Question: Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information about some of

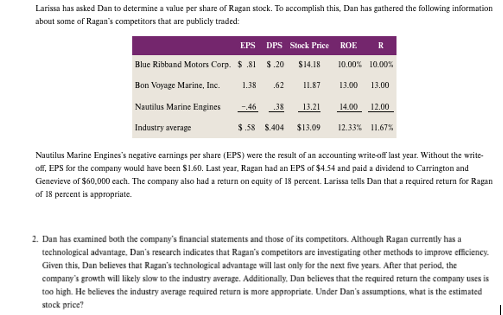

Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information

about some of Ragan's compttitors that are publicly traded:

Nautilus Marine Engines's negative carnings per share EPS were the result of an accounting writeoff last year. Without the write

off, EPS for the company would have been $ Last year, Ragan had an EPS of $ and paid a dividend io Carrington and

Genevieve of $ each. The company also had a return on equity of percent. Larissa tells Dan that a requirod return foe Ragan

of Is percent is appopriate.

Dan has examined both the company's financial statements and those of its competitors. Althoegh Ragan currently has a

technological advantage, Dan's research indicates that Ragan's competitors are imvestigating other methods to improve efficiency.

Given this, Dan believes that Ragan's technological advantage will last only for the next five years. After that period, the

company's growth will likely slow to the industry average. Additionally. Dan believes that the required return the company uses is

too high. He believes the industry average required return is more appropriate. Under Dan's assumptions, what is the estimated

stock price?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock