Question: Kindly resolve this problem but in another way, don not copy the previous answers, a need a new answer with good explaination please. If you

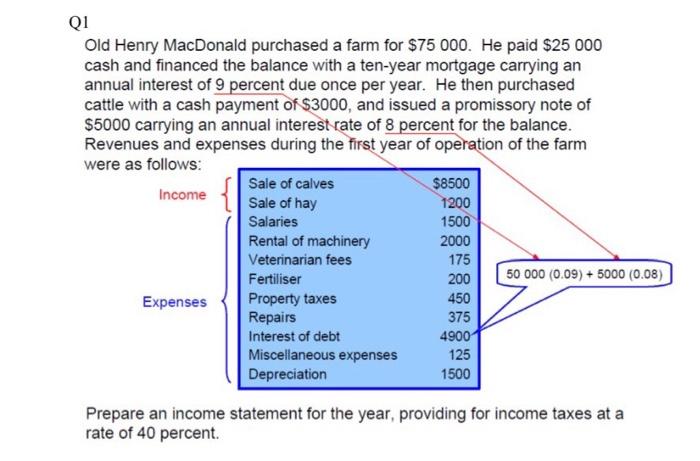

Q1 Old Henry MacDonald purchased a farm for $75 000. He paid $25 000 cash and financed the balance with a ten-year mortgage carrying an annual interest of 9 percent due once per year. He then purchased cattle with a cash payment of $3000, and issued a promissory note of $5000 carrying an annual interest rate of 8 percent for the balance. Revenues and expenses during the first year of operation of the farm were as follows: Sale of calves $8500 Income Sale of hay 1200 Salaries 1500 Rental of machinery 2000 Veterinarian fees 175 Fertiliser 200 50 000 (0.09) + 5000 (0.08) Expenses Property taxes 450 Repairs 375 Interest of debt 4900 Miscellaneous expenses 125 Depreciation 1500 Prepare an income statement for the year, providing for income taxes at a rate of 40 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts