Question: Learning Goals: - Understand how retirement saving arrangements are associated with tax shelters and investment products. Clark is 26 years old and he is about

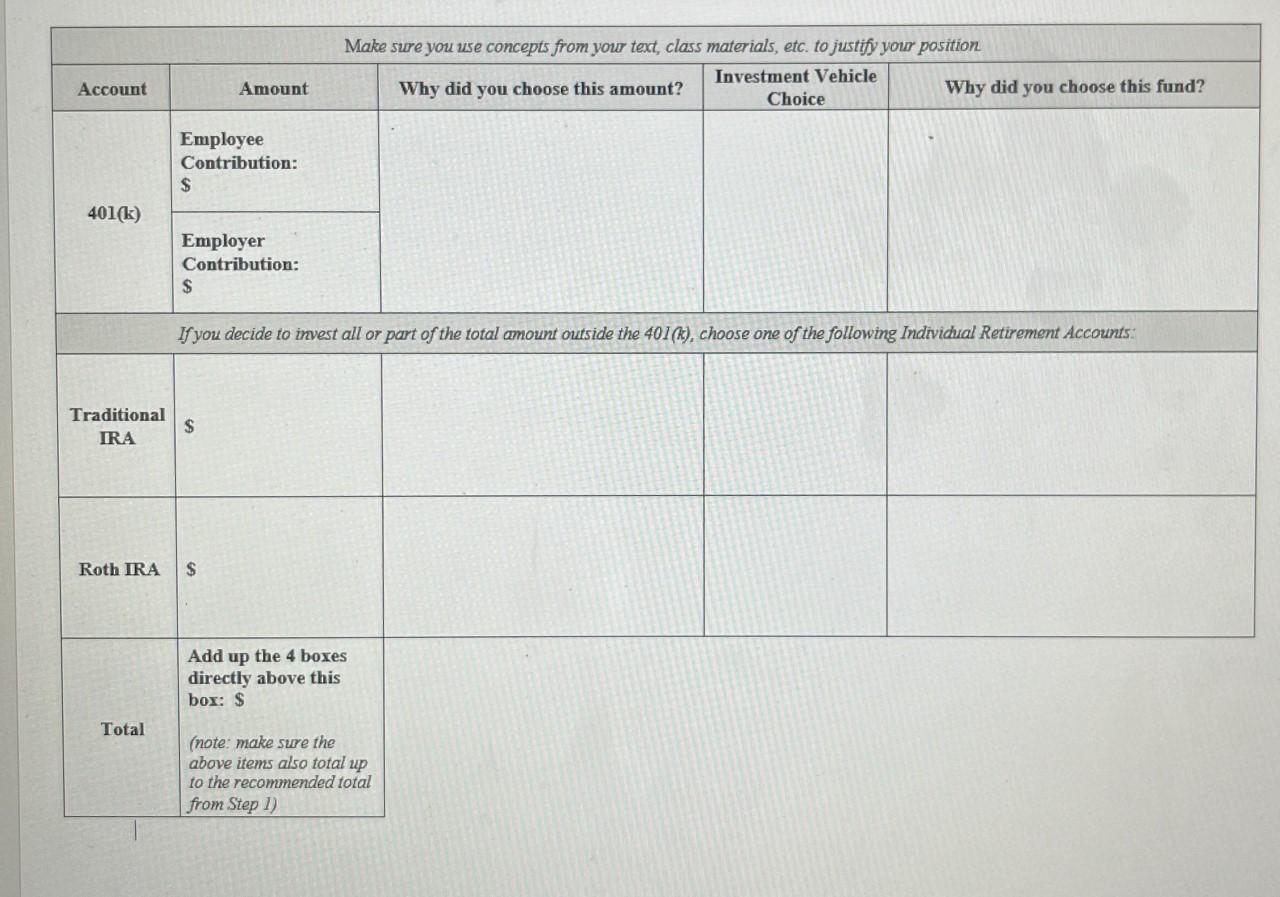

Learning Goals: - Understand how retirement saving arrangements are associated with tax shelters and investment products. Clark is 26 years old and he is about to start his first full-time job. He is currently single and he is willing to take the appropriate risk he needs to prepare for retirement. His starting annual salary is $55,000 and he has no retirement savings yet. His employer will match 100% of his contributions up to the first 3% of his salary to the company's 401(k) account. Use this link to determine his retirement saving needs: http-//money.cnn.com/tools/saveyoung/index html The information below accompanies the table (on page 2 ): Step 1: What amount do you recommend Clark should be saving each year? Use this amount in the "Total" box in the table below. Step 2: How much of the total annual savings should he be saving in his 401(k), a Traditional IRA, and/or a ROTH IRA? Put these amounts in the table in the "Amount" column. Step 3: Why did you pick each amount? Put your explanation in the "Why did you choose this amount" section of the table. Step 4: Employer offers the following 401(k) Investment Vehicle choices: - Davis New York Venture Fund Class Y [DNVYX] - Aberdeen Select International Equity Fund Class [JIEIX] - Janus Asia Equity Fund Class A [JAQAX] Research a fund analyzer to look up and compare the funds Clark has to choose from within his employer's 401(k) plan (focus on the fees, profits/losses). The following Traditional or Roth IRA choices: - Target Date Fund - Apple Stock - 10 Year Treasury Note - Your own choice (you must explain why) Pick the most appropriate choice from the lists above for the investment vehicles. Then type your choice in the "Investment Vehicle Choice" section of the table. Please note that when you finish the table, all the boxes may or may not contain data. It is OK to have N/A or zeros in some of the boxes as long as you provide your rationale as to why you put zero(s). Step 5: Why did you pick each fund? Put your explanation in the "Why did you choose this fund" section of the table. Learning Goals: - Understand how retirement saving arrangements are associated with tax shelters and investment products. Clark is 26 years old and he is about to start his first full-time job. He is currently single and he is willing to take the appropriate risk he needs to prepare for retirement. His starting annual salary is $55,000 and he has no retirement savings yet. His employer will match 100% of his contributions up to the first 3% of his salary to the company's 401(k) account. Use this link to determine his retirement saving needs: http-//money.cnn.com/tools/saveyoung/index html The information below accompanies the table (on page 2 ): Step 1: What amount do you recommend Clark should be saving each year? Use this amount in the "Total" box in the table below. Step 2: How much of the total annual savings should he be saving in his 401(k), a Traditional IRA, and/or a ROTH IRA? Put these amounts in the table in the "Amount" column. Step 3: Why did you pick each amount? Put your explanation in the "Why did you choose this amount" section of the table. Step 4: Employer offers the following 401(k) Investment Vehicle choices: - Davis New York Venture Fund Class Y [DNVYX] - Aberdeen Select International Equity Fund Class [JIEIX] - Janus Asia Equity Fund Class A [JAQAX] Research a fund analyzer to look up and compare the funds Clark has to choose from within his employer's 401(k) plan (focus on the fees, profits/losses). The following Traditional or Roth IRA choices: - Target Date Fund - Apple Stock - 10 Year Treasury Note - Your own choice (you must explain why) Pick the most appropriate choice from the lists above for the investment vehicles. Then type your choice in the "Investment Vehicle Choice" section of the table. Please note that when you finish the table, all the boxes may or may not contain data. It is OK to have N/A or zeros in some of the boxes as long as you provide your rationale as to why you put zero(s). Step 5: Why did you pick each fund? Put your explanation in the "Why did you choose this fund" section of the table

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts