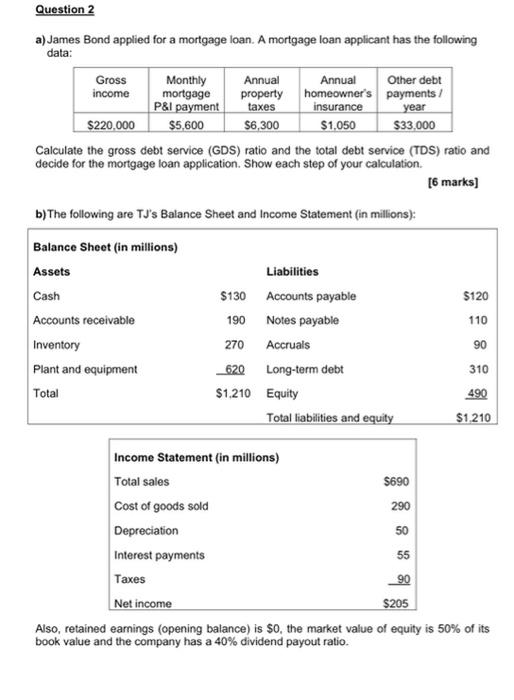

Question: Question 2 a) James Bond applied for a mortgage loan. A mortgage loan applicant has the following data: Gross Monthly Annual Annual Other debt income

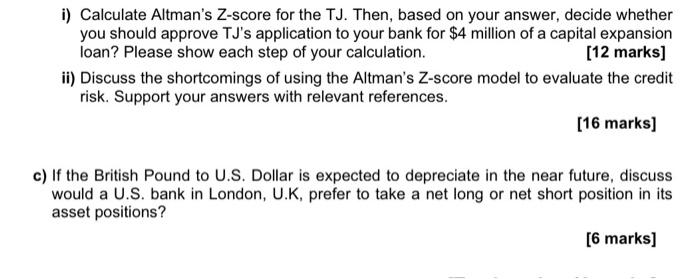

Question 2 a) James Bond applied for a mortgage loan. A mortgage loan applicant has the following data: Gross Monthly Annual Annual Other debt income mortgage property homeowner's payments/ P&I payment taxes insurance year $220.000 $5,600 $6,300 $1.050 $33.000 Calculate the gross debt service (GDS) ratio and the total debt service (TDS) ratio and decide for the mortgage loan application. Show each step of your calculation [6 marks) $120 b) The following are TJ's Balance Sheet and Income Statement (in millions): Balance Sheet (in millions) Assets Liabilities Cash $130 Accounts payable Accounts receivable 190 Notes payable Inventory 270 Accruals Plant and equipment 620 Long-term debt Total $1.210 Equity Total liabilities and equity 110 90 310 490 $1.210 Income Statement (in millions) Total sales $690 Cost of goods sold 290 Depreciation 50 Interest payments 55 Taxes 90 Net income $205 Also, retained earnings (opening balance) is $0, the market value of equity is 50% of its book value and the company has a 40% dividend payout ratio. i) Calculate Altman's Z-score for the TJ. Then, based on your answer, decide whether you should approve TJ's application to your bank for $4 million of a capital expansion loan? Please show each step of your calculation. [12 marks] ii) Discuss the shortcomings of using the Altman's Z-score model to evaluate the credit risk. Support your answers with relevant references. [16 marks] c) If the British Pound to U.S. Dollar is expected to depreciate in the near future, discuss would a U.S. bank in London, U.K, prefer to take a net long or net short position in its asset positions? [6 marks] Question 2 a) James Bond applied for a mortgage loan. A mortgage loan applicant has the following data: Gross Monthly Annual Annual Other debt income mortgage property homeowner's payments/ P&I payment taxes insurance year $220.000 $5,600 $6,300 $1.050 $33.000 Calculate the gross debt service (GDS) ratio and the total debt service (TDS) ratio and decide for the mortgage loan application. Show each step of your calculation [6 marks) $120 b) The following are TJ's Balance Sheet and Income Statement (in millions): Balance Sheet (in millions) Assets Liabilities Cash $130 Accounts payable Accounts receivable 190 Notes payable Inventory 270 Accruals Plant and equipment 620 Long-term debt Total $1.210 Equity Total liabilities and equity 110 90 310 490 $1.210 Income Statement (in millions) Total sales $690 Cost of goods sold 290 Depreciation 50 Interest payments 55 Taxes 90 Net income $205 Also, retained earnings (opening balance) is $0, the market value of equity is 50% of its book value and the company has a 40% dividend payout ratio. i) Calculate Altman's Z-score for the TJ. Then, based on your answer, decide whether you should approve TJ's application to your bank for $4 million of a capital expansion loan? Please show each step of your calculation. [12 marks] ii) Discuss the shortcomings of using the Altman's Z-score model to evaluate the credit risk. Support your answers with relevant references. [16 marks] c) If the British Pound to U.S. Dollar is expected to depreciate in the near future, discuss would a U.S. bank in London, U.K, prefer to take a net long or net short position in its asset positions? [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts