Question: Last year, Rocket Inc. earned a 20% return. Farmer's Corp. earned 10%. The overall market return last year was 16%, and the risk-free rate was

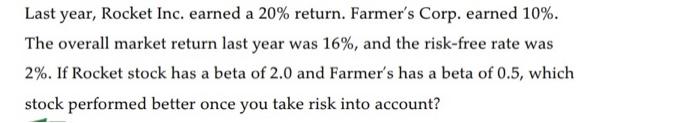

Last year, Rocket Inc. earned a 20% return. Farmer's Corp. earned 10%. The overall market return last year was 16%, and the risk-free rate was 2%. If Rocket stock has a beta of 2.0 and Farmer's has a beta of 0.5 , which stock performed better once you take risk into account? LG3 A security has a beta of 1.2 . Is this security more or less risky than the market? Explain. Assess the impact on the required return of this security in each of the following cases. a. The market return increases by 15%. b. The market return decreases by 8%. c. The market return remains unchanged

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock