Question: Knowing that two standard deviations represent about 95% of a normal distribution, what is the lowest return you can expect with a 95% confidence

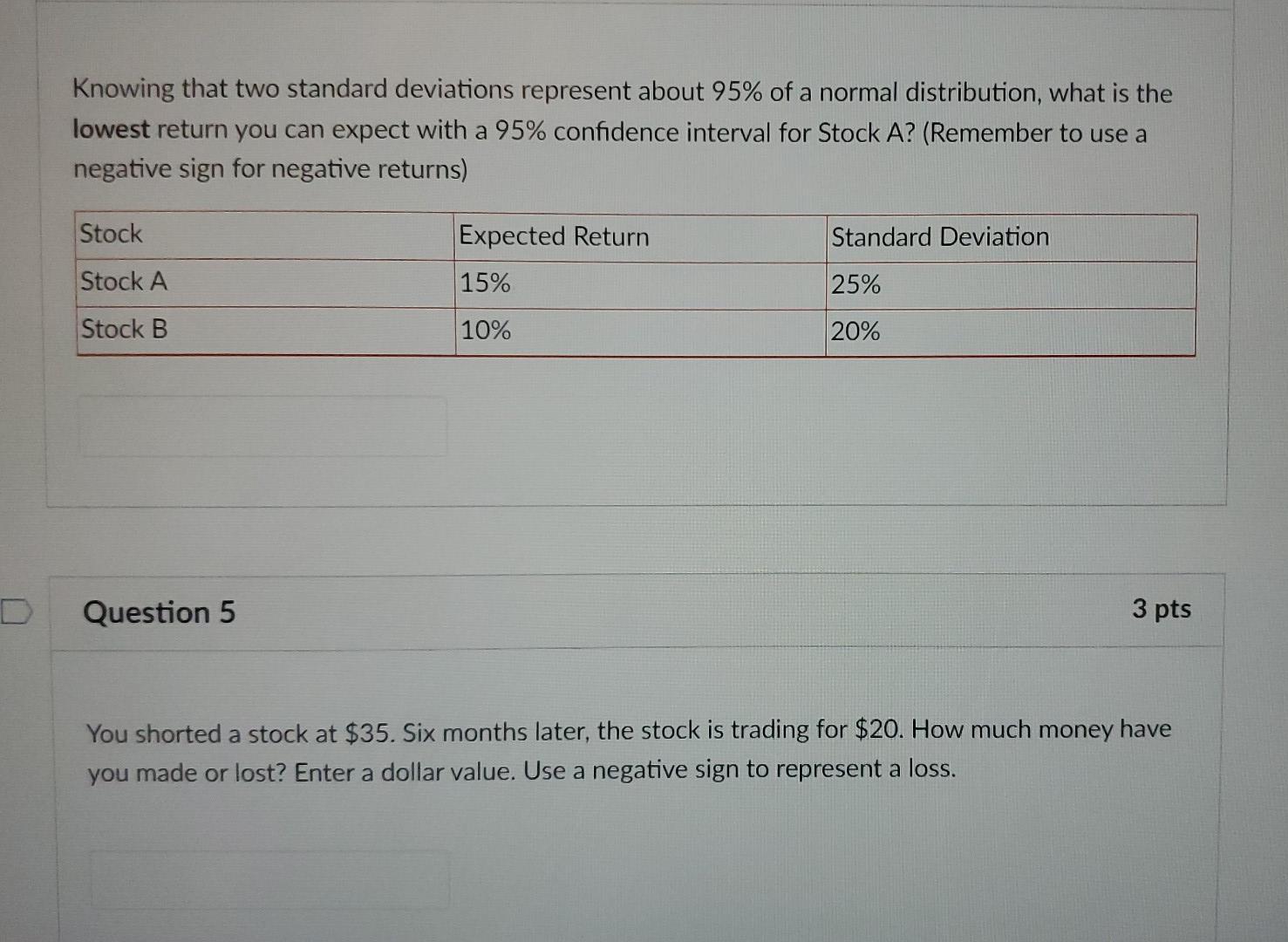

Knowing that two standard deviations represent about 95% of a normal distribution, what is the lowest return you can expect with a 95% confidence interval for Stock A? (Remember to use a negative sign for negative returns) Stock Stock A Stock B Question 5 Expected Return Standard Deviation 15% 10% 25% 20% 3 pts You shorted a stock at $35. Six months later, the stock is trading for $20. How much money have you made or lost? Enter a dollar value. Use a negative sign to represent a loss.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts