Question: ld a e is the hin e S Construction Contracts 14. contract price 242 Dark Co. was contracted to build a house for a

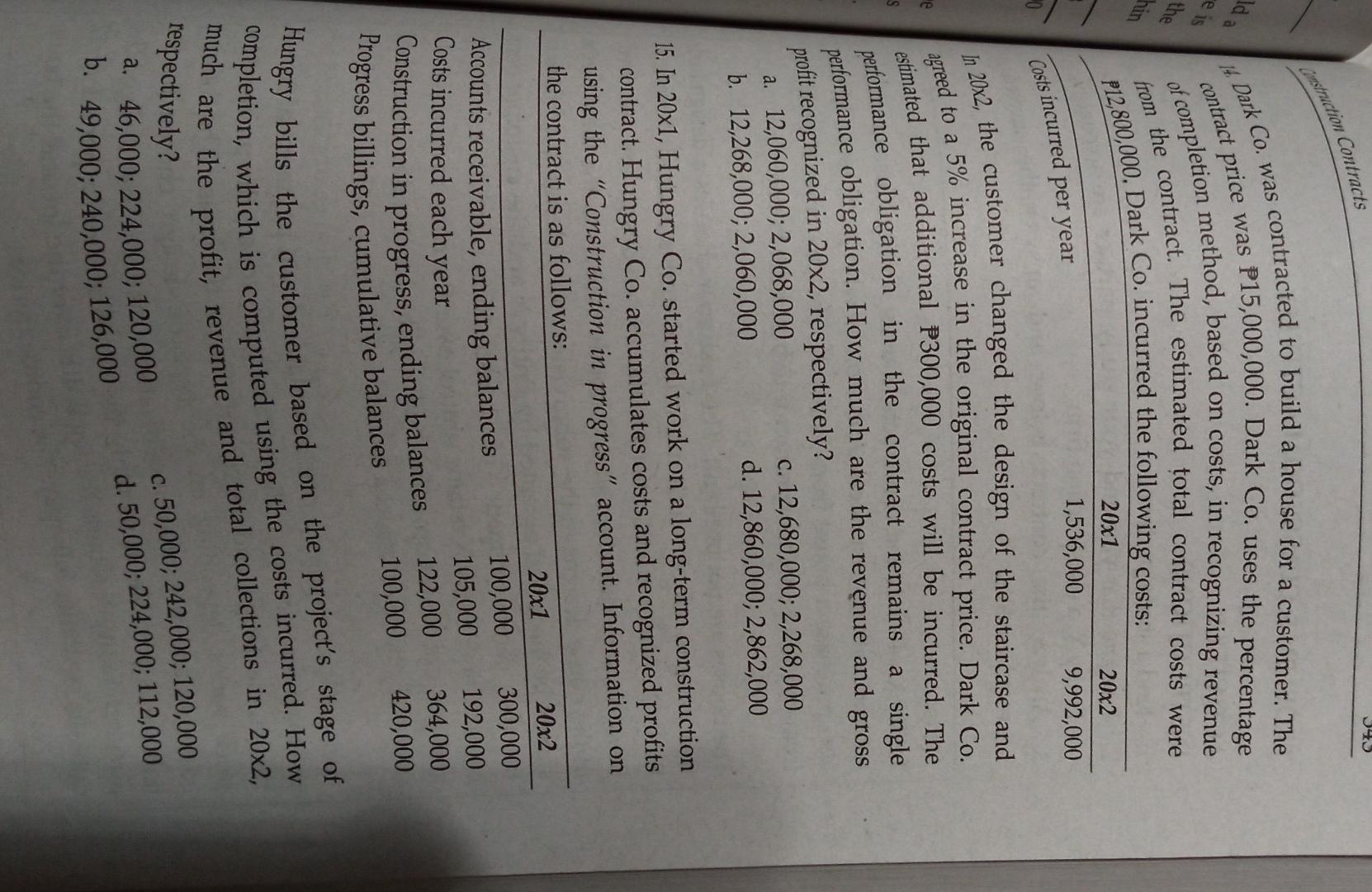

ld a e is the hin e S Construction Contracts 14. contract price 242 Dark Co. was contracted to build a house for a customer. The was P15,000,000. Dark Co. uses the percentage of completion method, based on costs, in recognizing revenue from the contract. The estimated total contract costs were P12,800,000, Dark Co. incurred the following costs: Costs incurred per year 20x1 1,536,000 20x2 9,992,000 In 20x2, the customer changed the design of the staircase and agreed to a 5% increase in the original contract price. Dark Co. estimated that additional P300,000 costs will be incurred. The performance obligation in the contract remains a single performance obligation. How much are the revenue and gross profit recognized in 20x2, respectively? a. 12,060,000; 2,068,000 b. 12,268,000; 2,060,000 c. 12,680,000; 2,268,000 d. 12,860,000; 2,862,000 15. In 20x1, Hungry Co. started work on a long-term construction contract. Hungry Co. accumulates costs and recognized profits using the "Construction in progress" account. Information on the contract is as follows: Accounts receivable, ending balances Costs incurred each year Construction in progress, ending balances Progress billings, cumulative balances 20x1 20x2 100,000 300,000 105,000 192,000 122,000 364,000 100,000 420,000 Hungry bills the customer based on the project's stage of completion, which is computed using the costs incurred. How much are the profit, revenue and total collections in 20x2, respectively? a. 46,000; 224,000; 120,000 b. 49,000; 240,000; 126,000 c. 50,000; 242,000; 120,000 d. 50,000; 224,000; 112,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts