Question: Kindly solve it on a paper no Ms Excel please 22. A firm has an issue of $1,000 par value bonds with a 9 percent

Kindly solve it on a paper no Ms Excel please

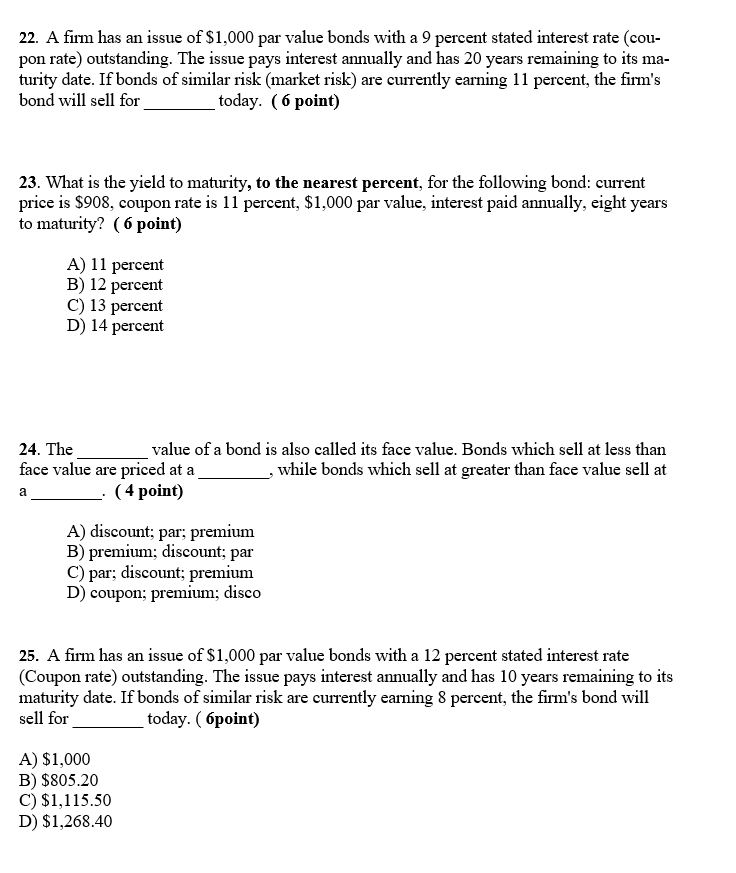

22. A firm has an issue of $1,000 par value bonds with a 9 percent stated interest rate (cou- pon rate) outstanding. The issue pays interest annually and has 20 years remaining to its ma- turity date. If bonds of similar risk (market risk) are currently earning 11 percent, the firm's bond will sell for today. (6 point) 23. What is the yield to maturity, to the nearest percent, for the following bond: current price is $908, coupon rate is 11 percent, $1,000 par value, interest paid annually, eight years to maturity? (6 point) A) 11 percent B) 12 percent C) 13 percent D) 14 percent a 24. The value of a bond is also called its face value. Bonds which sell at less than face value are priced at a , while bonds which sell at greater than face value sell at _- (4 point) A) discount; par; premium B) premium; discount; par C) par; discount; premium D) coupon; premium; disco 25. A firm has an issue of $1,000 par value bonds with a 12 percent stated interest rate (Coupon rate) outstanding. The issue pays interest annually and has 10 years remaining to its maturity date. If bonds of similar risk are currently earning 8 percent, the firm's bond will sell for today. ( point) A) $1,000 B) $805.20 C) $1,115.50 D) $1,268.40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts