Question: Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information about some of

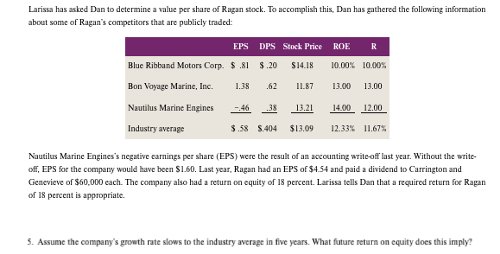

Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information

about some of Ragan's compttitors that are publicly traded:

Nautilus Marine Engines's negative carnings per share EPS were the result of an accounting writeoff last year. Without the write

off, EPS fot the company would have boen $ Last year, Ragan had an EPS of $ and paid a dividend io Carrington and

Getevieve of $ each. The company also had a return on equity of percent. Larissa tells Dan that a required return foe Ragan

of Is percent is appoopriate.

Assume the company's growth rate slows to the industry average in five years. What future return on equity does this imply?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock