Question: Last month, Dow Chemical analyzed a project with an initial cash outflow of $1 million, and expected cash inflows of $450,000 per year in years

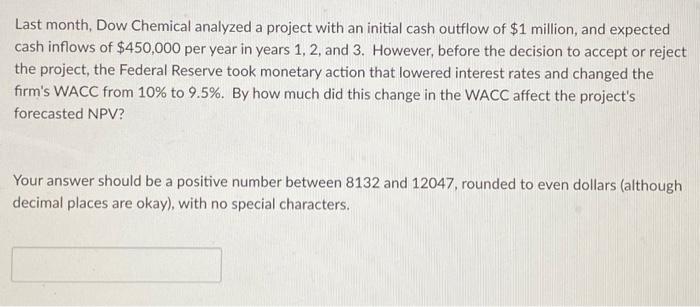

Last month, Dow Chemical analyzed a project with an initial cash outflow of $1 million, and expected cash inflows of $450,000 per year in years 1,2 , and 3 . However, before the decision to accept or reject the project, the Federal Reserve took monetary action that lowered interest rates and changed the firm's WACC from 10% to 9.5%. By how much did this change in the WACC affect the project's forecasted NPV? Your answer should be a positive number between 8132 and 12047 , rounded to even dollars (although decimal places are okay), with no special characters. Last month, Dow Chemical analyzed a project with an initial cash outflow of $1 million, and expected cash inflows of $450,000 per year in years 1,2 , and 3 . However, before the decision to accept or reject the project, the Federal Reserve took monetary action that lowered interest rates and changed the firm's WACC from 10% to 9.5%. By how much did this change in the WACC affect the project's forecasted NPV? Your answer should be a positive number between 8132 and 12047 , rounded to even dollars (although decimal places are okay), with no special characters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts