Question: ld i gross proht using the FlFO inventory costing method by computing the cost of goods sold and oost of ending merchandise i ction. Once

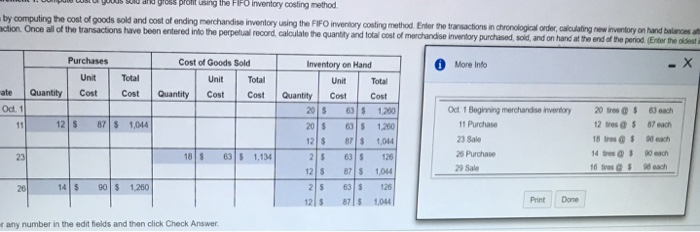

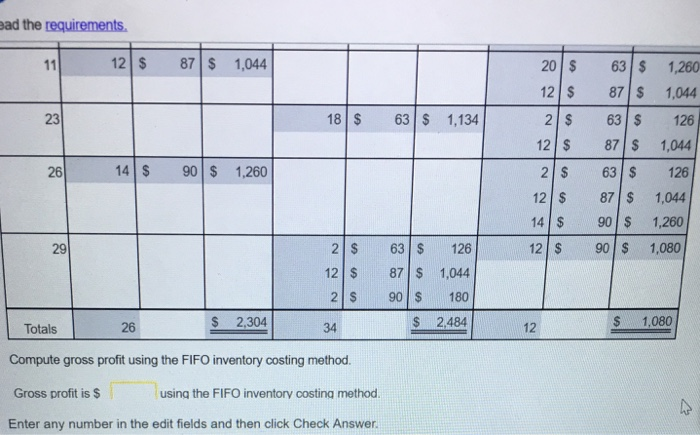

ld i gross proht using the FlFO inventory costing method by computing the cost of goods sold and oost of ending merchandise i ction. Once all of the transactions have been entered into the nventory using the FIFO inventory costing method Enter the transactions in chronological order, i perpetual record, caloulate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the calculating new inventory on hand balances at period. (Enter the oidest i t Purchases Cost of Goods Sold Inventory on Hand More Info Unit Total Unit Total Unit Total ate Quantity Cost Cost Quantity Cost Cost Quantity Cost Cost Oct. 1 20 S 63 $ 1.260 20 $ 63 $ 1,260 12 $ 87 1,044 2 63 126 12 S 87S 1,044 2 63 126 12 87s 1044 Oct 1 Beginning merchandse inventory20 tres @ 63 each 11 Purchase 23 Sale 26 Purchase 29 Sale 12 tres @ 87 18 tres @$ 98 ea 4 tres $ 90 eah 12 $ 87 $ 1,044 18 S 63 1,134 14 $ 90 1,260 Print Done r any number in the edit fields and then click Check Answer ad the requirements 12 $ 87 $ 1,044 20 $ 63 $ 1,260 12 $ 87 S 1,044 2 $ 63 S126 12/$ 87/$ 1,044 2 $ 63 $126 12 $ 87 1,044 23 18 $ 63 1,134 14 5 90 1.280 26 14 $ 90 $ 1,260 12 $ 29 90 $ 1,080 2 63 126 12 $ 87 1,044 2 S 90 S 180 $ 2,484 S 2,304 $1,080 Totals Compute gross profit using the FIFO inventory costing method Gross profit is $ Enter any number in the edit fields and then click Check Answer. 26 34 12 using the FIFO inventory costing method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts