Question: Kindly see both tables please and answer below questions : You will be able to access the prices for the calls and puts that are

Kindly see both tables please and answer below questions :

Kindly see both tables please and answer below questions :

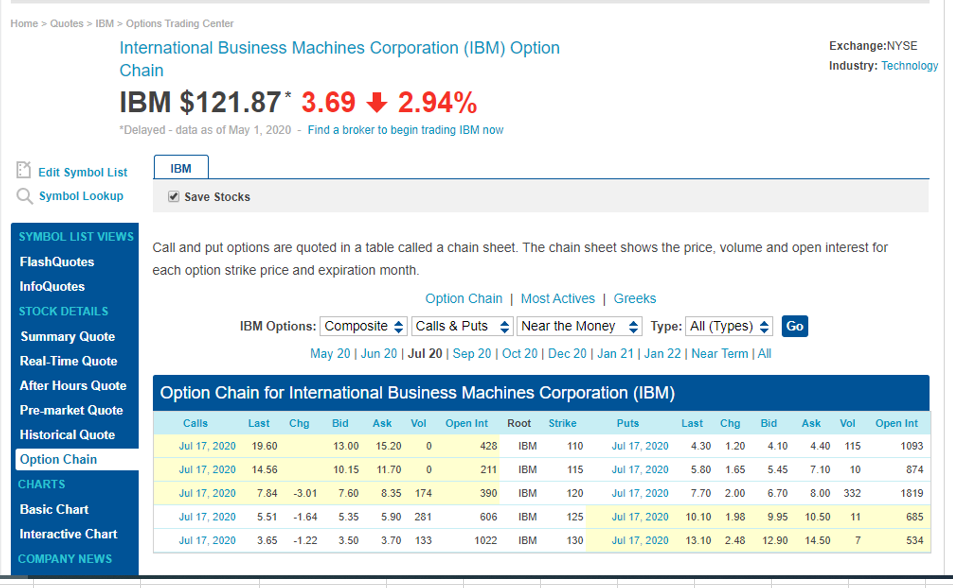

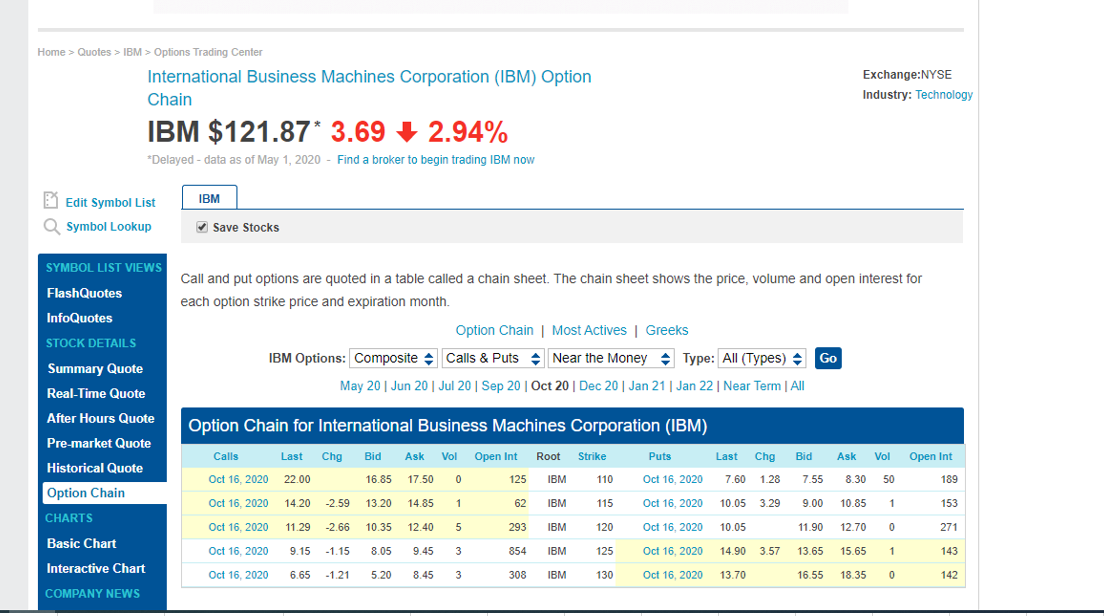

You will be able to access the prices for the calls and puts that are closest to the money. For example, if the price of IBM is $196.72, you will use the options with the $195 exercise price. Use near-term options. For example, in February, you would select April and July expirations.

a) What are the prices for the put and call with the nearest expiration date? b) What would be the cost of a straddle using these options? c) At expiration, what would be the break-even stock prices for the straddle? d) What would be the percentage increase or decrease in the stock price required to break even? e) What are the prices for the put and call with a later expiration date? f) What would be the cost of a straddle using the later expiration date? At expiration, what would be the break-even stock prices for the straddle? g) What would be the percentage increase or decrease in the stock price required to break even?

Exchange:NYSE Industry: Technology Home > Quotes > IBM > Options Trading Center International Business Machines Corporation (IBM) Option Chain IBM $121.87* 3.69 + 2.94% *Delayed - data as of May 1, 2020 - Find a broker to begin trading IBM now | IBM Edit Symbol List Q Symbol Lookup Save Stocks SYMBOL LIST VIEWS FlashQuotes InfoQuotes Call and put options are quoted in a table called a chain sheet. The chain sheet shows the price, volume and open interest for each option strike price and expiration month. STOCK DETAILS Option Chain | Most Actives | Greeks IBM Options: Composite Calls & Puts Near the Money Type: All (Types) Go May 20 Jun 20 Jul 20 Sep 20 Oct 20 Dec 20 Jan 21 Jan 22 | Near Term All Summary Quote Real-Time Quote Option Chain for International Business Machines Corporation (IBM) After Hours Quote Pre-market Quote Historical Quote Option Chain CHARTS Calls Jul 17, 2020 Jul 17, 2020 Jul 17, 2020 Jul 17, 2020 Jul 17, 2020 Last 19.60 14.56 7.84 5.51 3.65 Chg Bid 13.00 10.15 -3.01 7.60 -1.645.35 -1.22 3.50 Ask Vol 15.20 0 11.70 0 8.35 174 5.90 281 3.70 133 Open Int 4 28 2 11 390 606 1022 Root IBM IBM IBM IBM IBM Strike 110 115 120 125 130 Puts Jul 17, 2020 Jul 17, 2020 Jul 17, 2020 Jul 17, 2020 Jul 17, 2020 Last 4.30 5.80 7.70 10.10 13.10 Chg 1.20 1.65 2.00 1.99 2.48 Bid 4.10 5.45 6.70 9.95 12.90 Ask 4.40 7.10 8.00 10.50 14.50 Vol 115 10 332 11 7 Open Int 1093 874 1819 6 85 534 Basic Chart Interactive Chart COMPANY NEWS Exchange:NYSE Industry: Technology Home > Quotes > IBM > Options Trading Center International Business Machines Corporation (IBM) Option Chain IBM $121.87* 3.69 + 2.94% *Delayed - data as of May 1, 2020 - Find a broker to begin trading IBM now IBM Edit Symbol List Q Symbol Lookup Save Stocks SYMBOL LIST VIEWS FlashQuotes InfoQuotes Call and put options are quoted in a table called a chain sheet. The chain sheet shows the price, volume and open interest for each option strike price and expiration month. Option Chain | Most Actives | Greeks IBM Options: Composite Calls & Puts Near the Money Type: All (Types) Go May 20 Jun 20 Jul 20 Sep 20 Oct 20 Dec 20 Jan 21 Jan 22 Near Term All STOCK DETAILS Summary Quote Real-Time Quote After Hours Quote Option Chain for International Business Machines Corporation (IBM), Pre-market Quote Chg Historical Quote Option Chain CHARTS Calls Oct 16, 2020 Oct 16, 2020 Oct 16, 2020 Oct 16, 2020 Oct 16, 2020 Last 22.00 14.20 11.29 9.15 6.65 Bid 16.85 13.20 10.35 8.05 5.20 -2.59 -2.66 -1.15 -1.21 Ask Vol 17.500 14.85 1 12.40 5 9.453 8.45 3 Open Int 125 62 293 854 308 Root IBM IBM IBM IBM IBM Strike 1 10 115 120 125 130 Puts Oct 16, 2020 Oct 16, 2020 Oct 16, 2020 Oct 16, 2020 Oct 16, 2020 Last 7.60 10.05 10.05 14.90 13.70 Chg Bid 1.28 7.55 3.299.00 11.90 3.57 13.65 16.55 Ask Vol 8.30 50 10.851 12.700 15.65 1 18.350 Open Int 189 153 271 1 43 142 Basic Chart Interactive Chart COMPANY NEWS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts