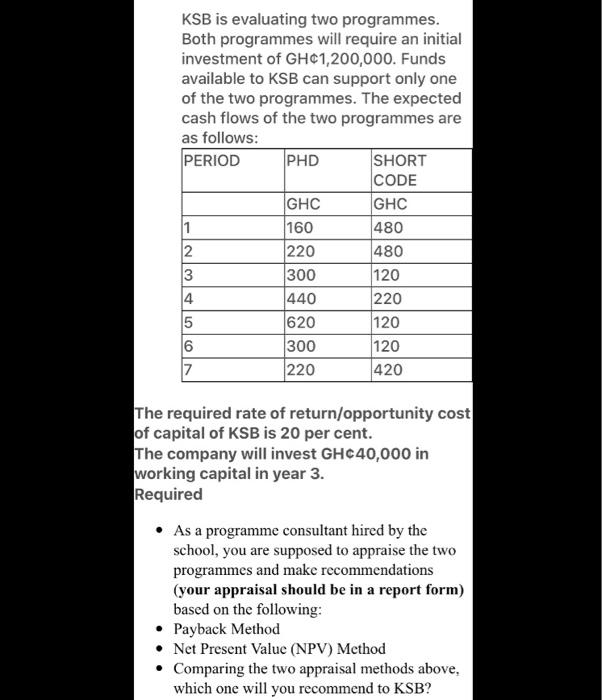

Question: KSB is evaluating two programmes. Both programmes will require an initial investment of GH1,200,000. Funds available to KSB can support only one of the two

KSB is evaluating two programmes. Both programmes will require an initial investment of GH1,200,000. Funds available to KSB can support only one of the two programmes. The expected cash flows of the two programmes are as follows: PERIOD PHD SHORT CODE GHC GHC 1 160 480 2 220 480 3 300 120 4 440 220 5 620 120 6 300 120 7 220 420 The required rate of return/opportunity cost of capital of KSB is 20 per cent. The company will invest GHC40,000 in working capital in year 3. Required As a programme consultant hired by the school, you are supposed to appraise the two programmes and make recommendations (your appraisal should be in a report form) based on the following: Payback Method Net Present Value (NPV) Method Comparing the two appraisal methods above, which one will you recommend to KSB

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts