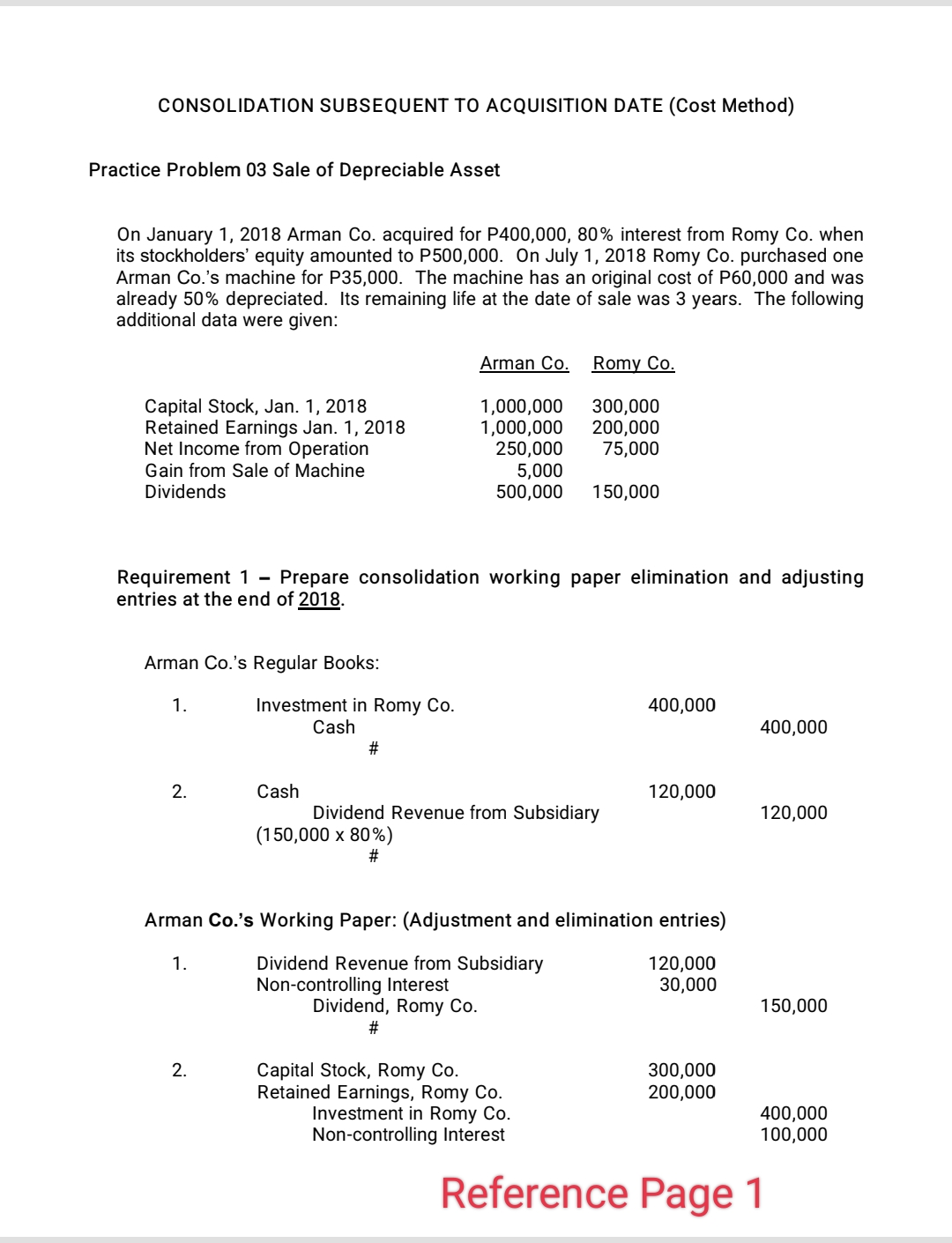

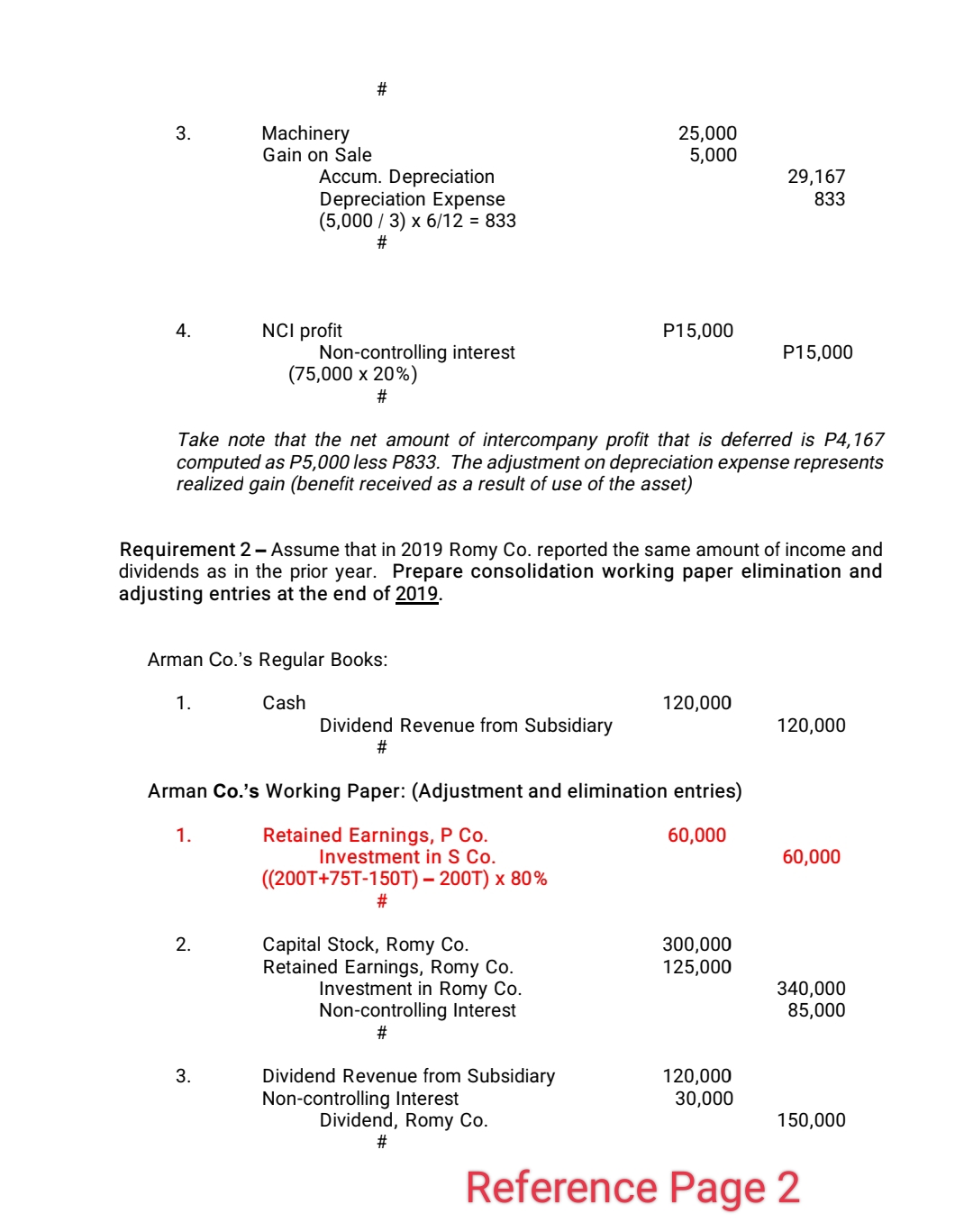

Question: Kindly provide solution same as the reference given after the problem. Pages are written in every photo for better understanding. Thank you. Problem: ASSIGNMENT 00

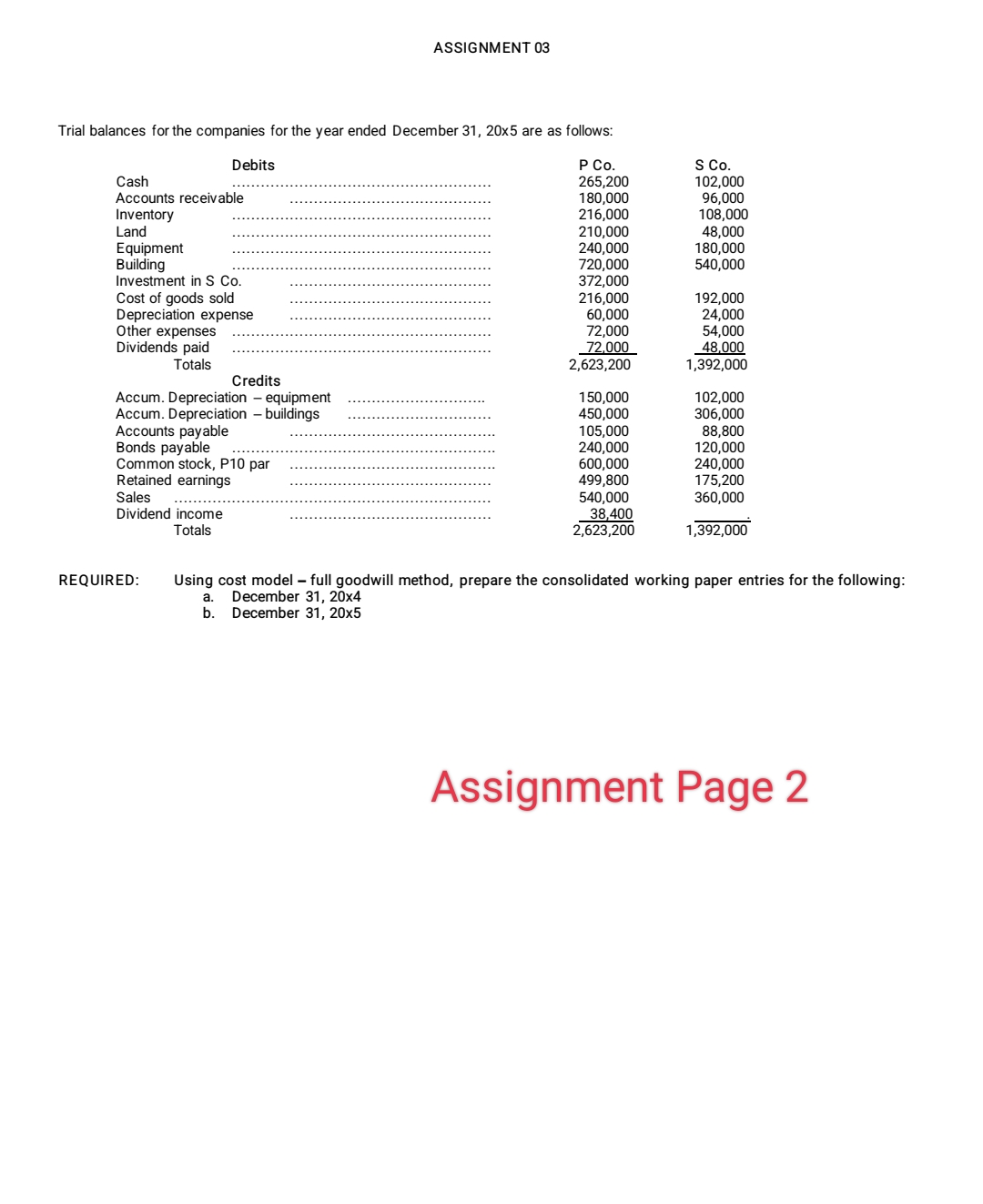

Kindly provide solution same as the reference given after the problem. Pages are written in every photo for better understanding. Thank you.

Problem:

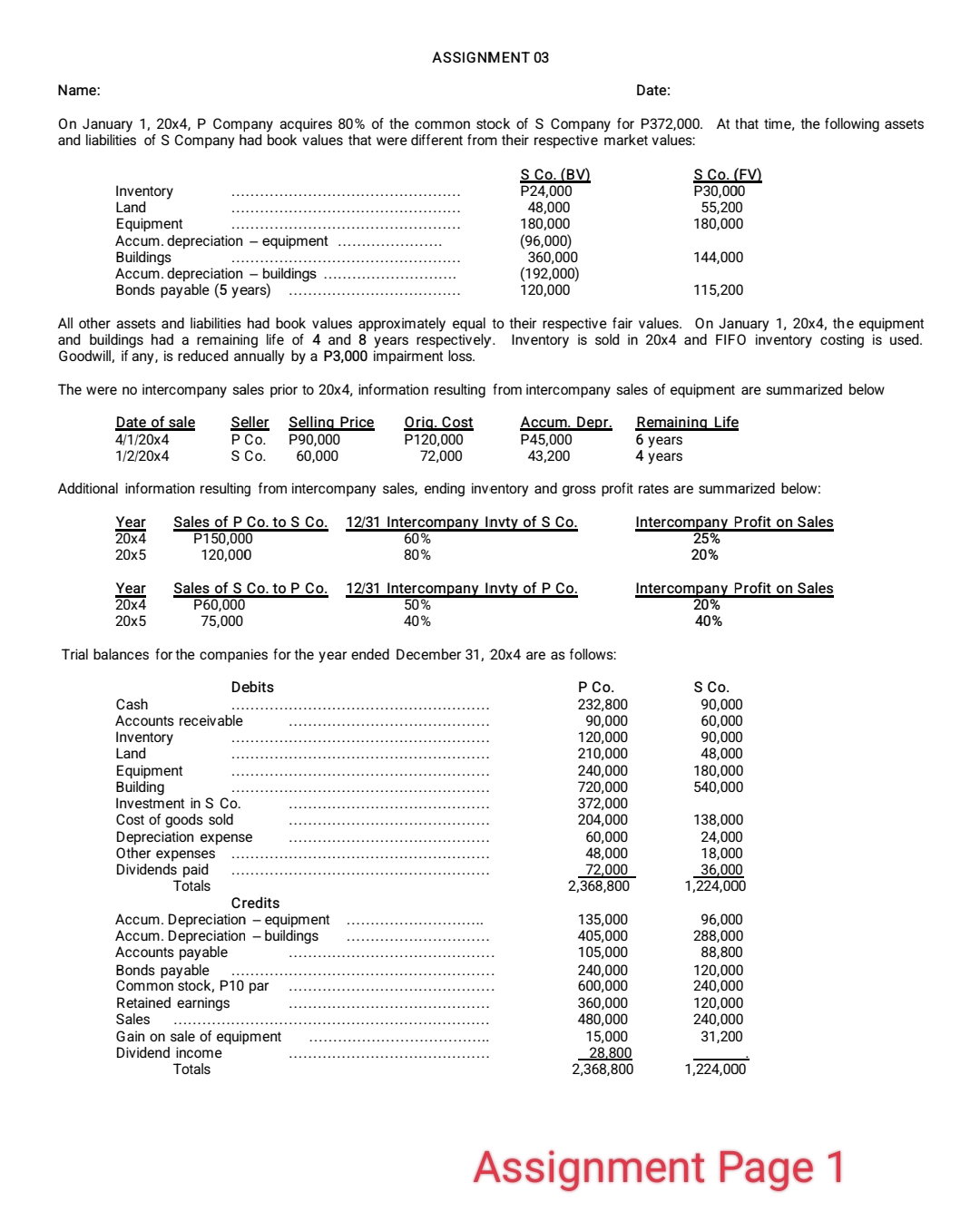

ASSIGNMENT 00 N ame: Date: On January 1, 20x4, P Company acquires 80% of the common stock of 8 Company for P372,000. At that time, the following assets and liabilities of 8 Company had book values that were different from their respective market values: $00.13!] SCO.|F

Get step-by-step solutions from verified subject matter experts