Question: Last month, Lloyd's Systems analyzed the project whose cash flows are shown below. However, before the decision to accept or reject the project, the Federal

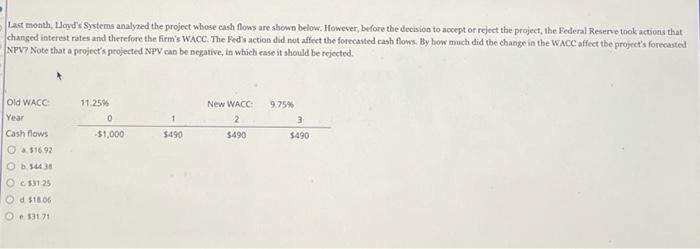

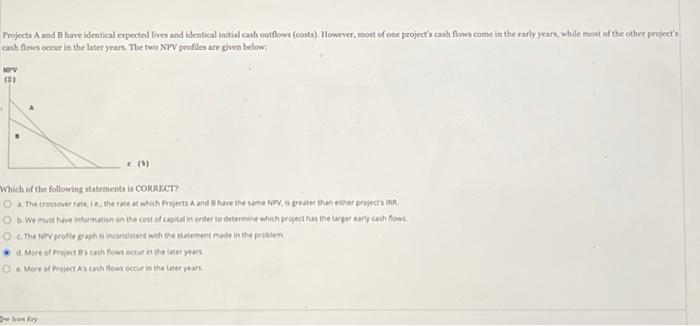

Last month, Lloyd's Systems analyzed the project whose cash flows are shown below. However, before the decision to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV7 Note that a project's projected NPV can be negative, in which case it should be rejected. a 11.25% 0 1 New WACC 2 $490 9.75% 3 $490 -$1,000 $490 Old WACC Year Cash flows O $1692 5443 C33125 Od 18.06 33171 Projects A and B have identical expected lives and identical initial cash outflows (coat). However, most of one project's cash flows come in the early years, while most of the other project' cash flows occur in the later years. The two NTV profiles are piven below NOPY (5) (1) Which of the following statements CORRECT? The crossover vate the rate at which Projects and have the same NV, peater than the projects O b. We must information on the cost of capital in order to determine which project has the pretty cathom The NPV profile wap incontent with the statement made in the problem d. More or Project cowocour in the tears O More of Project A Cash flow occur in the water year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts