Question: Lab Accounting ain Menu signments Homework: Chapter 10 Homework Question 3, SF10-3 (book/static) Part 2 of HW Score: 6.87%, 1.65 of 24 points Points:

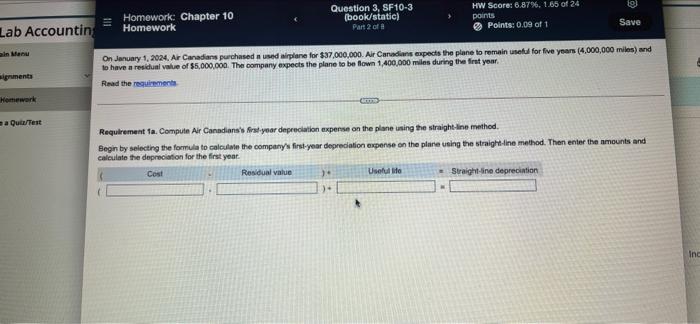

Lab Accounting ain Menu signments Homework: Chapter 10 Homework Question 3, SF10-3 (book/static) Part 2 of HW Score: 6.87%, 1.65 of 24 points Points: 0.09 of 1 Save On January 1, 2024, Air Canadians purchased a used airplane for $37,000,000. Air Canadians expects the plane to remain useful for five years (4,000,000 miles) and to have a residual value of $5,000,000. The company expects the plane to be flown 1,400,000 miles during the first year. Read the requirements Homework a Quiz/Test Requirement 1a. Compute Air Canadians's first-year depreciation expense on the plane using the straight-line method. Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the straight-line method. Then enter the amounts and calculate the depreciation for the first year. Cost Residual value " Useful life Straight-line depreciation Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts