Question: Last month, Lloyd's Systems analyzed the project whose cash flows are shown below. However, before the decision to accept or reject the project, the Federal

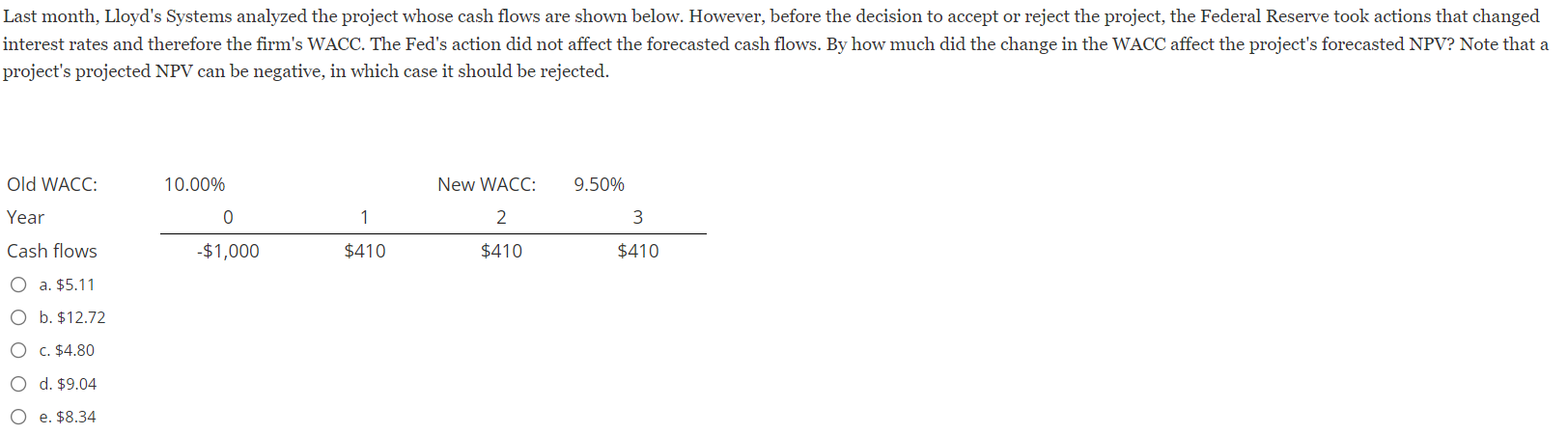

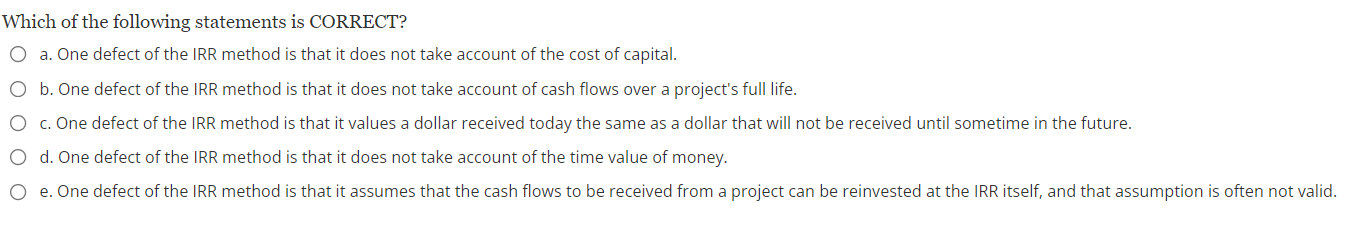

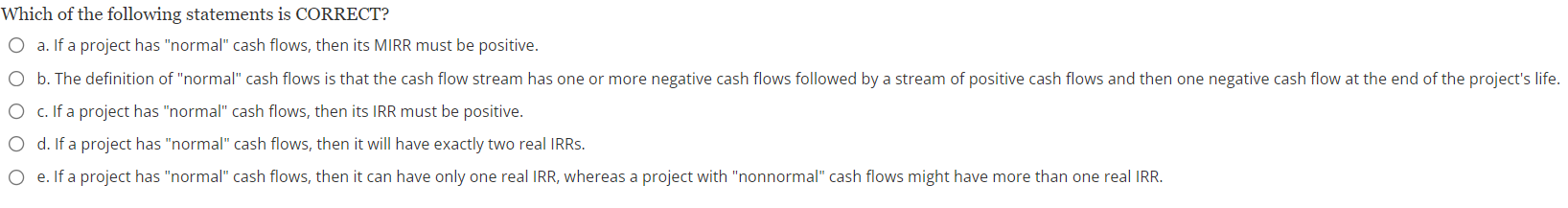

Last month, Lloyd's Systems analyzed the project whose cash flows are shown below. However, before the decision to accept or reject the project, the Federal Reserve took actions that changed interest rates and therefore the firm's WACC. The Fed's action did not affect the forecasted cash flows. By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative, in which case it should be rejected. Old WACC: 10.00% New WACC: 9.50% Year 0 1 2 3 Cash flows -$1,000 $410 $410 $410 O a. $5.11 O b. $12.72 O c. $4.80 O d. $9.04 O e. $8.34 Which of the following statements is CORRECT? O a. One defect of the IRR method is that it does not take account of the cost of capital. O b. One defect of the IRR method is that it does not take account of cash flows over a project's full life. O c. One defect of the IRR method is that it values a dollar received today the same as a dollar that will not be received until sometime in the future. O d. One defect of the IRR method is that it does not take account of the time value of money. O e. One defect of the IRR method is that it assumes that the cash flows to be received from a project can be reinvested at the IRR itself, and that assumption is often not valid. Which of the following statements is CORRECT? O a. If a project has "normal" cash flows, then its MIRR must be positive. O b. The definition of "normal" cash flows is that the cash flow stream has one or more negative cash flows followed by a stream of positive cash flows and then one negative cash flow at the end of the project's life. O c. If a project has "normal" cash flows, then its IRR must be positive. O d. If a project has "normal" cash flows, then it will have exactly two real IRRs. O e. If a project has "normal" cash flows, then it can have only one real IRR, whereas a project with "nonnormal" cash flows might have more than one real IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts