Question: Know ratios based on the etext:Gross Debt Service (GDS): no more than 32%Mortgage, heating, property taxes, 50% condo fees/incomeTotal Debt Service (TDS) no more than

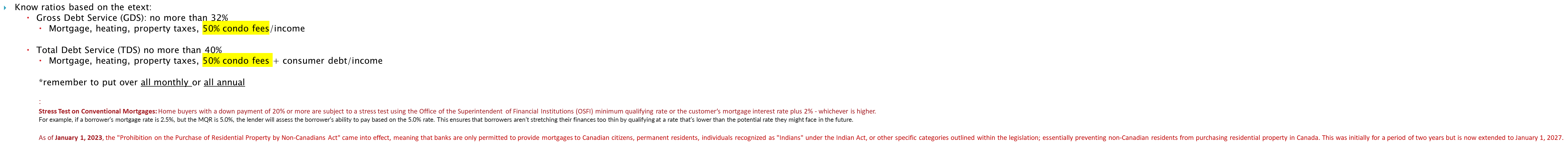

Know ratios based on the etext:Gross Debt Service (GDS): no more than 32%Mortgage, heating, property taxes, 50% condo fees/incomeTotal Debt Service (TDS) no more than 40%Mortgage, heating, property taxes, 50% condo fees + consumer debt/income*remember to put over all monthly or all annual:Stress Test on Conventional Mortgages:Home buyers with a down payment of 20% or more are subject to a stress test using the Office of the Superintendent of Financial Institutions (OSFI) minimum qualifying rate or the customer's mortgage interest rate plus 2% - whichever is higher. For example, if a borrower's mortgage rate is 2.5%, but the MQR is 5.0%, the lender will assess the borrower's ability to pay based on the 5.0% rate. This ensures that borrowers aren't stretching their finances too thin by qualifying at a rate that's lower than the potential rate they might face in the future.As ofJanuary 1, 2023, the "Prohibition on the Purchase of Residential Property by Non-Canadians Act" came into effect, meaning that banks are only permitted to provide mortgages to Canadian citizens, permanent residents, individuals recognized as "Indians" under the Indian Act, or other specific categories outlined within the legislation;essentially preventing non-Canadian residents from purchasing residential property in Canada. This was initially for a period of two years but is now extended to January 1, 2027.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts