Question: Lear Incorporated has $ 8 2 0 , 0 0 0 in current assets, $ 3 6 0 , 0 0 0 of which are

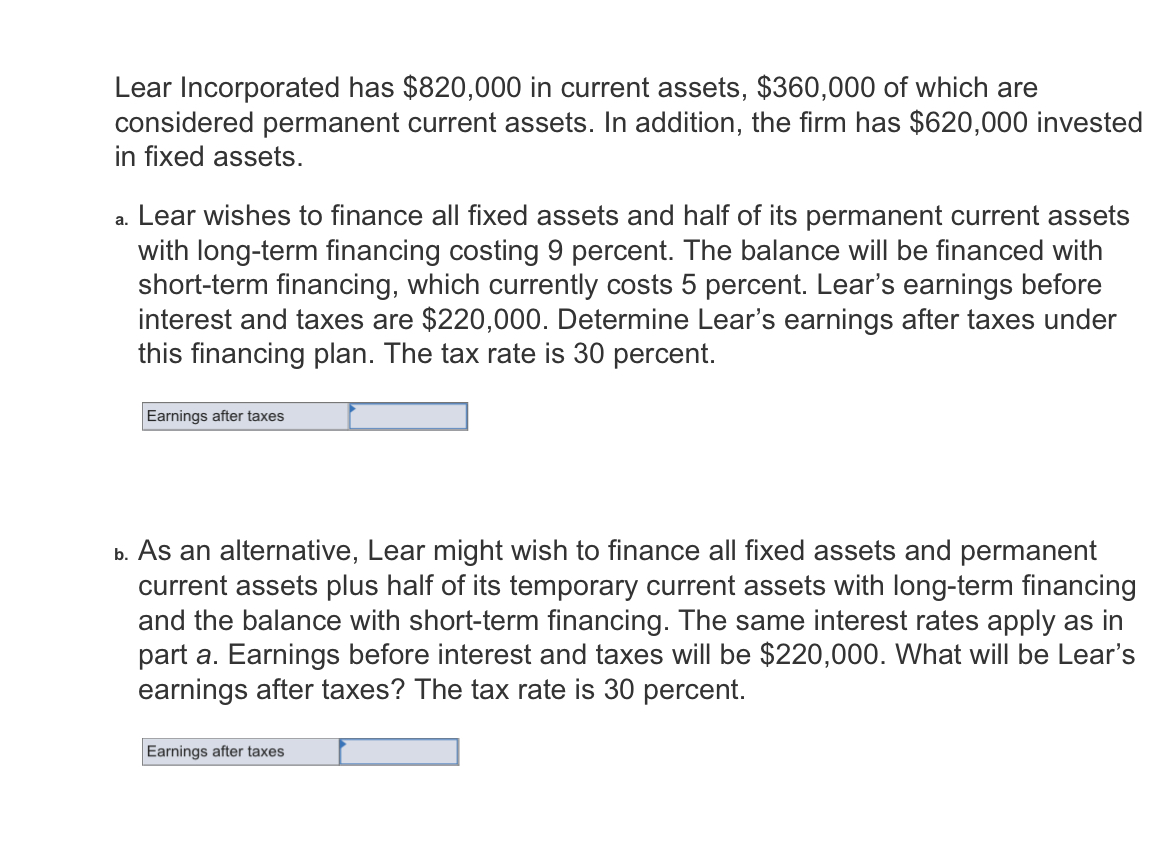

Lear Incorporated has $ in current assets, $ of which are considered permanent current assets. In addition, the firm has $ invested in fixed assets.

a Lear wishes to finance all fixed assets and half of its permanent current assets with longterm financing costing percent. The balance will be financed with shortterm financing, which currently costs percent. Lear's earnings before interest and taxes are $ Determine Lear's earnings after taxes under this financing plan. The tax rate is percent.

Earnings after taxes

b As an alternative, Lear might wish to finance all fixed assets and permanent current assets plus half of its temporary current assets with longterm financing and the balance with shortterm financing. The same interest rates apply as in part Earnings before interest and taxes will be $ What will be Lear's earnings after taxes? The tax rate is percent.

Earnings after taxes

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock