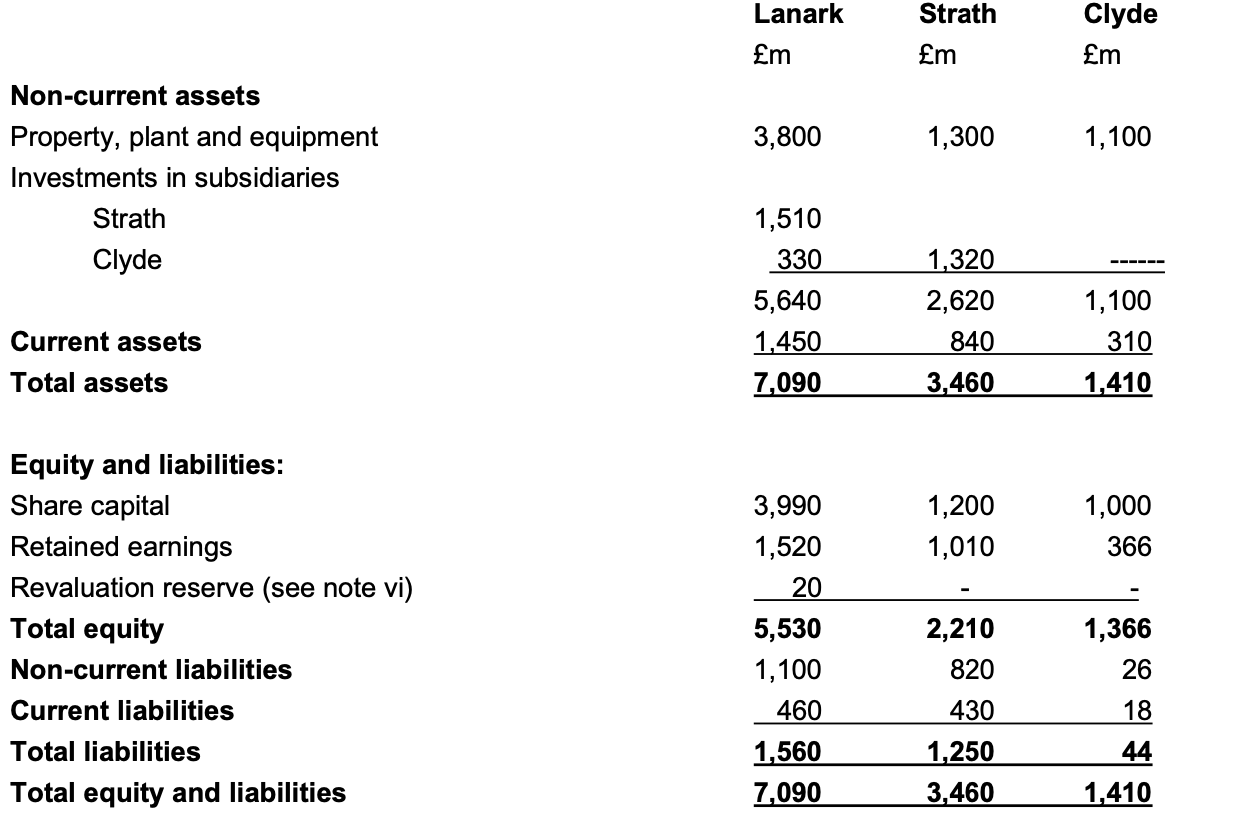

Question: Lanark plc ( Lanark ) , a public limited company, operates in the manufacturing sector. Lanark has investments in two other companies. The draft statements

Lanark plc Lanark a public limited company, operates in the manufacturing sector. Lanark has investments in two other companies. The draft statements of financial position as at December are as follows: The following information is relevant to the preparation of the group financial statements:

i On January Lanark acquired of the equity interests of Strath Ltd The purchase consideration comprised cash of million. On January the fair value of the identifiable net assets acquired was million and retained earnings of Strath were million. The excess in fair value is due to nondepreciable land.

It is the groups policy to measure the noncontrolling interest at acquisition at its proportionate share of the fair value of the subsidiarys net assets.

ii On January Lanark acquired of the equity interests of Clyde Ltd for a cash consideration of million and Strath acquired of the equity interests of Clyde for a cash consideration of million. At January the identifiable net assets of Clyde had a fair value of million and retained earnings were million. The excess in fair value is due to nondepreciable land.

At January the identifiable net assets of Clyde had a fair value of million, retained earnings were million. The excess in fair value is due to nondepreciable land.The fair value of the holding of Lanark in Clyde was million on January and million at December The fair value of Straths interest in Clyde had not changed since acquisition.

iii On July Lanark sold some property to Strath Ltd for million. The property had a carrying amount in Lanarks books of million at the date of sale. The estimated remaining useful life of the property was reassessed at the date of sale as twenty years.

iv During Strath Ltd has invoiced million of sales to Lanark all at a markup of One quarter of these goods were still in Lanarks inventories at the year end.

v On January Lanark issued share options to each of its staff. The share options are conditional on staff being employed by Lanark on December and the share options cannot be exercised unless Lanarks share price reaches on December Provided the share price target is met, the share options can be exercised at any time during the following two years ie from January to December

The unadjusted fair value of the options on January was : the adjusted fair value considering the share price target was per share.

On January the directors estimated that of the staff would leave and forfeit their rights to the shares. This estimate was subsequently revised down to on December

Lanarks equity shares were quoted at per share on January and at on December The directors consider there is an probability that the share price target will be met on December The directors wish to account for the sharebased payments in a separate equity reserve.

vi Lanark acquired a piece of land used for storage purposes in The land was owner occupied and correctly accounted for as PPE no depreciation The land was revalued in The fair value as at December has not yet been reflected in the financial statements.

Details of the land values are as follows:

Cost January

Fair Value January Fair Value December

Required

million million million

Prepare the group consolidated statement of financial position of Lanark in a form suitable for publication as at December

Prepare your statement in millions to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock