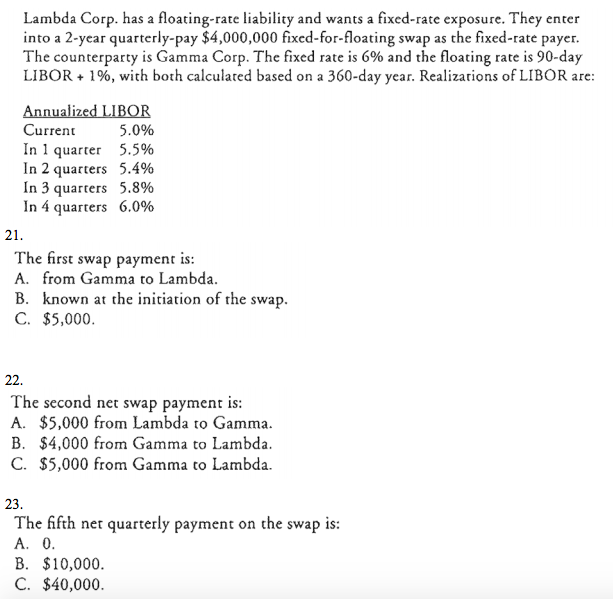

Question: Lambda Corp. has a floating-rate liability and wants a fixed-rate exposure. They enter into a 2-year quarterly-pay $4,000,000 fixed-for-floating swap as the fixed-rate payer The

Lambda Corp. has a floating-rate liability and wants a fixed-rate exposure. They enter into a 2-year quarterly-pay $4,000,000 fixed-for-floating swap as the fixed-rate payer The counterparty is Gamma Corp. The fixed rate is 6% and the floating rate is 90-day LIBOR 1%, with both calculated based on a 360-day year. Realizarions of LIBOR are 5.0% Current In 1 quarter 5.5% In 2 quarters 5.4% In 3 quarters In 4 quarters 6.0% 5.8% 21 The first swap payment is A. from Gamma to Lambda B. known at the initiation of the swa C. $5,000 22. The second net swap payment is A. $5,000 from Lambda to Gamma B. $4,000 from Gamma to Lambda C. $5,000 from Gamma to Lambda. 23 The fifth net quarterly payment on the swap is: A. 0 B. $10,000 C. $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts