Question: Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information about some of

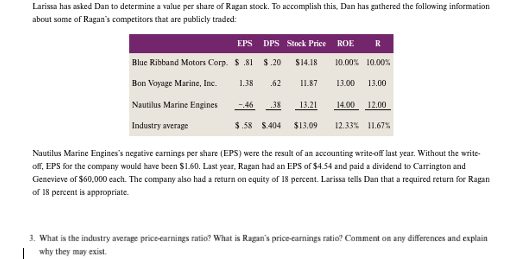

Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information

about some of Ragan's competitors that are publicly traded:

Nautilus Marine Engines's negative carnings per share EPS were the result of an accounting writeoff last year. Without the write

off, EPS for the company would tave boen $ Last year, Ragan had an EPS of $ and paid a dividend io Carrington and

Genevieve of $ each. The company also had a feturn on equity of percent. Larissa tells Dan that a required return foe Ragan

of percent is appopriate.

What is the industry average priceearnings ratio? What is Ragan's priceearnings ratio? Comment on any differences and explain

why they may exist.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock