Question: kindly select each option 1 to 4 Why do many small business owners fall short in their record keeping? Select an answer: Bookkeeping is too

kindly select each option 1 to 4

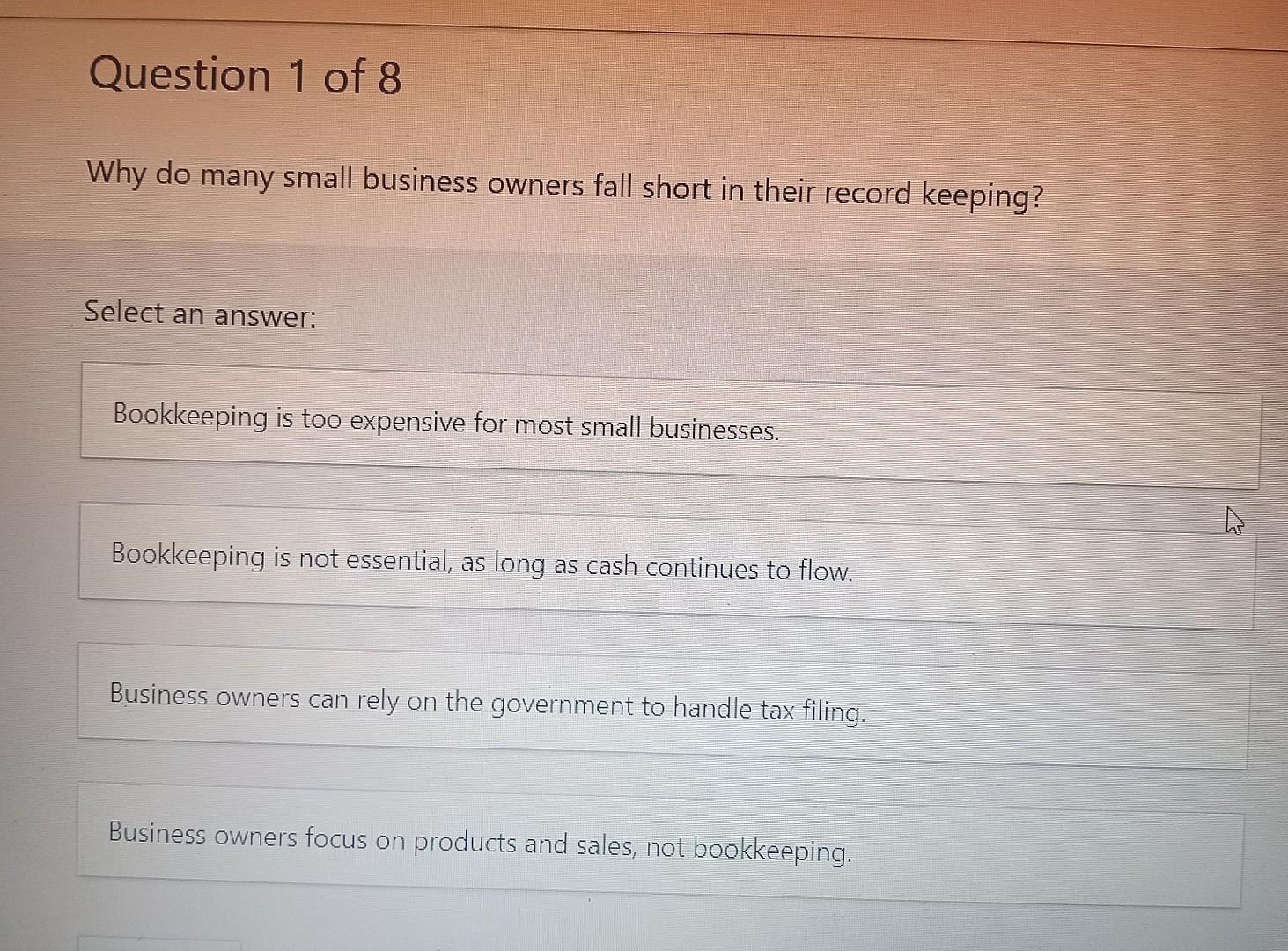

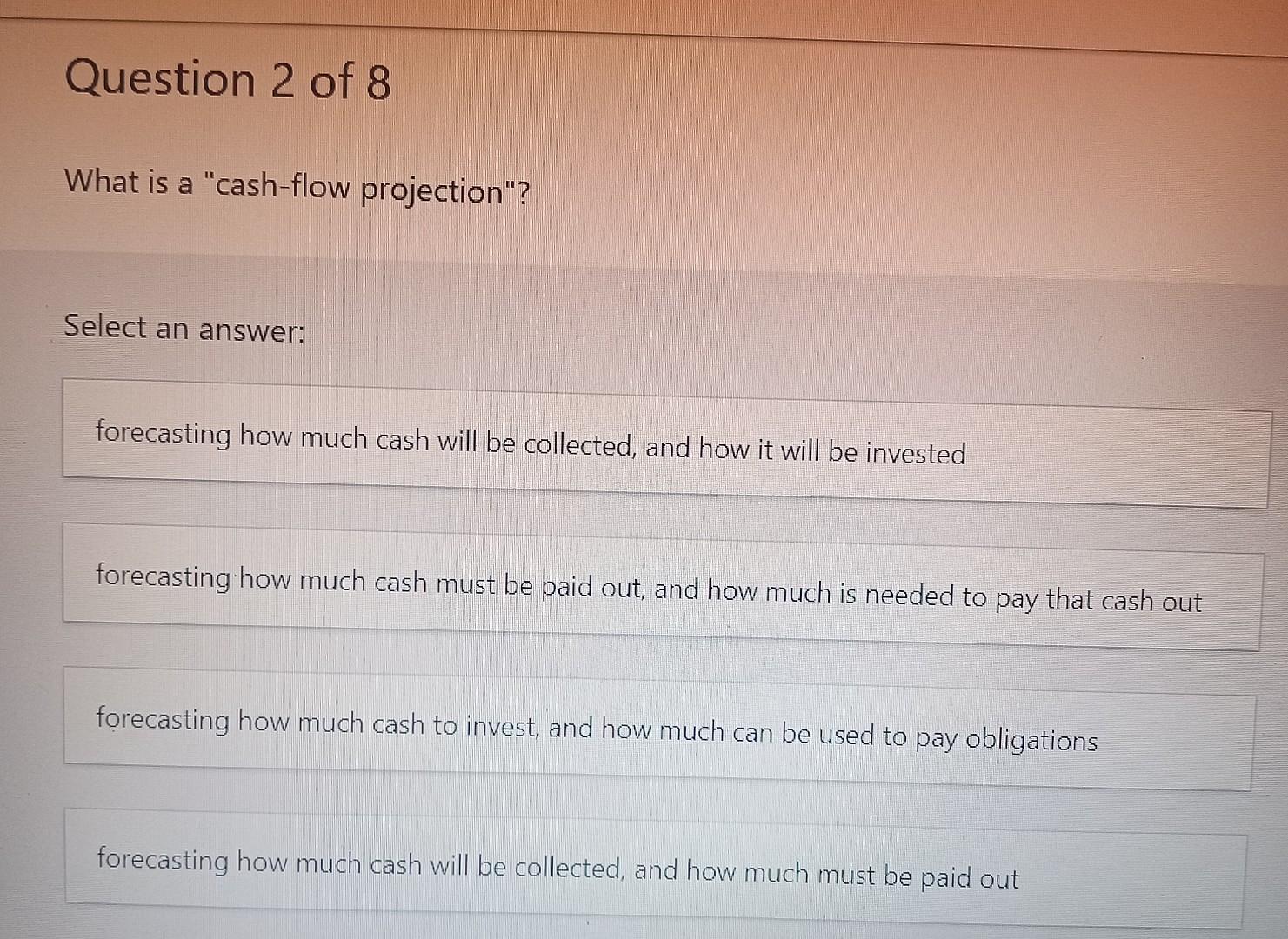

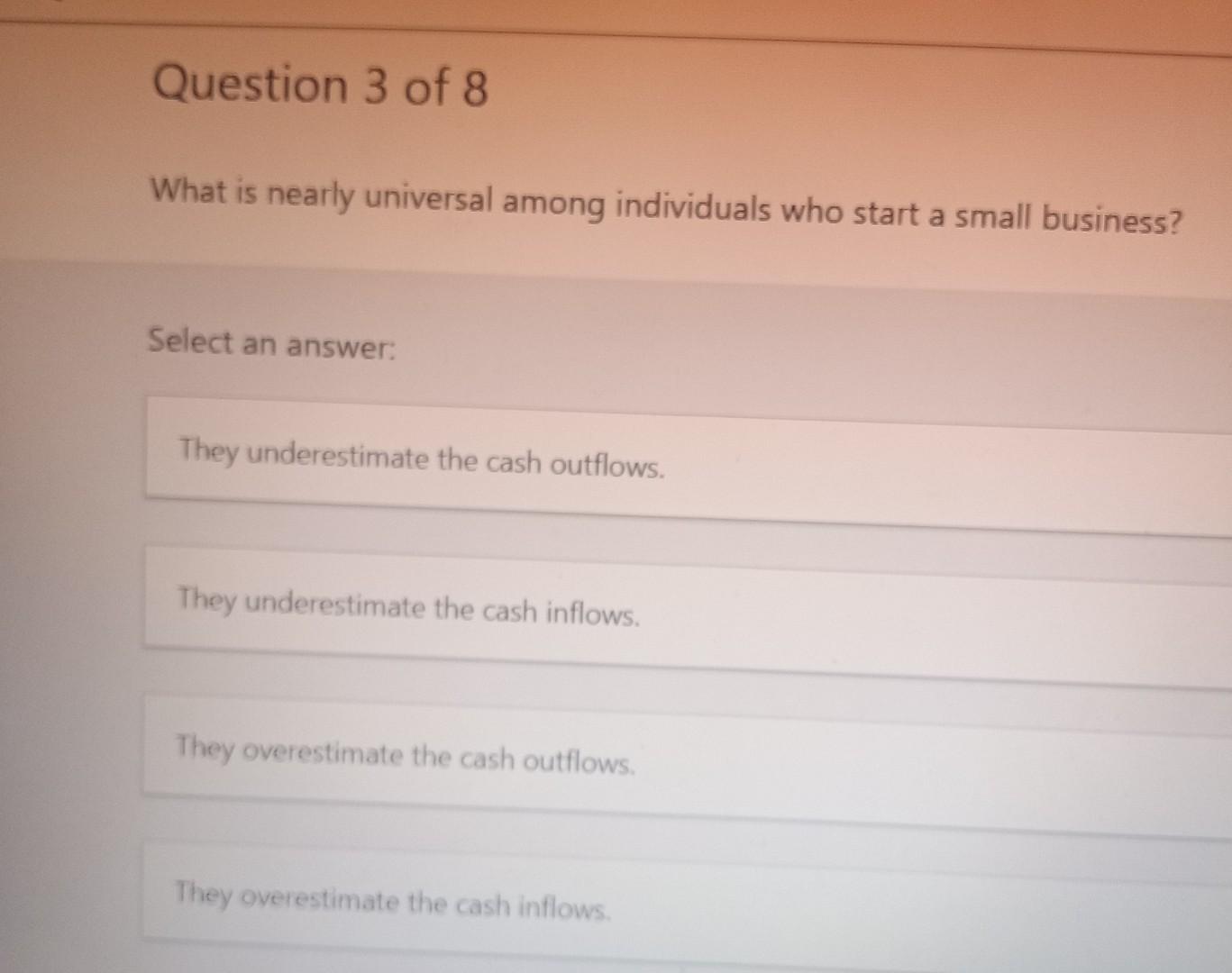

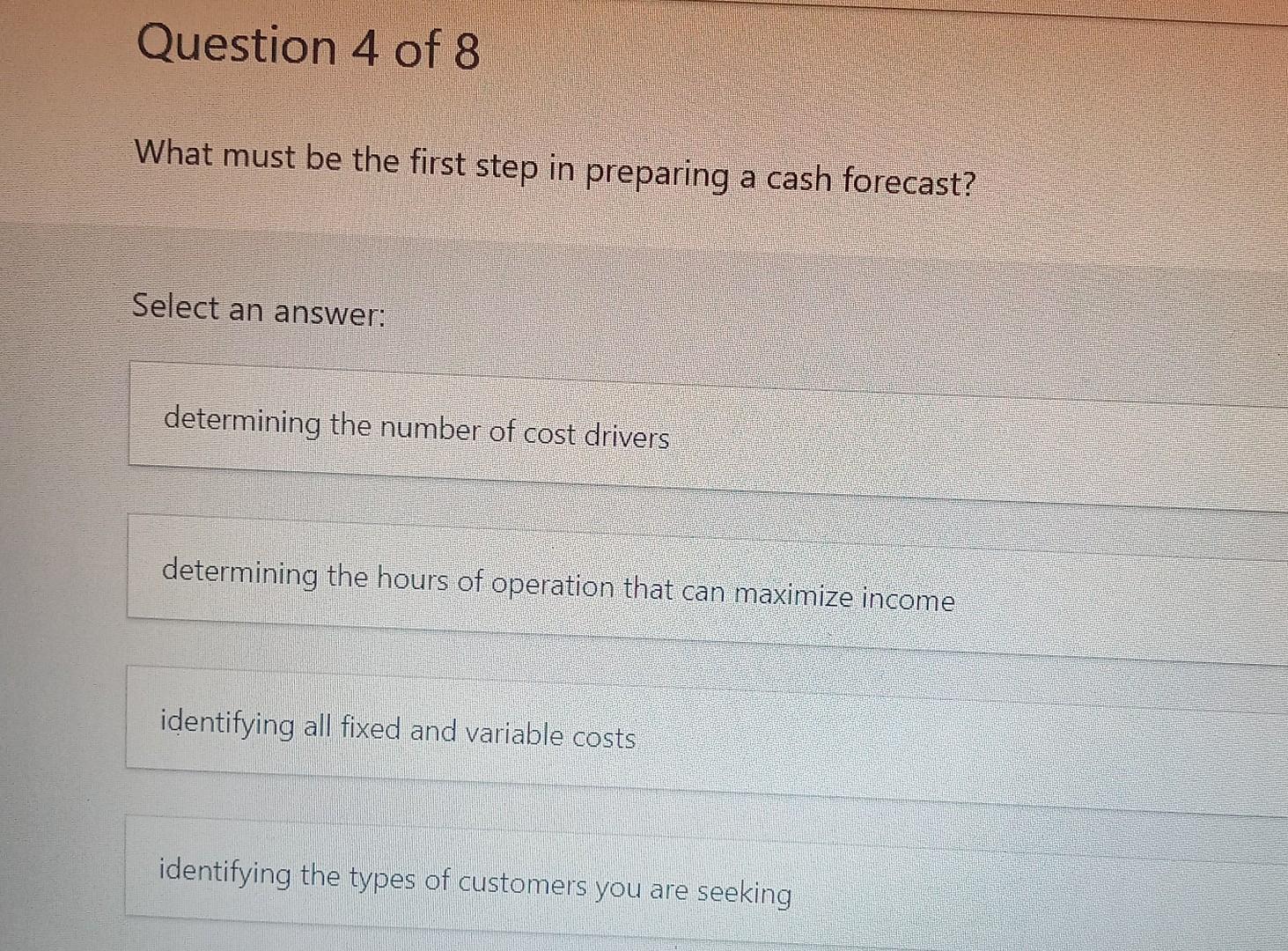

Why do many small business owners fall short in their record keeping? Select an answer: Bookkeeping is too expensive for most small businesses. Bookkeeping is not essential, as long as cash continues to flow. Business owners can rely on the government to handle tax filing. Business owners focus on products and sales, not bookkeeping. What is a "cash-flow projection"? Select an answer: forecasting how much cash will be collected, and how it will be invested forecasting how much cash must be paid out, and how much is needed to pay that cash out forecasting how much cash to invest, and how much can be used to pay obligations forecasting how much cash will be collected, and how much must be paid out What is nearly universal among individuals who start a small business? Select an answer: They underestimate the cash outflows. They underestimate the cash inflows. They overestimate the cash outflows. They overestimate the cash inflows. What must be the first step in preparing a cash forecast? Select an answer: determining the number of cost drivers determining the hours of operation that can maximize income identifying all fixed and variable costs identifying the types of customers you are seeking

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts