Question: Lab 7 Ch 10 Making Cap. Inv. ... i Saved Help Save & Exit Submit Check my work ho 2 10 points Hubrey Home Inc.

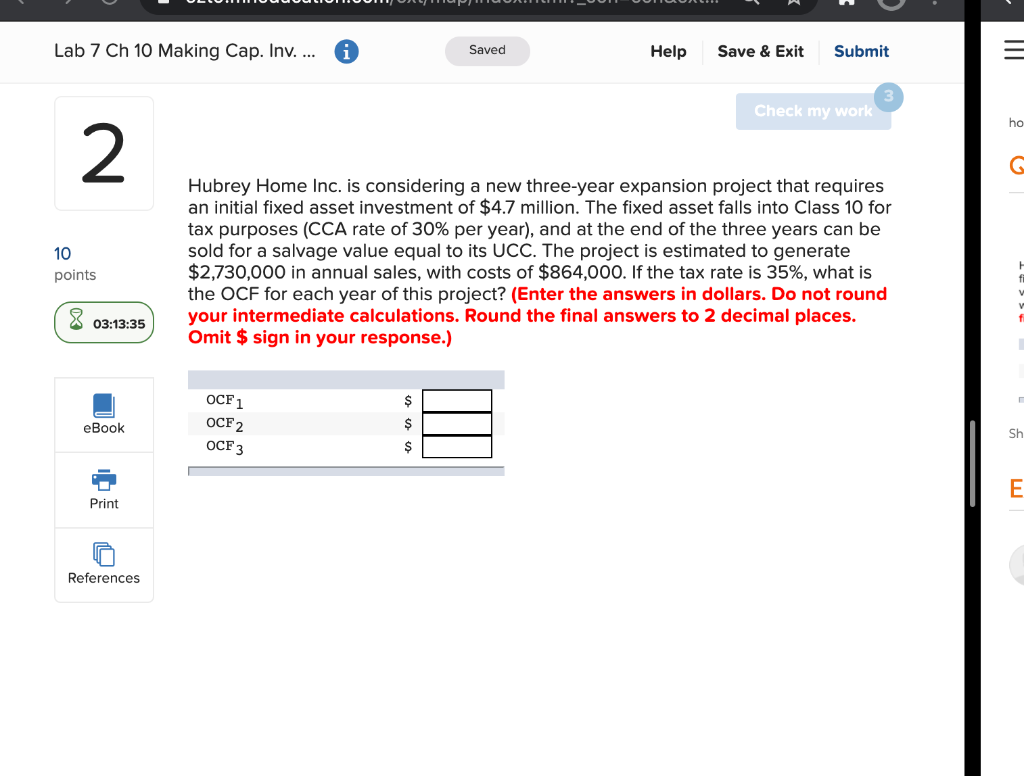

Lab 7 Ch 10 Making Cap. Inv. ... i Saved Help Save & Exit Submit Check my work ho 2 10 points Hubrey Home Inc. is considering a new three-year expansion project that requires an initial fixed asset investment of $4.7 million. The fixed asset falls into Class 10 for tax purposes (CCA rate of 30% per year), and at the end of the three years can be sold for a salvage value equal to its UCC. The project is estimated to generate $2,730,000 in annual sales, with costs of $864,000. If the tax rate is 35%, what is the OCF for each year of this project? (Enter the answers in dollars. Do not round your intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) ff 8 03:13:35 f OCF1 eBook OCF2 a es es Sh OCF3 $ E Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts