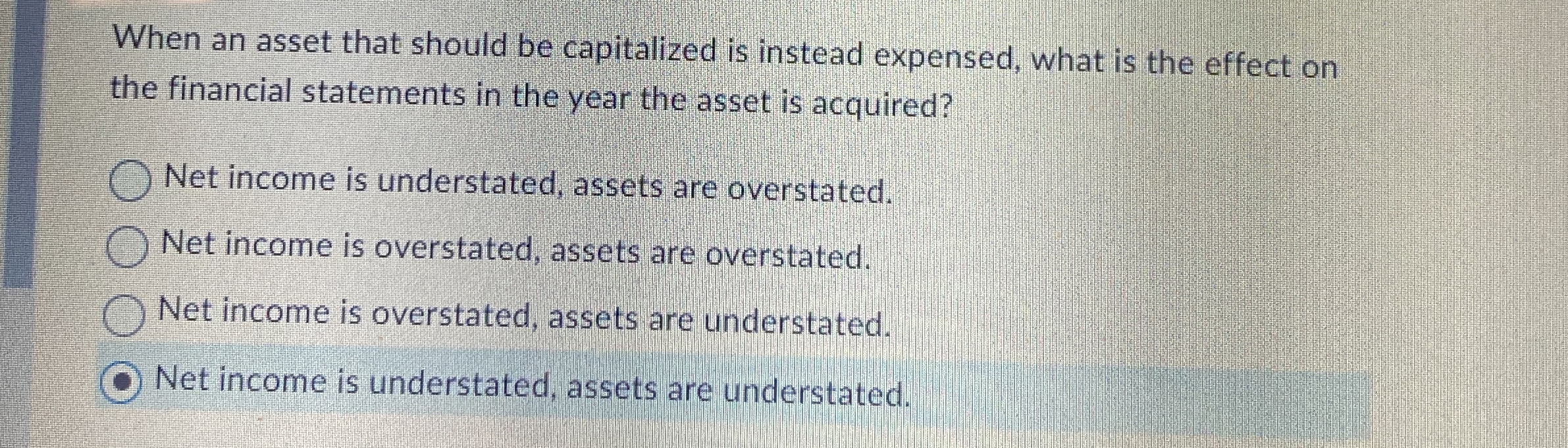

When an asset that should be capitalized is instead expensed, what is the effect on the financial statements in the year the asset is acquired?

Net income is understated, assets are overstated.

Net income is overstated, assets are overstated.

Net income is overstated, assets are understated.

Net income is understated, assets are understated.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock