Question: Kindly solve the following problems. A restaurant faces very high demand for its signature mousse desserts in the evening but is less busy during the

Kindly solve the following problems.

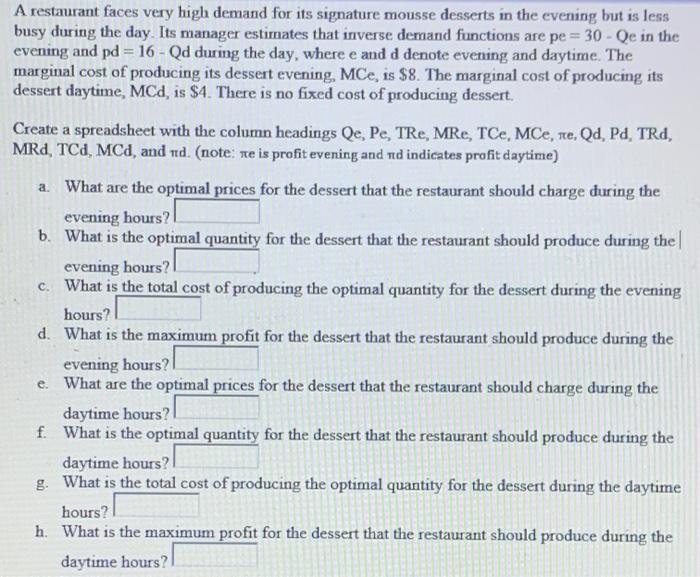

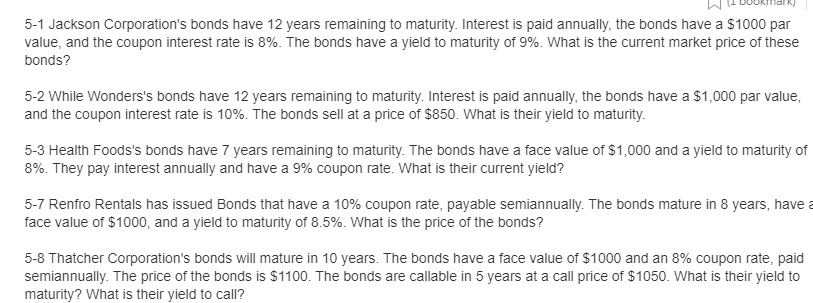

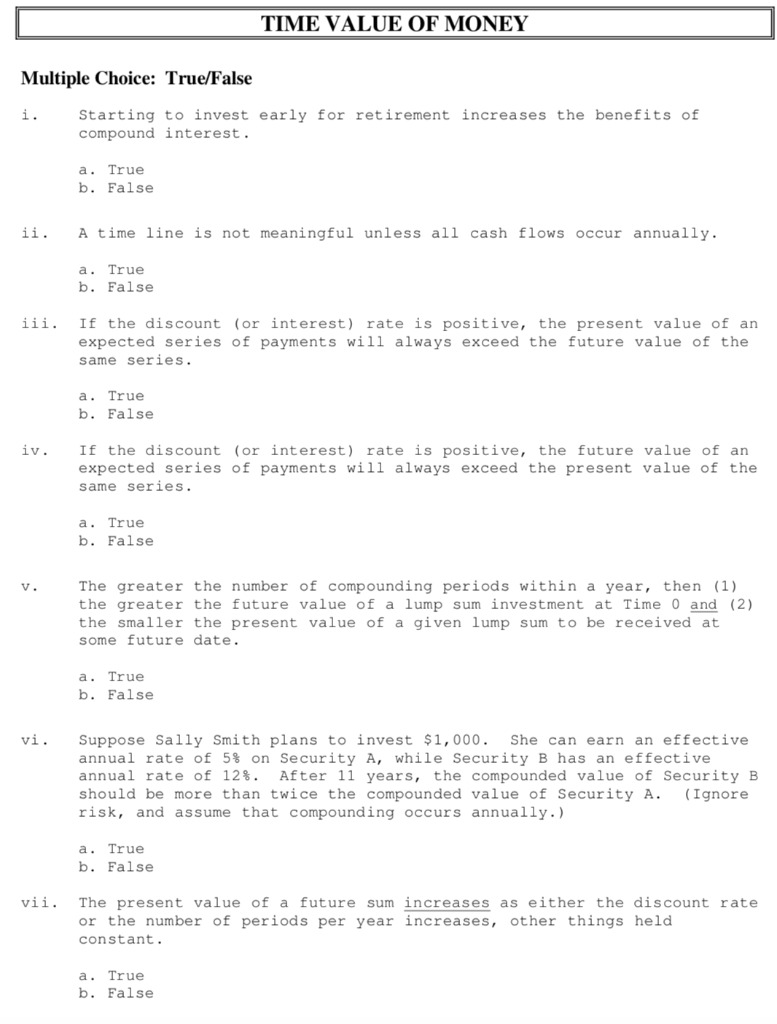

A restaurant faces very high demand for its signature mousse desserts in the evening but is less busy during the day. Its manager estimates that inverse demand functions are pe = 30 - Qe in the evening and pd = 16 -Qd during the day, where e and d denote evening and daytime. The marginal cost of producing its dessert evening, MCe, is $8. The marginal cost of producing its dessert daytime, MCd, is $4. There is no fixed cost of producing dessert. Create a spreadsheet with the column headings Qe, Pe, TRe, MRe, TCe, MCe, ne, Qd, Pd, TRd, MRd, TCd, MCd, and nd. (note: ne is profit evening and nd indicates profit daytime) a. What are the optimal prices for the dessert that the restaurant should charge during the evening hours? b. What is the optimal quantity for the dessert that the restaurant should produce during the evening hours? c. What is the total cost of producing the optimal quantity for the dessert during the evening hours? d. What is the maximum profit for the dessert that the restaurant should produce during the evening hours? e. What are the optimal prices for the dessert that the restaurant should charge during the daytime hours? f. What is the optimal quantity for the dessert that the restaurant should produce during the daytime hours? I g. What is the total cost of producing the optimal quantity for the dessert during the daytime hours? h. What is the maximum profit for the dessert that the restaurant should produce during the daytime hours?In] 11. Ll'U'UKJIldIIKJ 5-1 Jackson Corporation's bonds have 12 years remaining to maturity. Interest is paid annually, the ponds have a $1000 par value, and the coupon interest rate is 8%. The bonds have a yield to maturity of 9%. What is the current market price of these bonds? 5-2 While Wonders's oonds have 12 years remaining to maturity. Interest is paid annuatly, the bonds have a $1,000 par value, and the coupon interest rate is 10%. The bonds sell at a price of $850. What is their yield to maturity. 5-3 Health Foods's bonds have T years remaining to maturity. The bonds have a face 1iralue of $1,000 and a yield to maturity of 8%. They pay interest annually and have a 9% coupon rate. What is their current yield? 5-? Renfro Renters has issued Bonds that have a 10% coupon rate, payable semiannually. The bonds mature in 3 years, have 2 face value of $1000, and a yield to maturity of 8.5%. What is the price of the bonds\"?I 5-8 Thatcher Corporation's bonds will mature in 10 years. The bonds have a face value of $1000 and an 8% coupon rate, paid semiannuatiy. The price cfthe bonds is $1100. The bonds are callable in 5 years at a call price of $1050. What is their yield to maturity? What is their yield to call? TIME VALUE OF MONEY Multiple Choice: TrueFFalse i. Starting to invest early for retirement increases the benefits of compound interest. a. True h. False ii. A time line is not meaningful unless all cash flows occur annually. a. True h. False iii. If the discount {or interest] rate is positive, the present value of an expected series of payments will always exceed the future value of the same series. a. True h. False iv. If the discount {or interest] rate is positive, the future value of an expected series of payments will always exceed the present value of the same series. a. True h. False v. The greater the number of compounding periods within a yearIr then [1} the greater the future value of a lump aum investment at Time and t2} the smaller the present value of a given lump sum to be received at some future date. a. True h. False vi. Suppose Sally Smith plans to invest $1.00. She can earn an effective annual rate of 5% on Security A. while Security B has an effective annual rate of 12%. After 11 years, the compounded value of Security B should be more than twice the compounded value of Security A. [Ignore risk. and assume that compounding occurs annually.i a. True h. False vii. The present value of a future sum increases as either the discount rate or the number of periods per year increases, other things held constant. a. True h. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts