Question: Solve the attached questions. Simple linear regression is a statistical method that allows us to summarize and study relationships between two continuous (quantitative) variables: One

Solve the attached questions.

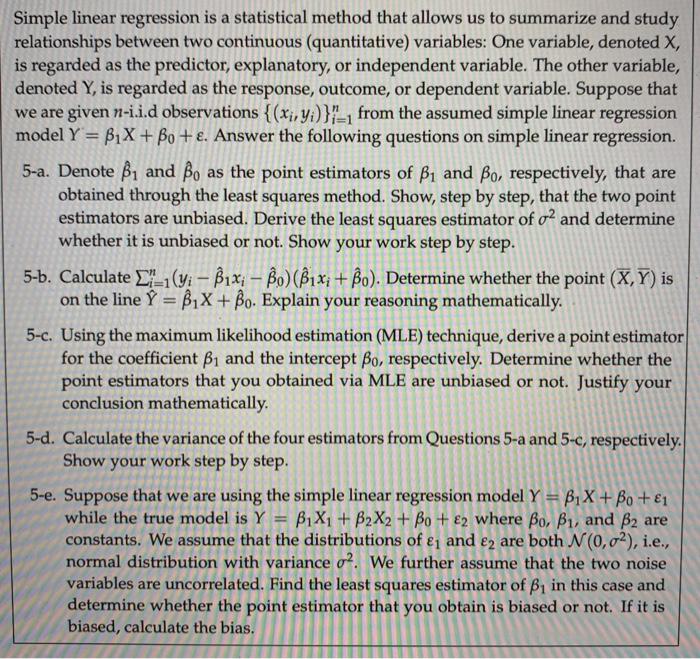

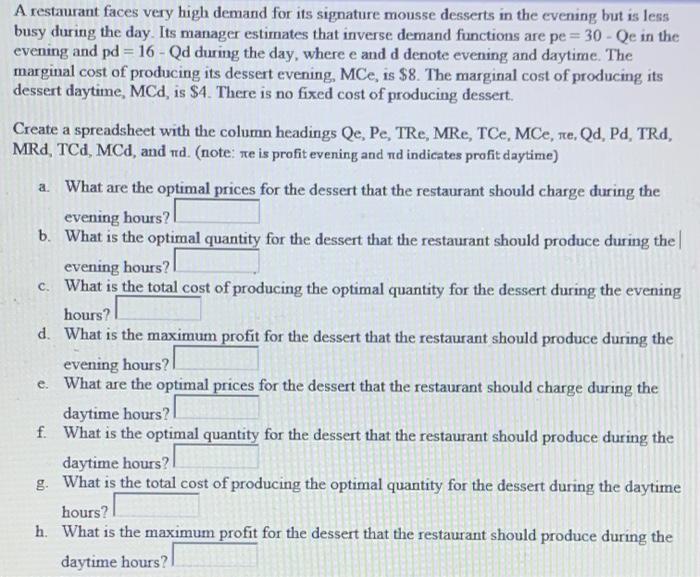

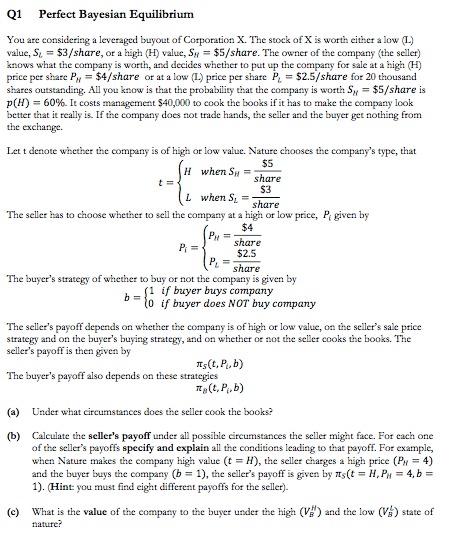

Simple linear regression is a statistical method that allows us to summarize and study relationships between two continuous (quantitative) variables: One variable, denoted X, is regarded as the predictor, explanatory, or independent variable. The other variable, denoted Y, is regarded as the response, outcome, or dependent variable. Suppose that we are given n-i.i.d observations { (x;, y;)}"_, from the assumed simple linear regression model Y = BIX + Bo + . Answer the following questions on simple linear regression. 5-a. Denote 1 and Bo as the point estimators of B, and Bo, respectively, that are obtained through the least squares method. Show, step by step, that the two point estimators are unbiased. Derive the least squares estimator of of and determine whether it is unbiased or not. Show your work step by step. 5-b. Calculate _'_1(yi - Bix; - Bo) (Bix, + Bo). Determine whether the point (X, Y) is on the line Y = 1X + Bo. Explain your reasoning mathematically. 5-c. Using the maximum likelihood estimation (MLE) technique, derive a point estimator for the coefficient B1 and the intercept Bo, respectively. Determine whether the point estimators that you obtained via MLE are unbiased or not. Justify your conclusion mathematically. 5-d. Calculate the variance of the four estimators from Questions 5-a and 5-c, respectively. Show your work step by step. 5-e. Suppose that we are using the simple linear regression model Y = B1 X + Bo + 1 while the true model is Y = 1X1 + B2X2 + Bo + 82 where Bo, B1, and B2 are constants. We assume that the distributions of &, and e2 are both N(0,02), i.e., normal distribution with variance o?. We further assume that the two noise variables are uncorrelated. Find the least squares estimator of B, in this case and determine whether the point estimator that you obtain is biased or not. If it is biased, calculate the bias.A restaurant faces very high demand for its signature mousse desserts in the evening but is less busy during the day. Its manager estimates that inverse demand functions are pe = 30 - Qe in the evening and pd = 16 -Qd during the day, where e and d denote evening and daytime. The marginal cost of producing its dessert evening, MCe, is $8. The marginal cost of producing its dessert daytime, MCd, is $4. There is no fixed cost of producing dessert. Create a spreadsheet with the column headings Qe, Pe, TRe, MRe, TCe, MCe, ne, Qd, Pd, TRd, MRd, TCd, MCd, and nd. (note: ne is profit evening and nd indicates profit daytime) a. What are the optimal prices for the dessert that the restaurant should charge during the evening hours? b. What is the optimal quantity for the dessert that the restaurant should produce during the evening hours? c. What is the total cost of producing the optimal quantity for the dessert during the evening hours? d. What is the maximum profit for the dessert that the restaurant should produce during the evening hours? e. What are the optimal prices for the dessert that the restaurant should charge during the daytime hours? f. What is the optimal quantity for the dessert that the restaurant should produce during the daytime hours? I g. What is the total cost of producing the optimal quantity for the dessert during the daytime hours? h. What is the maximum profit for the dessert that the restaurant should produce during the daytime hours?Q1 Perfect Bayesian Equilibrium You are considering a leveraged buyout of Corporation X. The stock of X is worth either a low (1.) value, 51 = $3/share, or a high (H) value, Sy = $5/share. The owner of the company (the seller) knows what the company is worth, and decides whether to put up the company for sale at a high (H) price per share Py = $4/share or at a low (L.) price per share P, = $2.5/share for 20 thousand shares outstanding. All you know is that the probability that the company is worth 5, = $5/share is p(H) = 60% It costs management $40,000 to cook the books if it has to make the company look better that it really is. If the company does not trade hands, the seller and the buyer get nothing from the exchange. Let t denote whether the company is of high or low value. Nature chooses the company's type, that H when S, = $5 share 53 L when S, = share The seller has to choose whether to sell the company at a high or low price, P given by $4 PH = share P . $2.5 share The buyer's strategy of whether to buy or not the company is given by b = [1 if buyer buys company 10 if buyer does NOT buy company The seller's payoff depends on whether the company is of high or low value, on the seller's sale price strategy and on the buyer's buying strategy, and on whether or not the seller cooks the books. The seller's payoff is then given by ITS (t, P. b) The buyer's payoff also depends on these strategies HA (t, PA.b) (a) Under what circumstances does the seller cook the books? (b) Calculate the seller's payoff under all possible circumstances the seller might face. For each one of the seller's payoffs specify and explain all the conditions leading to that payoff. For example, when Nature makes the company high value (t = H), the seller charges a high price (Py = 4) and the buyer bays the company (b = 1), the seller's payoff is given by my(t = H, Py = 4, b = 1). (Hint you must find eight different payoffs for the seller). (c) What is the value of the company to the buyer under the high (Vg ) and the low (Vy ) state of nature