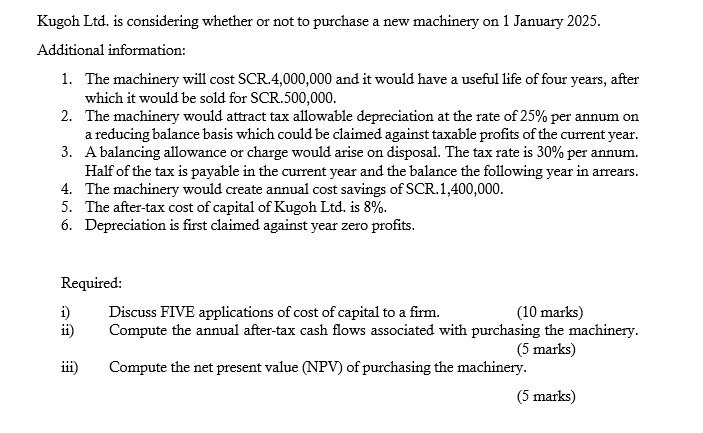

Question: Kugoh Ltd . is considering whether or not to purchase a new machinery on 1 January 2 0 2 5 . Additional information: 1 .

Kugoh Ltd is considering whether or not to purchase a new machinery on January Additional information: The machinery will cost SCR and it would have a useful life of four years, after which it would be sold for SCR The machinery would attract tax allowable depreciation at the rate of per annum on a reducing balance basis which could be claimed against taxable profits of the current year. A balancing allowance or charge would arise on disposal. The tax rate is per annum. Half of the tax is payable in the current year and the balance the following year in arrears. The machinery would create annual cost savings of SCR The aftertax cost of capital of Kugoh Ltd is Depreciation is first claimed against year zero profits. Required: i Discuss FIVE applications of cost of capital to a firm. marks ii Compute the annual aftertax cash flows associated with purchasing the machinery. marks iii Compute the net present value NPV of purchasing the machinery.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock