Question: Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information about some of

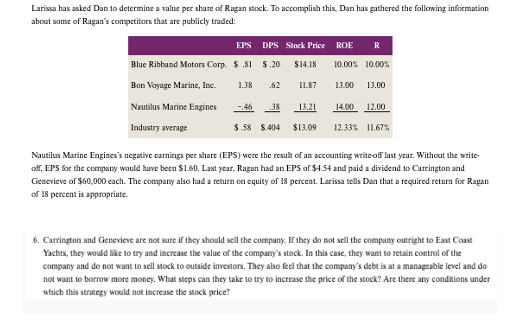

Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information

about some of Ragan's comptitors that are publicly traded:

Nautilus Marine Engines's negative carnings per share EPS were the rcsult of an accounting writeoff last year. Without the write

off, EPS for the company would have boen $ Last year, Ragan had an EPS of $ and paid a dividend is Carrington and

Genevieve of $ each. The company also had a return on equity of percent. Larissa tells Dan that a required return foe Ragan

of Is percent is appoporiate.

Carrington and Genevieve are not suec if they should sell the company. If they do not sell the company outright to East Coast

Yachts, they would like to try and increase the value of the compary's stock. In this ease, they want to retain control of the

company and do not want to sell stock to outside investors. They also feel that the company's debt is at a manageable level and do

not want to borrow more money. What steps can they take to try to increase the peice of the stock? Are there any eonditions under

which this strategy would not increase the stock price?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock