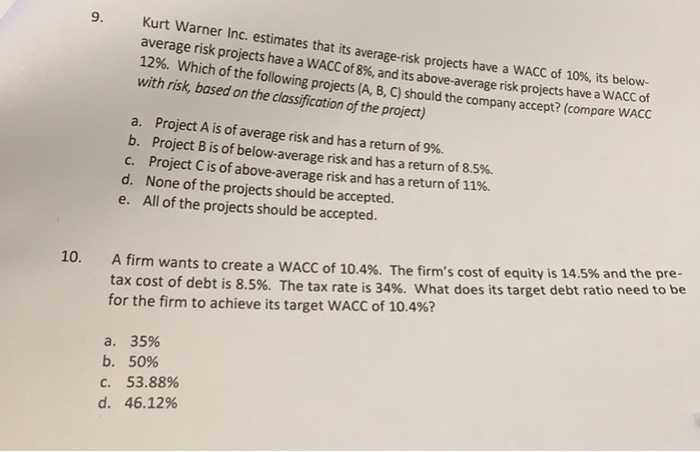

Question: Kurt Warner Inc. estimates that its average-risk pro 9. average risk projects have a WACC of 8%, and its above-average risk projects have awACC of

Kurt Warner Inc. estimates that its average-risk pro 9. average risk projects have a WACC of 8%, and its above-average risk projects have awACC of 12%, jects have a wACC of 10%, its below- Which of the following projects (A, B, C) should the company accept? (compare WACC with risk, based on the classification of the project) Project A is of average risk and has a return of 9%. Project B is of below-average risk and has a return of 8.5%. Project C is of above-average risk and has a return of 11%. None of the projects should be accepted. All of the projects should be accepted. a. b. c. d. e. A firm wants to create a WACC of 10.4%. The firm's cost of equity is 14.5% and the pre- tax cost of debt is 8.5%. The tax rate is 34%, what does its target debt ratio need to be for the firm to achieve its target WACC of 10.4%? 10. a. 35% b. 50% c. 53.88% d. 46.12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts