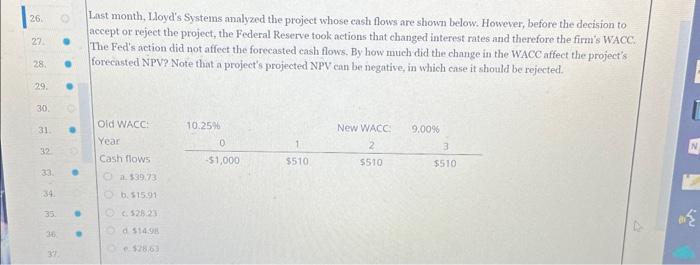

Question: please help asap. anst month, Hoyd's Systems analyzed the project whose cash flows are shown below. However, before the decision to accept or reject the

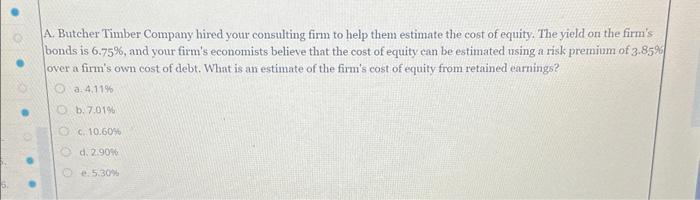

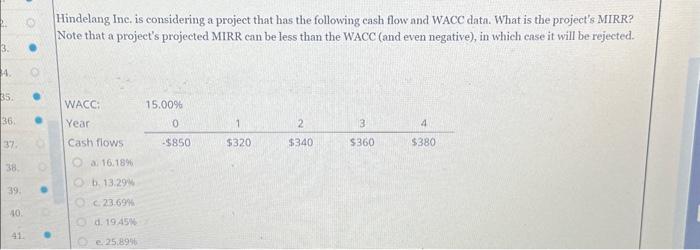

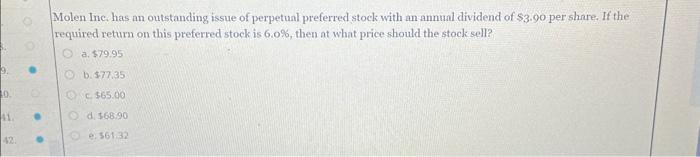

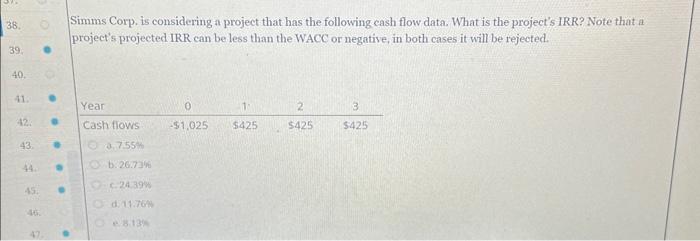

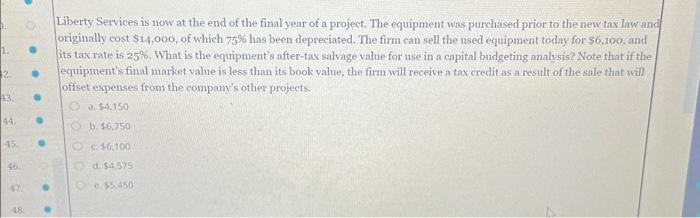

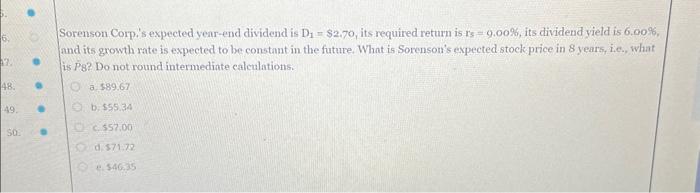

anst month, Hoyd's Systems analyzed the project whose cash flows are shown below. However, before the decision to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected. b. 515.91 cos52321 a 514.918 Butcher Timber Company hired your consulting firm to help them estimate the cost of equity. The yield on the firm's bonds is 6.75%, and your firm's economists believe that the cost of equity can be estimated using a risk premium of 3.85% over a firn's own cost of debt. What is an estimate of the firm's cost of equity from retained earnings? a. 4.11% b. 7.01% c. 10.60% d. 2.90% e. 5.3002 Hindelang Ine, is considering a project that has the following cash flow and WACC data. What is the project's MIRR? Note that a project's projected MIRR can be less than the WACC (and even negative), in which case it will be rejected. a. 16.18% b. 13.29M c. 23.69% d. 19.45% e. 25.8996 Molen Inc. has an outstanding issue of perpetual preferred stock with an annual dividend of \$3.90 per share. If the required return on this preferred stock is 6.0%, then at what price should the stock sell? a. $79.95 b. $77,35 c. 565.00 d. 568:90 e. 56132 Simms Corp. is considering a project that has the following cash flow data. What is the project's IRR? Note that a project's projected IRR can be less than the WACC or negative, in both cases it will be rejected. b. 26.731Ni c. 24.396 d. 11.76 . Lberty Services is now at the end of the final year of a project. The equipment was purchased prior to the new tax law and originally cost $14,000, of which 75%6 has been depreciated. The firm can sell the used equipment today for $6,100, and its tax rate is 25%. What is the equipment's after-tax salvage value for use in a capital budgeting analysis? Note that if the equipment's final market value is less than its book value, the firm will receive a tax credit as a result of the sale that will offset expenses from the company's other projects. a. $4.150 b. 56,750 c. 4.100 d. 54.575 Sorenson Corp.'s expected year-end dividend is D1$2.70, its required return is r=9.00%8, its dividend yield is 6.0098 , and its growth rate is expected to be constant in the future. What is Sorenson's expected stock price in 8 years, i.e., what is Pg? Do not round intermedinte calculations. a. 589.67 b. $55.34 c. 557,00 (. 571.72 e. 546.35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts