Question: provide solution same as the reference given after the problem. Pages are written in every photo for better understanding. Thank you. CONSOLIDATION SUBSEQUENT TO ACQUISITION

provide solution same as the reference given after the problem. Pages are written in every photo for better understanding. Thank you.

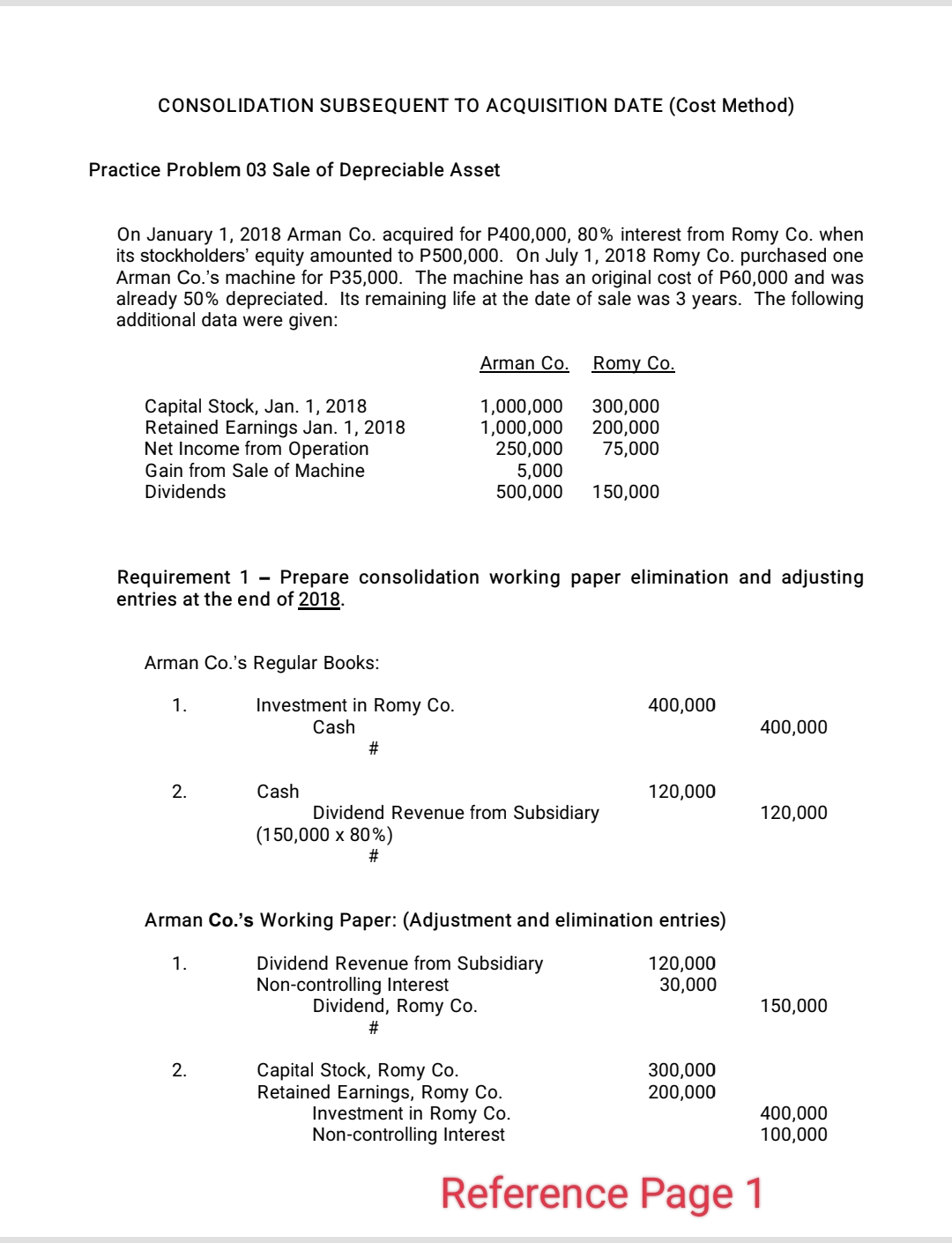

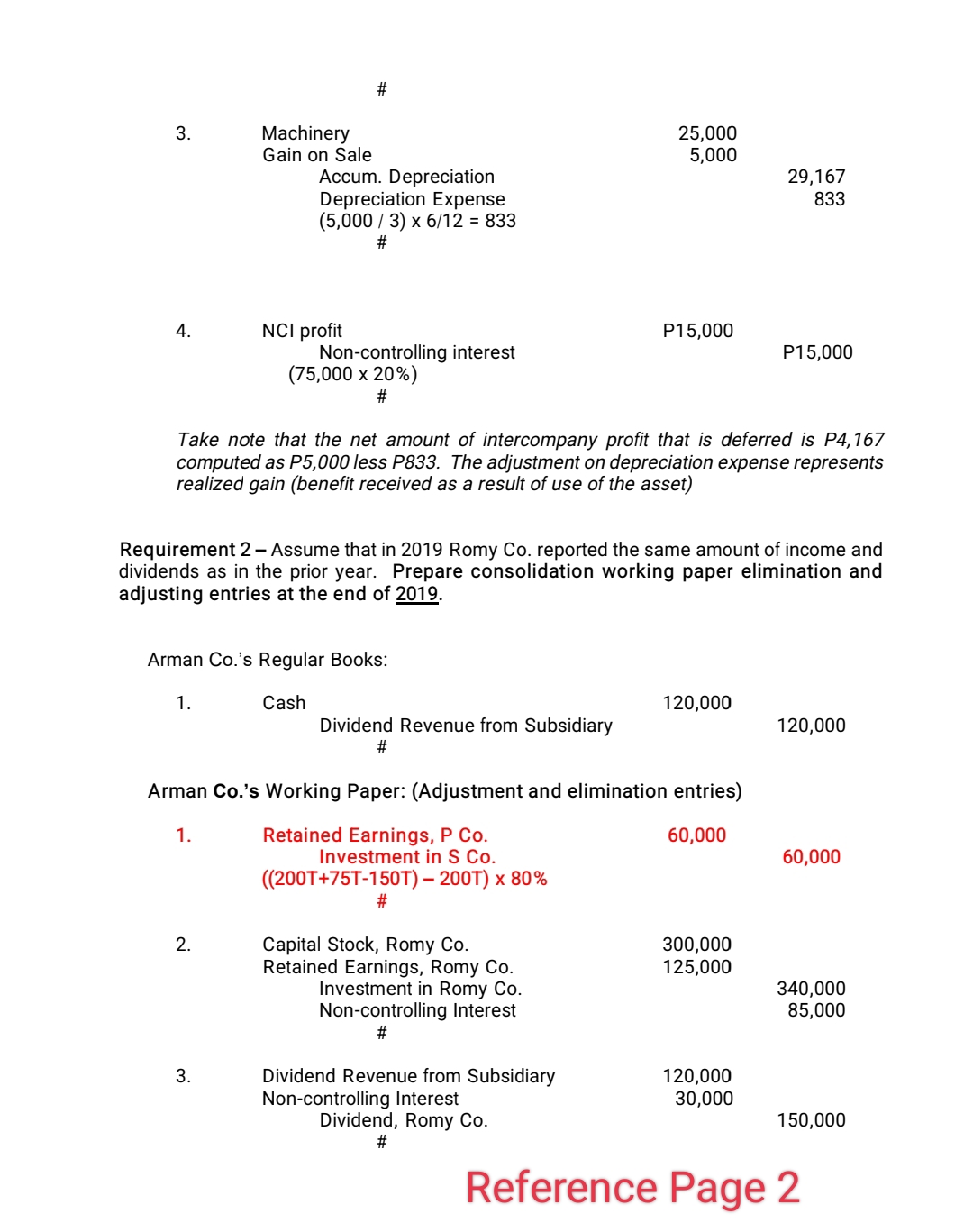

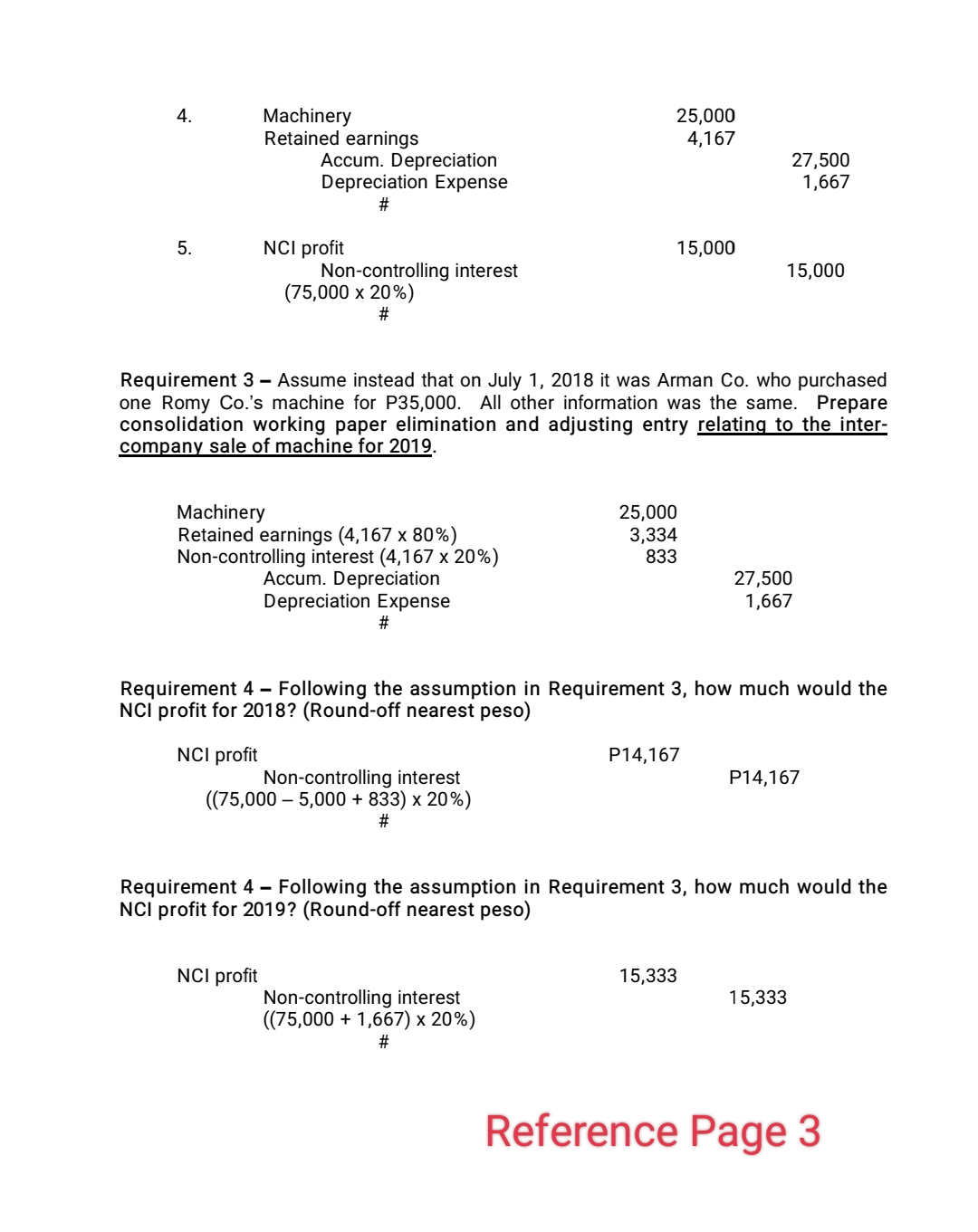

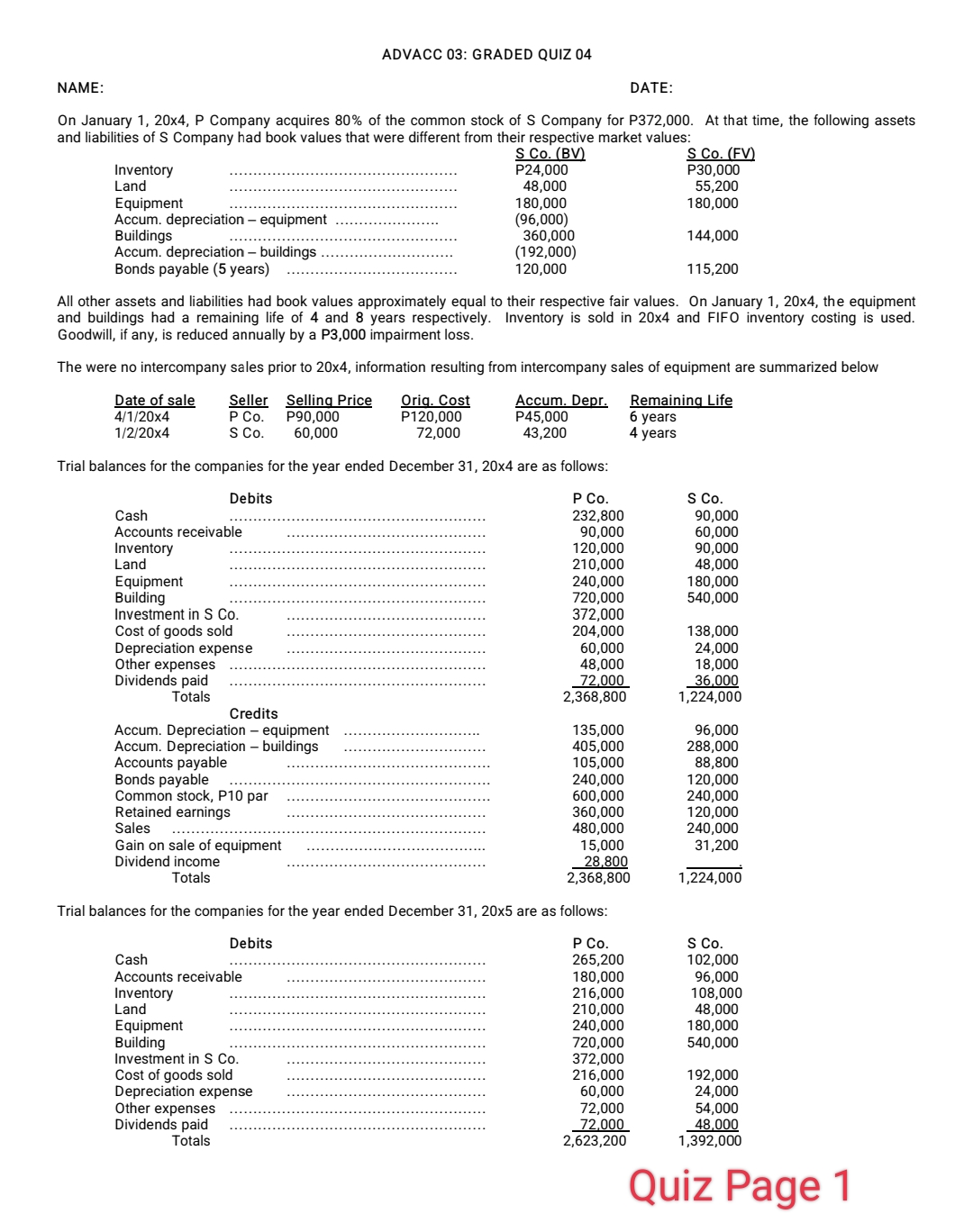

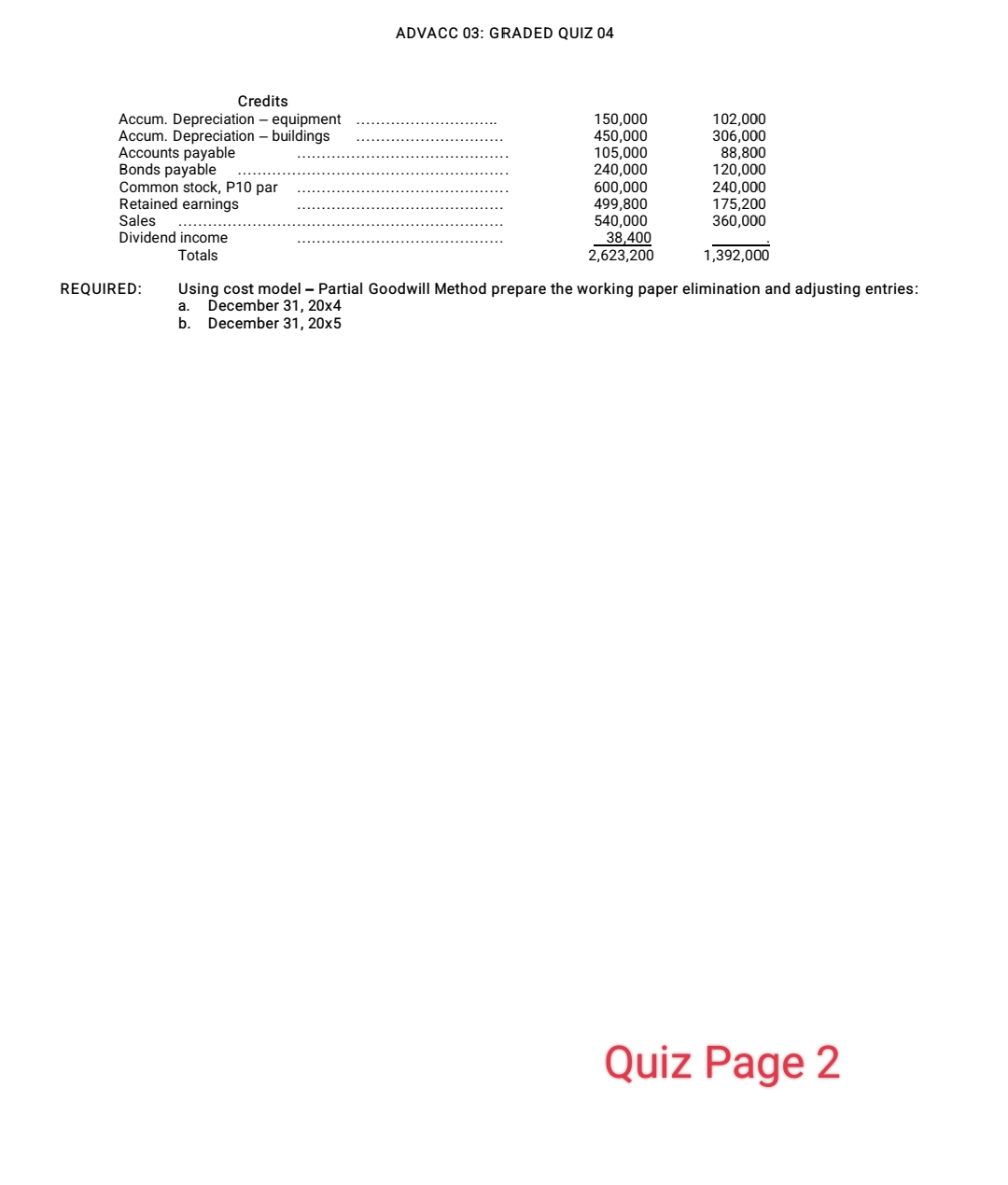

CONSOLIDATION SUBSEQUENT TO ACQUISITION DATE (Cost Method) Practice Problem 03 Sale of Depreciable Asset On January 1, 2018 Arman Co. acquired for P400,000, 80% interest from Romy Co. when its stockholders' equity amounted to P500,000. On July 1, 2018 Romy Co. purchased one Arman Co.'s machine for P35,000. The machine has an original cost of P60,000 and was already 50% depreciated. Its remaining life at the date of sale was 3 years. The following additional data were given: Arman Co. Romy Co. Capital Stock, Jan. 1, 2018 1,000,000 300,000 Retained Earnings Jan. 1, 2018 1,000,000 200,000 Net Income from Operation 250,000 75,000 Gain from Sale of Machine 5,000 Dividends 500,000 150,000 Requirement 1 - Prepare consolidation working paper elimination and adjusting entries at the end of 2018. Arman Co.'s Regular Books: 1. Investment in Romy Co. 400,000 Cash 400,000 # 2. Cash 120,000 Dividend Revenue from Subsidiary 120,000 (150,000 x 80%) Arman Co.'s Working Paper: (Adjustment and elimination entries) 1. Dividend Revenue from Subsidiary 120,000 Non-controlling Interest 30,000 Dividend, Romy Co. 150,000 2. Capital Stock, Romy Co. 300,000 Retained Earnings, Romy Co. 200,000 Investment in Romy Co. 400,000 Non-controlling Interest 100,000 Reference Page 1# 3. Machinery 25,000 Gain on Sale 5,000 Accum. Depreciation 29,167 Depreciation Expense 833 (5,000 / 3) x 6/12 = 833 4. NCI profit P15,000 Non-controlling interest P15,000 (75,000 x 20%) # Take note that the net amount of intercompany profit that is deferred is P4,167 computed as P5,000 less P833. The adjustment on depreciation expense represents realized gain (benefit received as a result of use of the asset) Requirement 2 - Assume that in 2019 Romy Co. reported the same amount of income and dividends as in the prior year. Prepare consolidation working paper elimination and adjusting entries at the end of 2019 Arman Co.'s Regular Books: 1 . Cash 120,000 Dividend Revenue from Subsidiary 120,000 # Arman Co.'s Working Paper: (Adjustment and elimination entries) 1 Retained Earnings, P Co. 60,000 Investment in S Co. 60,000 ((200T+75T-150T) - 200T) x 80% 2. Capital Stock, Romy Co. 300,000 Retained Earnings, Romy Co. 125,000 Investment in Romy Co. 340,000 Non-controlling Interest 85,000 # 3. Dividend Revenue from Subsidiary 120,000 Non-controlling Interest 30,000 Dividend, Romy Co. 150,000 Reference Page 24. Machinery 25,000 Retained earnings 4,167 Accum. Depreciation 27,500 Depreciation Expense 1,667 5. NCI profit 15,000 Non-controlling interest 15,000 (75,000 x 20% # Requirement 3 - Assume instead that on July 1, 2018 it was Arman Co. who purchased one Romy Co.'s machine for P35,000. All other information was the same. Prepare consolidation working paper elimination and adjusting entry relating to the inter- company sale of machine for 2019 Machinery 25,000 Retained earnings (4, 167 x 80%) 3,334 Non-controlling interest (4, 167 x 20%) 833 Accum. Depreciation 27,500 Depreciation Expense 1,667 # Requirement 4 - Following the assumption in Requirement 3, how much would the NCI profit for 2018? (Round-off nearest peso) NCI profit P14,167 Non-controlling interest P14,167 ((75,000 - 5,000 + 833) x 20%) Requirement 4 - Following the assumption in Requirement 3, how much would the NCI profit for 2019? (Round-off nearest peso) NCI profit 15,333 Non-controlling interest 15,333 ((75,000 + 1,667) x 20%) Reference Page 3ADVACC 03: GRADED QUIZ 04 NAME: DATE: On January 1. 20x4. P Company acquires 80% of the common stock of 8 Company for P372000. At that time. the following assets and liabilities of 3 Company had book values that were different from their respective market values: 3 00.1311 5 Co. [FE] Inventory P24.000 P300013 Land 48.000 55.200 Equipment 180.000 1 80.000 Accum. depreciation equipment .................... (96,000) Buildings ............................................. 360.000 144.000 Accum. depreciation buildings .......................... (192.000) Bonds payable (5 years} .................................... 120.000 115.200 All other assets and liabilities had book values approximately equal to their respective fair values. On January 1. 20x4. the equipment and buildings had a remaining life of 4 and 3 years respectively. Inventory is sold in 20x4 and FIFO inventory costing is used. Goodwill. if any. is reduced annually by a P3.000 impairment loss. The were no intercompany sales prior to 20x4. infom'tation resulting from intercompany sales of equipment are summarized below Date of sale Seller Selling Price Orig. Cost Accum. Degr. Remaining Life 4i1!20x4 P Go. P90.000 P120.000 P45.000 6 years 13320\" 8 Co. 60. 000 72.000 43.200 4 years Trial balances for the companies for the year ended December 31. 20x4 are as follows: Debits P Co. 5 Co. Cash ...................................................... 232.800 90.000 Accounts receivable 90.000 60.000 Inventory ................................... 120.000 90.000 Land ...................................................... 210.000 43.000 Equipment ...................................................... 240.000 180.000 Building ................................... 720.000 540.000 Investment in 8 Co. 372.000 Cost of goods sold 204.000 133.000 Depreciation expense .......................................... 60.000 24.000 Other expenses 43.000 13.000 Dividends paid 72.000 36.000 Totals 2,368,300 1.224.000 Credits Accum. Depreciation equipment ............................. 135.000 96.000 Accum. Depreciation buildings 405.000 283.000 Accounts payable ....................... 105.000 83.800 Bonds payable ....................................................... 240.000 120.000 Common stock. P10 par 600.000 240.000 Retained earnings 360.000 120.000 Sales ............................................... 430.000 240.000 Gain on sale of equipment 15.000 31.200 Dividend income 28.800 . Totals 2.368.800 1.224.000 Trial balances for the companies for the year ended December 31. 20x5 are as follows: Debits P Co. S 00. Cash ...................................................... 265.200 1 02.000 Accounts receivable 130.000 96.000 Inventory ................................... 21 6.000 108.000 Land 210.000 43.000 Equipment 240.000 180.000 Building ................................... 720.000 540.000 Investment in 8 Co. 372.000 Cost of goods sold 216.000 192.000 Depreciation expense 60.000 24.000 Other expenses ................................... 72.000 54.000 Dividends paid ...................................................... 72.000 43.000 Totals 2,623,200 1,392,000 Quiz Page 1 ADVACC D3: GRADED QUIZ 04 Credits Accum. Depreciation equipment 150.000 102.000 Accum. Depreciation buildings 450.000 306.000 Accounts payable .......................... 105.000 88.800 Bonds payable ....................................................... 240.000 120.000 Common stock. P10 par ........................................... 600.000 240.000 Retained earnings .......................... 499.800 175.200 Sales .................................................. 540.000 360.000 Dividend income .......................................... 38.400 . Totals 2. 623.200 1.392.000 REQUIRED: Using cost model - Partial Goodwill Method prepare the working paper elimination and adjusting entries: a. December 31. 20x4 b. December 31. 20315 Quiz Page 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts