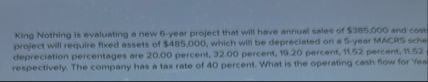

Question: King Nothing is evaluating a new 6 - year project that will have annual sales of 3 8 5 , 0 0 0 and cost

King Nothing is evaluating a new year project that will have annual sales of and cost project will require fixed assets of $ which will be depreciated on a yyar MACRS sche respectively. The comparny has a tax rate of percent. What is the operating cash flow for Yoa

Of the options listed below, which one is most directly impected by the level of systematic risk?

Multiple Choice

Expected rate of return

Variance of the returns

Riskfree rote

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock