Question: le Net Present Value-Unequal Lives Mulkey Development Company has two competing projects: an electric shovel and a processing mill. Both projects have an initial investment

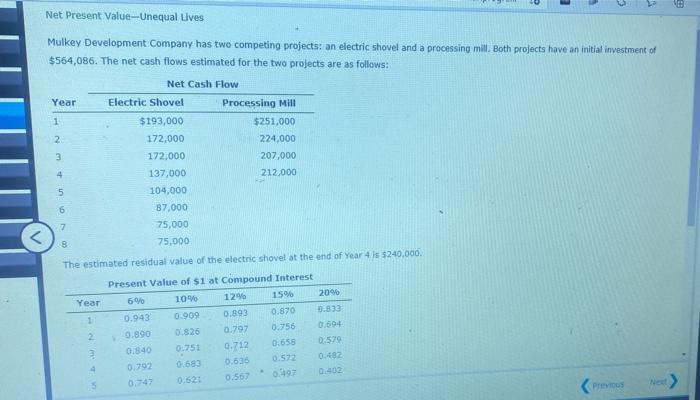

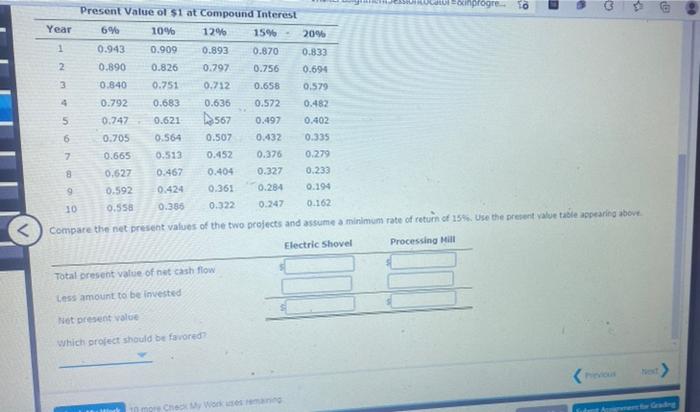

le Net Present Value-Unequal Lives Mulkey Development Company has two competing projects: an electric shovel and a processing mill. Both projects have an initial investment of $564,086. The net cash flows estimated for the two projects are as follows: Net Cash Flow Year Electric Shovel Processing Mill 1 $193,000 $251,000 2 172,000 224,000 3 172.000 207.000 4 137,000 212,000 5 104,000 87.000 7 75,000 75,000 000wN The estimated residual value of the electric shovel at the end of Year 4 is $240,000. Year 1 N.TV Present Value of $1 at Compound Interest 6 10% 12% 15% 2096 0.943 0.909 0.593 0.870 0.833 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.655 0.579 0.792 0.683 0.636 0.572 0.482 0.747 0.521 0.56 0.402 497 3 G Present Value ol si at Compound Interest Urocinprogre. To Year 6% 10% 12% 15% 20% 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 567 0.497 0.402 6 0.705 0.564 0:507 0.432 0.335 7 0.665 0:513 0.452 0.376 0.279 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 0.558 0.385 0.322 0.247 0.162 Compare the net present values of the two projects and assume a minimum rate of return of 15%. Use the present value table appearing above Electric Shovel Processing Mill 10 Total present value of net cash flow Less amount to be invested Net present value which project should be favored

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts