Question: Laura is self Tax Analyst Certification- Case Study 1 Prepare a return using BlockWorks in PRACTICE mode. Access and use the BlockWorks shell return by

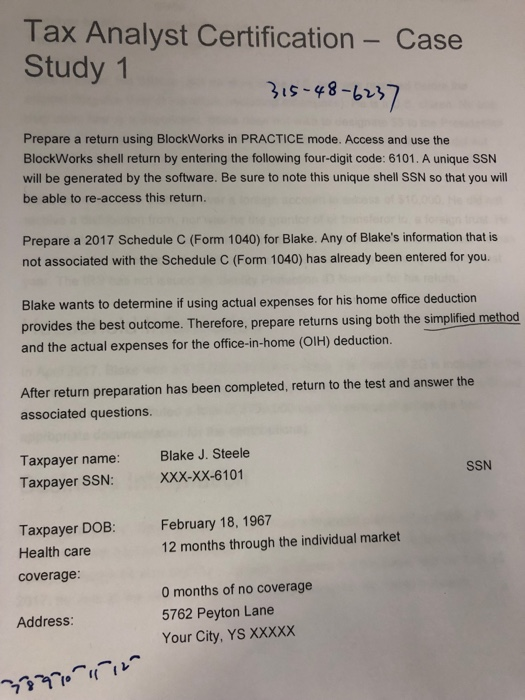

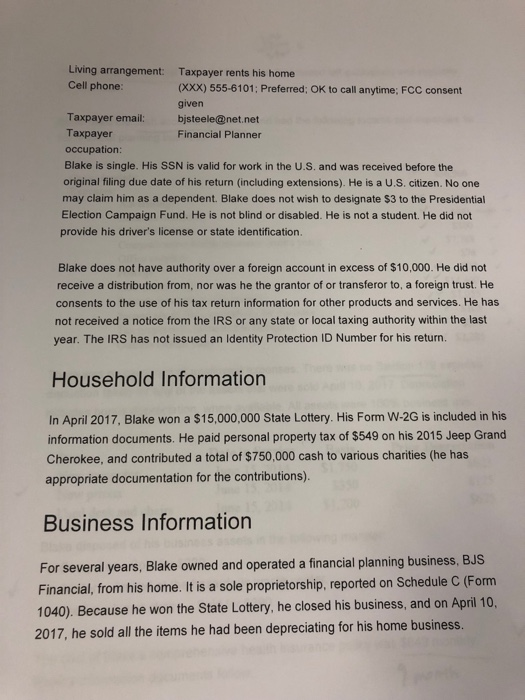

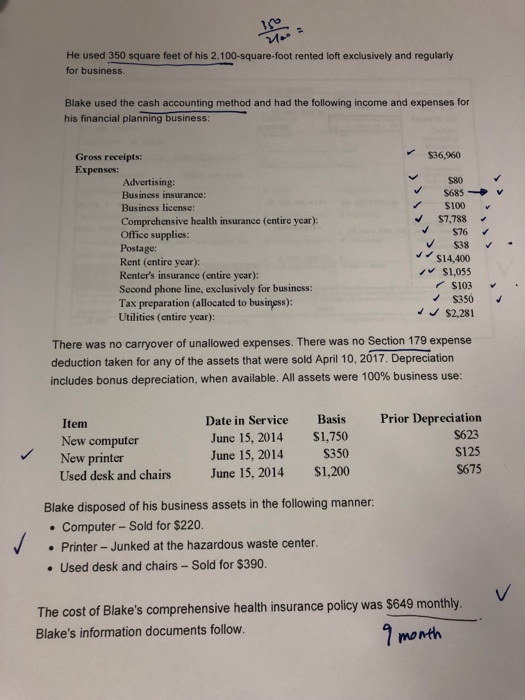

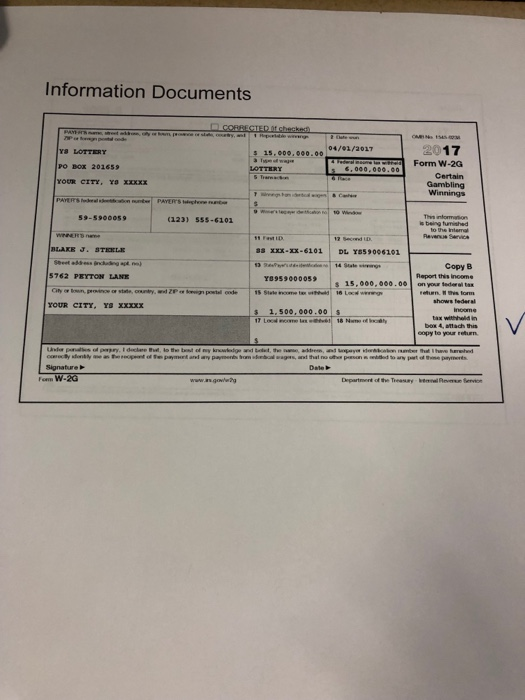

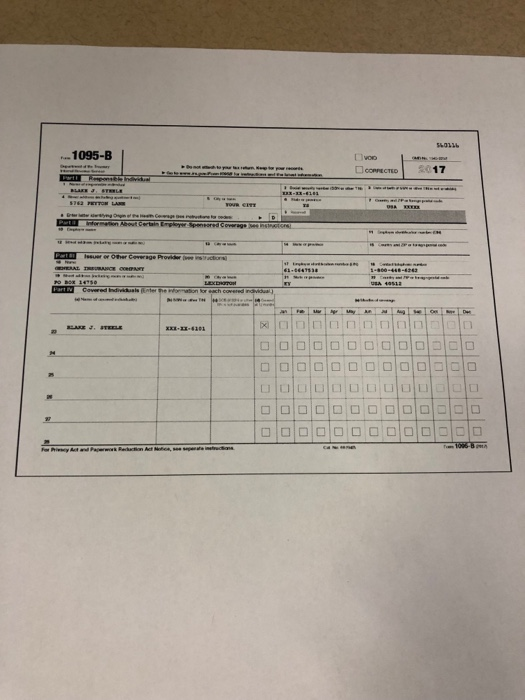

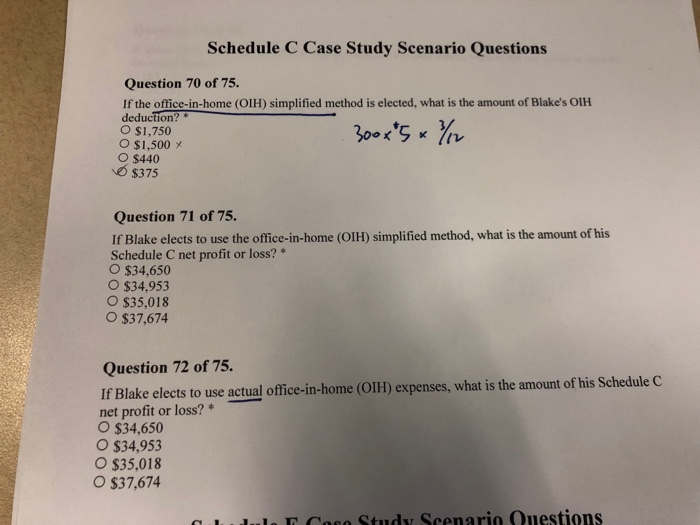

Tax Analyst Certification- Case Study 1 Prepare a return using BlockWorks in PRACTICE mode. Access and use the BlockWorks shell return by entering the following four-digit code: 6101. A unique SSN will be generated by the software. Be sure to note this unique shell SSN so that you will be able to re-access this return. Prepare a 2017 Schedule C (Form 1040) for Blake. Any of Blake's information that is not associated with the Schedule C (Form 1040) has already been entered for you. Blake wants to determine if using actual expenses for his home office deduction provides the best outcome. Therefore, prepare returns using both the simplified method and the actual expenses for the office-in-home (OlH) deduction. After return preparation has been completed, return to the test and answer the associated questions Taxpayer name: Taxpayer SSN: Blake J. Steele XXX-XX-6101 SSN Taxpayer DOB: Health care coverage: February 18, 1967 12 months through the individual market 0 months of no coverage 5762 Peyton Lane Your City, YS XXXXX Address Living arrangement: Taxpayer rents his home Cell phone: (xxx) 555-6101: Preferred; OK to call anytime: FCC consent given Taxpayer email: bjsteele@net.net Taxpayer Financial Planner occupation Blake is single. His SSN is valid for work in the U.S. and was received before the original filing due date of his return (including extensions). He is a U.S. citizen. No one may claim him as a dependent. Blake does not wish to designate $3 to the Presidential Election Campaign Fund. He is not blind or disabled. He is not a student. He did not provide his driver's license or state identification. Blake does not have authority over a foreign account in excess of $10,000. He did not receive a distribution from, nor was he the grantor of or transferor to, a foreign trust. He consents to the use of his tax return information for other products and services. He has not received a notice from the IRS or any state or local taxing authority within the last year. The IRS has not issued an Identity Protection ID Number for his return. Household Information In April 2017, Blake won a $15,000,000 State Lottery. His Form W-2G is included in his information documents. He paid personal property tax of $549 on his 2015 Jeep Grand Cherokee, and contributed a total of $750,000 cash to various charities (he has appropriate documentation for the contributions). Business Information For several years, Blake owned and operated a financial planning business, Bus Financial, from his home. It is a sole proprietorship, reported on Schedule C (Form 1040). Because he won the State Lottery, he closed his business, and on April 10. 2017, he sold all the items he had been depreciating for his home business He used 350 square feet of his 2.100-square-foot rented loft exclusively and regularly for business. Blake used the cash accounting method and had the following income and expenses for his financial planning business $36,960 $80 $100 Gross receipts: Expenses Advertising Business insurance Business license: Comprehensive health insurance (entire year): Office supplies Postage: Rent (entire year): Renter's insurance (entire year): Second phone line, exelusively for business: Tax preparation (allocated to busingss) Utilities (entire year): $7,788 5% S38 . $14,400 $1,055 $103 $350 $2,281 There was no carryover of unallowed expenses. There was no Section 179 expense deduction taken for any of the assets that were sold April 10, 2017. Depreciation includes bonus depreciation, when available. All assets were 100% business use: Date in Service Junc 15, 2014 June 15, 2014 June 15, 2014 Basis $1,750 S350 S1,200 Prior Depreciation S623 $125 S675 Item New computer New printer Used desk and chairs Blake disposed of his business assets in the following manner Computer- Sold for $220. Printer-Junked at the hazardous waste center. . Used desk and chairs -Sold for $390. The cost of Blake's comprehensive health insurance policy was $649 monthly. Blake's information documents follow. month . 1095-B Schedule C Case Study Scenario Questions Question 70 of 75. If the office-in-home (OIH) simplified method is elected, what is the amount of Blake's OIH deduction? O $1,750 O $1,500 O $440 $375 Question 71 of 75. If Blake elects to use the office-in-home (OlH) simplified method, what is the amount of his Schedule C net profit or loss?" O $34,650 O $34,953 O $35,018 O $37,674 Question 72 of 75 If Blake elects to use actual office-in-home (OlH) expenses, what is the amount of his Schedule C net profit or loss?* $34,650 O $34,953 O $35,018 O $37,674 gile Cese Study Scenario Questions Tax Analyst Certification- Case Study 1 Prepare a return using BlockWorks in PRACTICE mode. Access and use the BlockWorks shell return by entering the following four-digit code: 6101. A unique SSN will be generated by the software. Be sure to note this unique shell SSN so that you will be able to re-access this return. Prepare a 2017 Schedule C (Form 1040) for Blake. Any of Blake's information that is not associated with the Schedule C (Form 1040) has already been entered for you. Blake wants to determine if using actual expenses for his home office deduction provides the best outcome. Therefore, prepare returns using both the simplified method and the actual expenses for the office-in-home (OlH) deduction. After return preparation has been completed, return to the test and answer the associated questions Taxpayer name: Taxpayer SSN: Blake J. Steele XXX-XX-6101 SSN Taxpayer DOB: Health care coverage: February 18, 1967 12 months through the individual market 0 months of no coverage 5762 Peyton Lane Your City, YS XXXXX Address Living arrangement: Taxpayer rents his home Cell phone: (xxx) 555-6101: Preferred; OK to call anytime: FCC consent given Taxpayer email: bjsteele@net.net Taxpayer Financial Planner occupation Blake is single. His SSN is valid for work in the U.S. and was received before the original filing due date of his return (including extensions). He is a U.S. citizen. No one may claim him as a dependent. Blake does not wish to designate $3 to the Presidential Election Campaign Fund. He is not blind or disabled. He is not a student. He did not provide his driver's license or state identification. Blake does not have authority over a foreign account in excess of $10,000. He did not receive a distribution from, nor was he the grantor of or transferor to, a foreign trust. He consents to the use of his tax return information for other products and services. He has not received a notice from the IRS or any state or local taxing authority within the last year. The IRS has not issued an Identity Protection ID Number for his return. Household Information In April 2017, Blake won a $15,000,000 State Lottery. His Form W-2G is included in his information documents. He paid personal property tax of $549 on his 2015 Jeep Grand Cherokee, and contributed a total of $750,000 cash to various charities (he has appropriate documentation for the contributions). Business Information For several years, Blake owned and operated a financial planning business, Bus Financial, from his home. It is a sole proprietorship, reported on Schedule C (Form 1040). Because he won the State Lottery, he closed his business, and on April 10. 2017, he sold all the items he had been depreciating for his home business He used 350 square feet of his 2.100-square-foot rented loft exclusively and regularly for business. Blake used the cash accounting method and had the following income and expenses for his financial planning business $36,960 $80 $100 Gross receipts: Expenses Advertising Business insurance Business license: Comprehensive health insurance (entire year): Office supplies Postage: Rent (entire year): Renter's insurance (entire year): Second phone line, exelusively for business: Tax preparation (allocated to busingss) Utilities (entire year): $7,788 5% S38 . $14,400 $1,055 $103 $350 $2,281 There was no carryover of unallowed expenses. There was no Section 179 expense deduction taken for any of the assets that were sold April 10, 2017. Depreciation includes bonus depreciation, when available. All assets were 100% business use: Date in Service Junc 15, 2014 June 15, 2014 June 15, 2014 Basis $1,750 S350 S1,200 Prior Depreciation S623 $125 S675 Item New computer New printer Used desk and chairs Blake disposed of his business assets in the following manner Computer- Sold for $220. Printer-Junked at the hazardous waste center. . Used desk and chairs -Sold for $390. The cost of Blake's comprehensive health insurance policy was $649 monthly. Blake's information documents follow. month . 1095-B Schedule C Case Study Scenario Questions Question 70 of 75. If the office-in-home (OIH) simplified method is elected, what is the amount of Blake's OIH deduction? O $1,750 O $1,500 O $440 $375 Question 71 of 75. If Blake elects to use the office-in-home (OlH) simplified method, what is the amount of his Schedule C net profit or loss?" O $34,650 O $34,953 O $35,018 O $37,674 Question 72 of 75 If Blake elects to use actual office-in-home (OlH) expenses, what is the amount of his Schedule C net profit or loss?* $34,650 O $34,953 O $35,018 O $37,674 gile Cese Study Scenario Questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts