Question: last picture is example Organization TechVision is organized as a sole proprietorship. The business is fully owned and operated by Jack Hines. Your Job Responsibilities

last picture is example

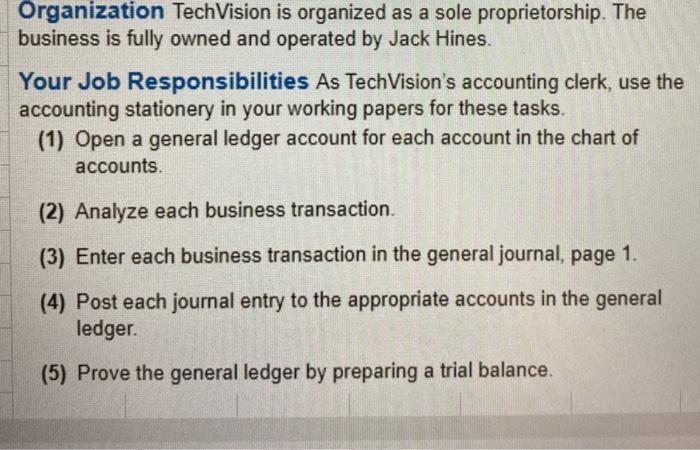

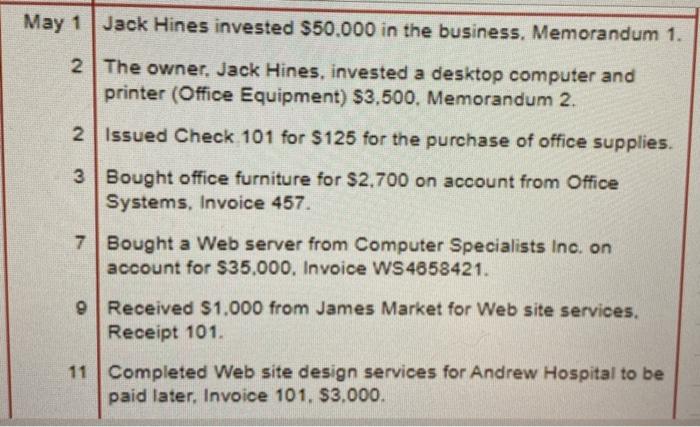

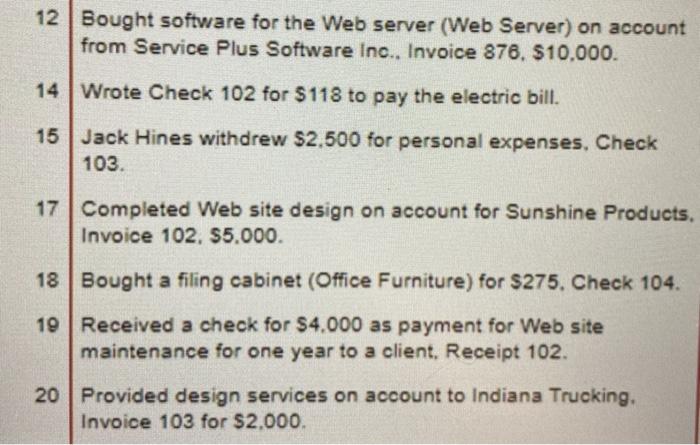

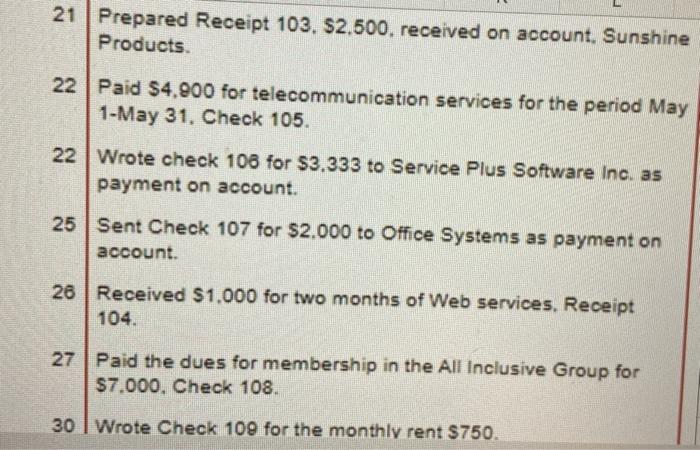

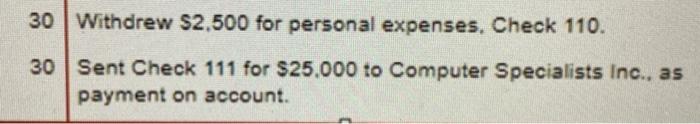

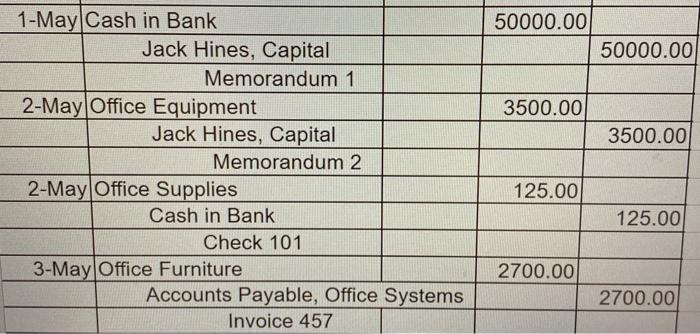

last picture is exampleOrganization TechVision is organized as a sole proprietorship. The business is fully owned and operated by Jack Hines. Your Job Responsibilities As TechVision's accounting clerk, use the accounting stationery in your working papers for these tasks. (1) Open a general ledger account for each account in the chart of accounts. (2) Analyze each business transaction. (3) Enter each business transaction in the general journal, page 1. (4) Post each journal entry to the appropriate accounts in the general ledger (5) Prove the general ledger by preparing a trial balance. May 1 Jack Hines invested $50.000 in the business, Memorandum 1. 2 The owner, Jack Hines, invested a desktop computer and printer (Office Equipment) $3,500. Memorandum 2. 2 Issued Check 101 for $125 for the purchase of office supplies. 3 Bought office furniture for $2.700 on account from Office Systems, Invoice 457. 7 Bought a Web server from Computer Specialists Inc. on account for $35.000. Invoice WS4858421. 9 Received $1.000 from James Market for Web site services. Receipt 101. 11 Completed Web site design services for Andrew Hospital to be paid later, Invoice 101. $3.000. 12 Bought software for the Web server (Web Server) on account from Service Plus Software Inc., Invoice 876, $10,000. 14 Wrote Check 102 for $118 to pay the electric bill. 15 Jack Hines withdrew $2.500 for personal expenses. Check 103. 17 Completed Web site design on account for Sunshine Products, Invoice 102. $5.000. 18 Bought a filing cabinet (Office Furniture) for $275. Check 104. 19 Received a check for $4.000 as payment for Web site maintenance for one year to a client. Receipt 102. 20 Provided design services on account to Indiana Trucking, Invoice 103 for $2.000. 21 Prepared Receipt 103. $2.500. received on account, Sunshine Products 22 Paid $4.900 for telecommunication services for the period May 1-May 31. Check 105. 22 Wrote check 106 for $3.333 to Service Plus Software Inc. as payment on account. 25 Sent Check 107 for $2.000 to Office Systems as payment on account. 26 Received $1.000 for two months of Web services, Receipt 104. 27 Paid the dues for membership in the All Inclusive Group for $7.000. Check 108. 30 | Wrote Check 109 for the monthly rent $750. 30 Withdrew $2,500 for personal expenses. Check 110. 30 Sent Check 111 for $25,000 to Computer Specialists Inc., as payment on account. 50000.00 50000.00 3500.00 3500.00 1-May Cash in Bank Jack Hines, Capital Memorandum 1 2-May Office Equipment Jack Hines, Capital Memorandum 2 2-May Office Supplies Cash in Bank Check 101 3-May Office Furniture Accounts Payable, Office Systems Invoice 457 125.00 125.00 2700.00 2700.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts