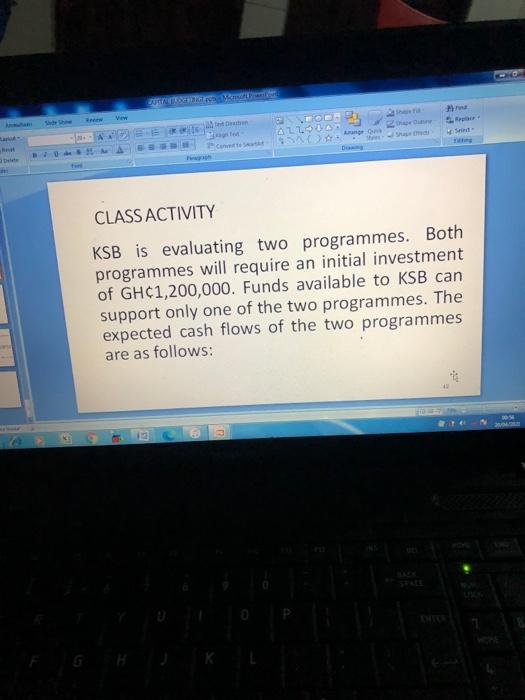

Question: P) ALL CLASS ACTIVITY KSB is evaluating two programmes. Both programmes will require an initial investment of GHC1,200,000. Funds available to KSB can support only

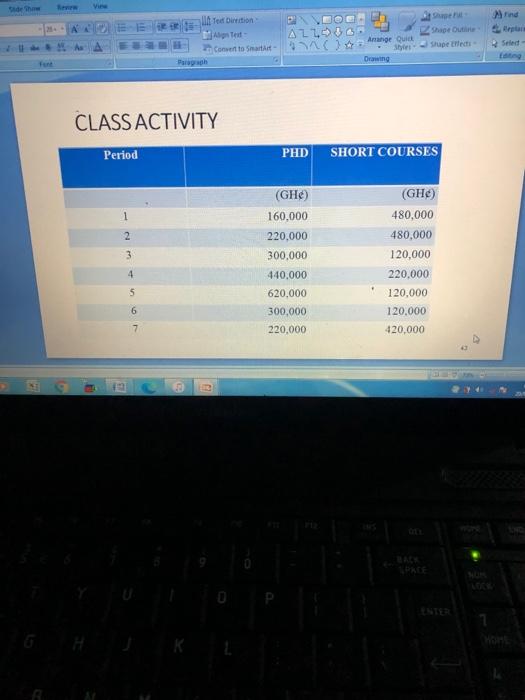

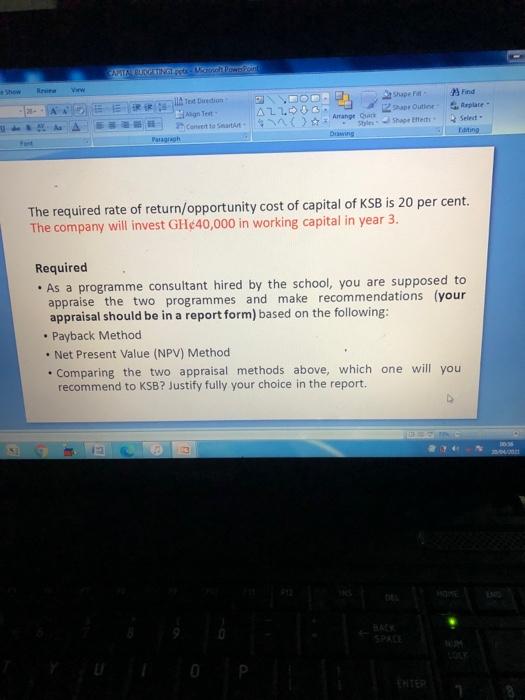

P) ALL CLASS ACTIVITY KSB is evaluating two programmes. Both programmes will require an initial investment of GHC1,200,000. Funds available to KSB can support only one of the two programmes. The expected cash flows of the two programmes are as follows: Aind Toe Diction ALL-30 Convento Sat nange quid Parah Drawing Shape Out Supertec Sele CLASS ACTIVITY Period PHD SHORT COURSES 1 2 (GHC) 160.000 220.000 300.000 440,000 620,000 3 (GH) 480,000 480,000 120,000 220,000 120,000 120,000 420.000 4 5 6 300,000 220,000 7 Www Find Outline Artesan Tot i ER ER Agnet AL233 Con Pangh The required rate of return/opportunity cost of capital of KSB is 20 per cent. The company will invest GH40,000 in working capital in year 3. . Required . As a programme consultant hired by the school, you are supposed to appraise the two programmes and make recommendations (your appraisal should be in a report form) based on the following: Payback Method Net Present Value (NPV) Method Comparing the two appraisal methods above, which one will you recommend to KSB? Justify fully your choice in the report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts